Question: PLEASE ONLY ANSWER THE ONE'S MARKED WRONG FORM 2022 - 1040 Note: This problem is for the 2022 tax year. Alfred E. Old and Beulah

PLEASE ONLY ANSWER THE ONE'S MARKED WRONG

FORM 2022 - 1040

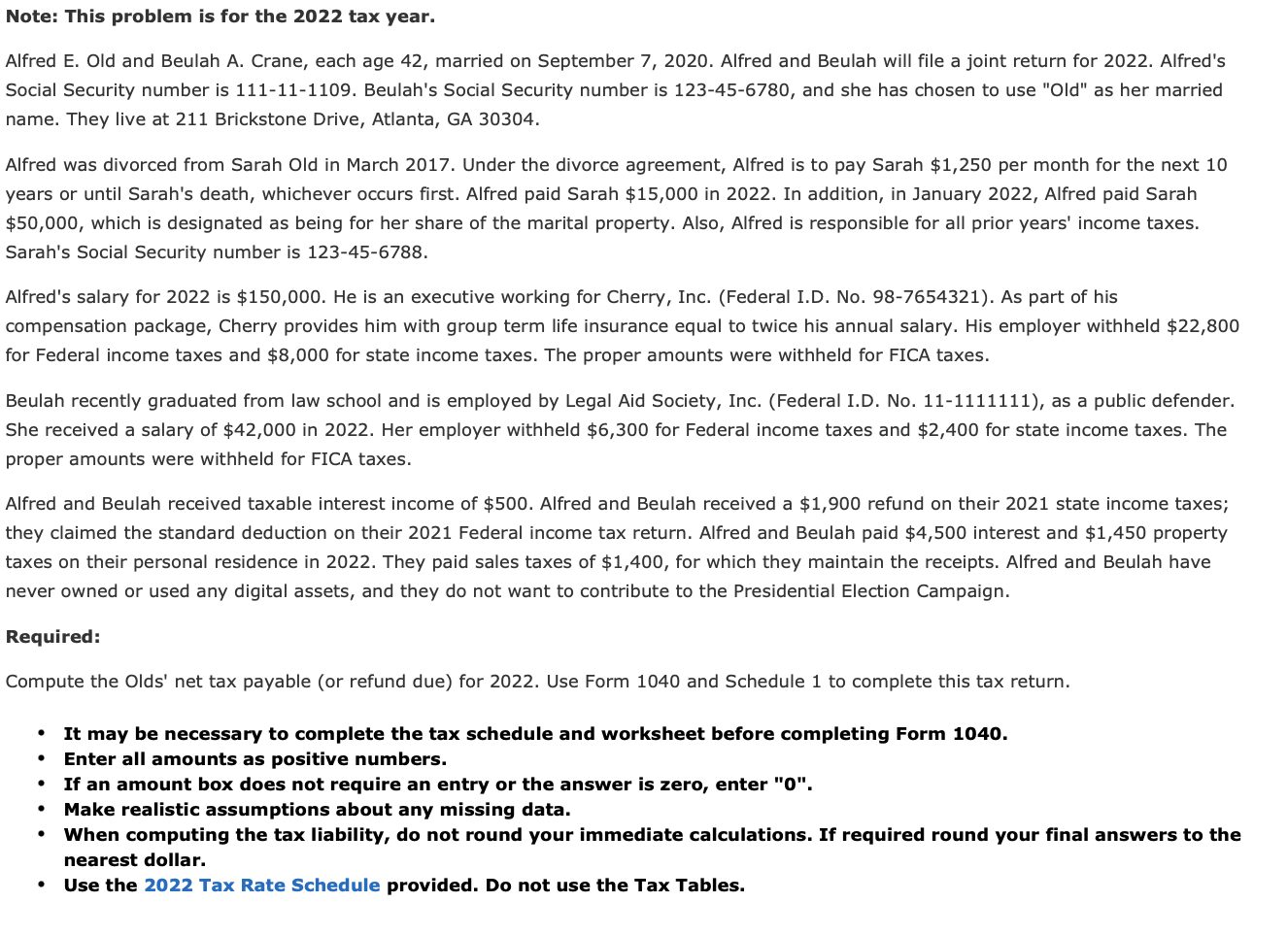

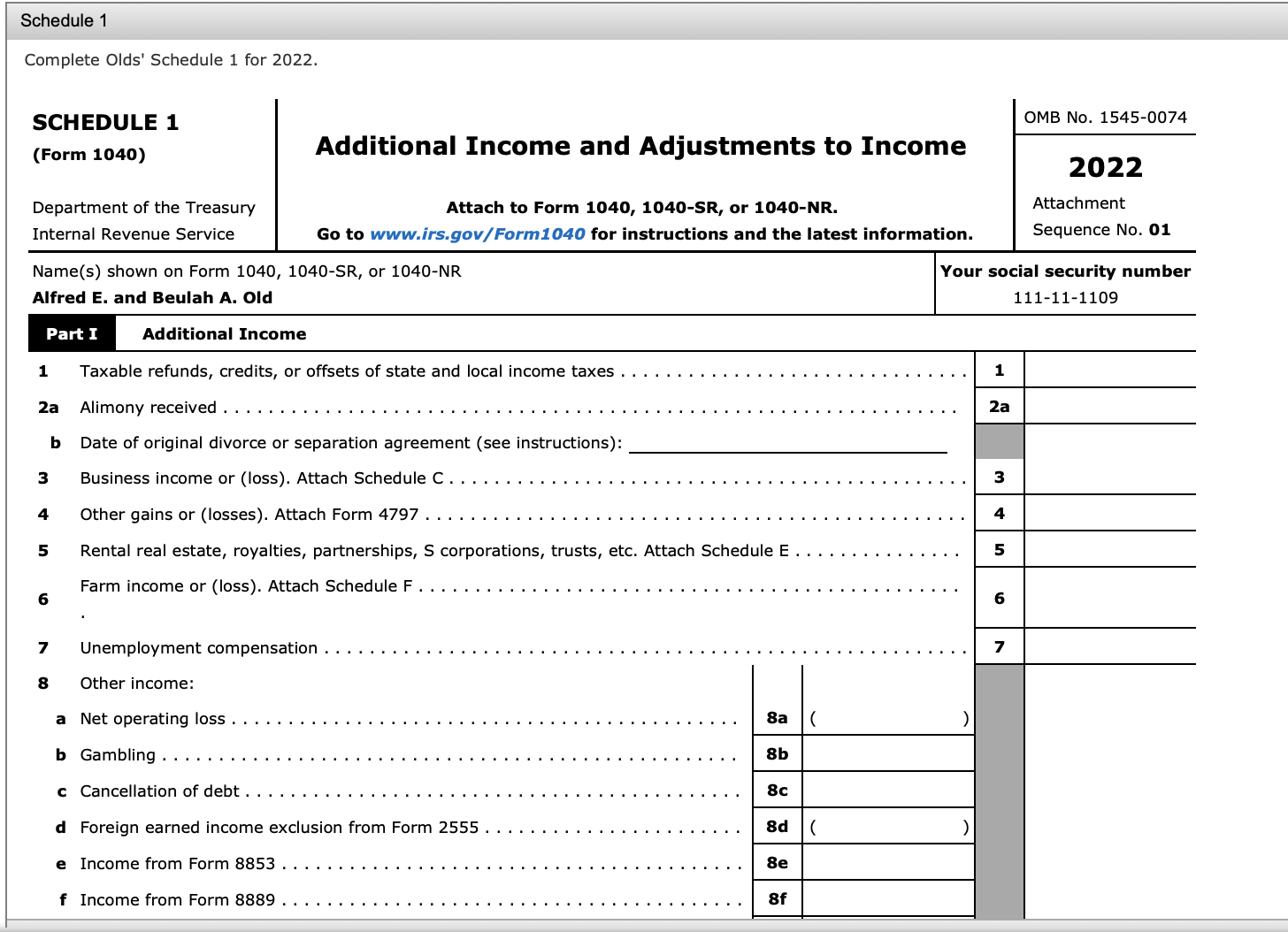

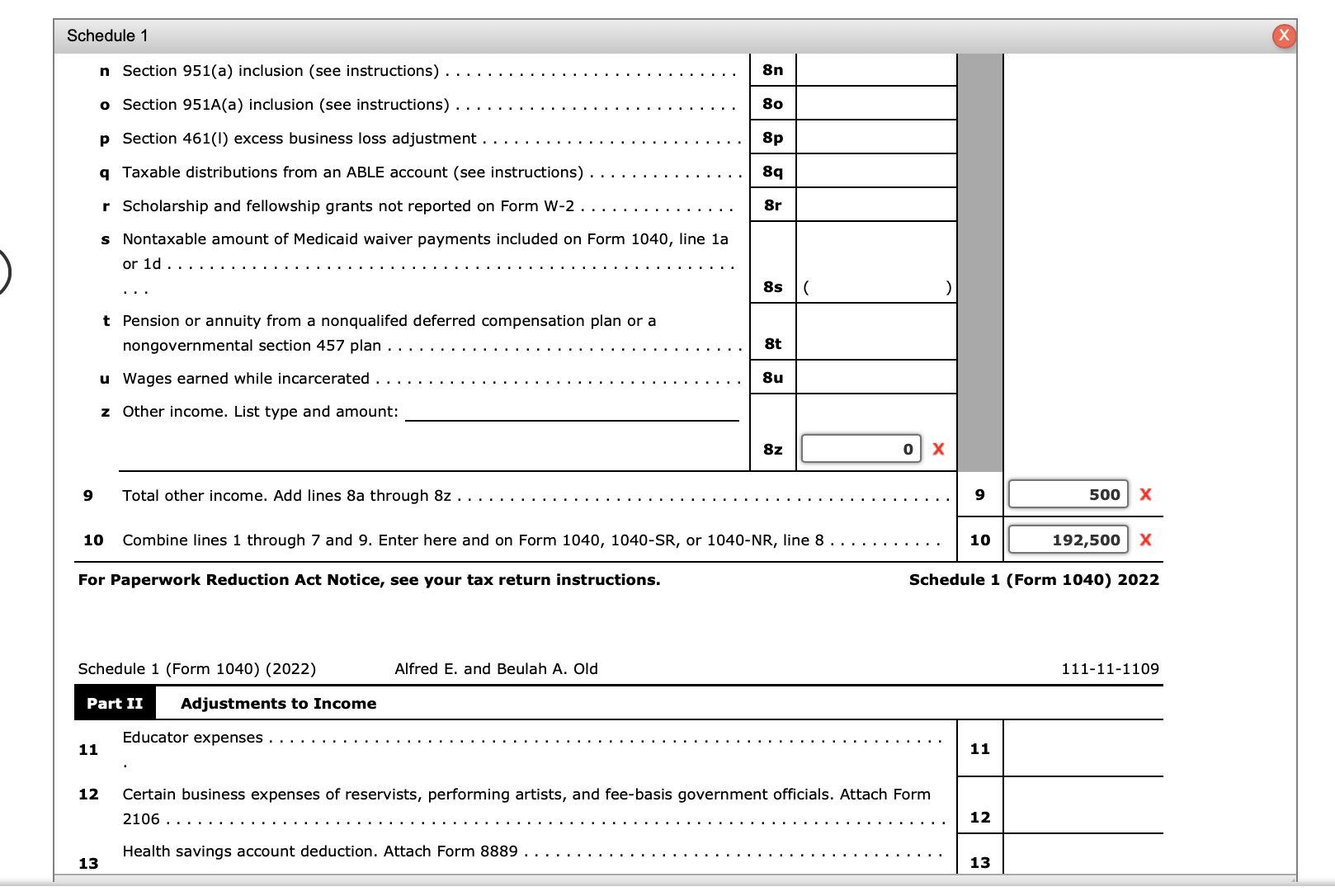

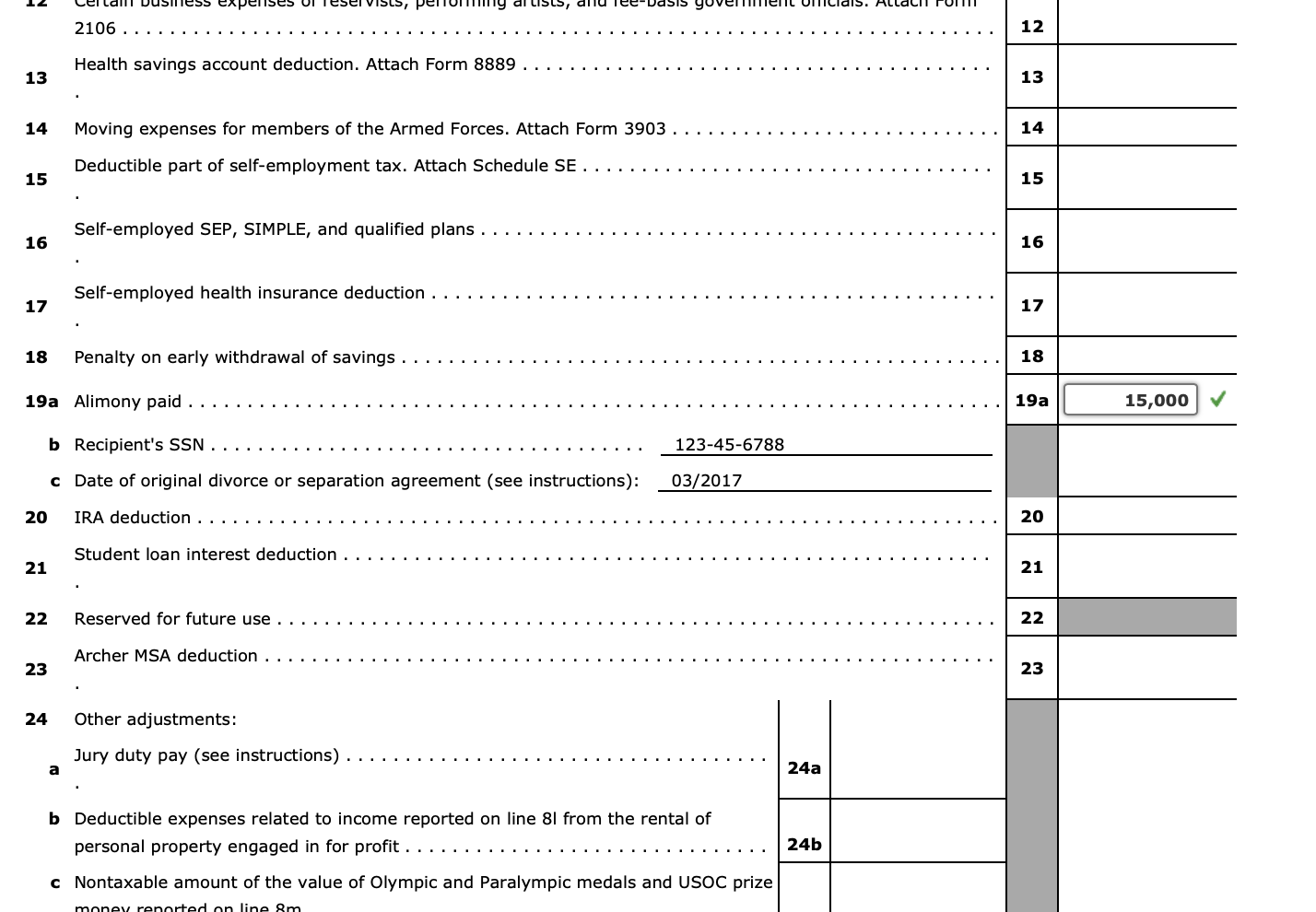

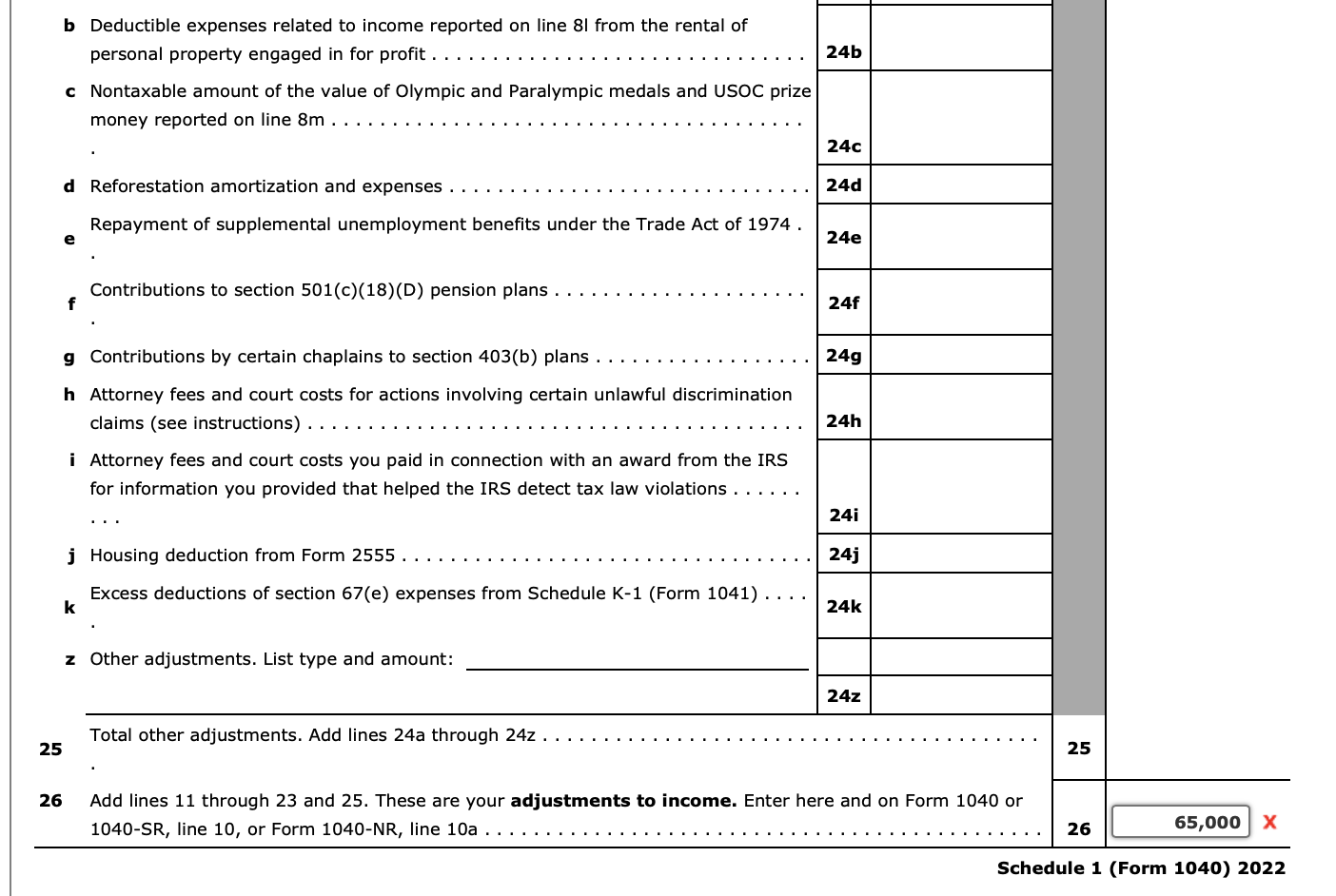

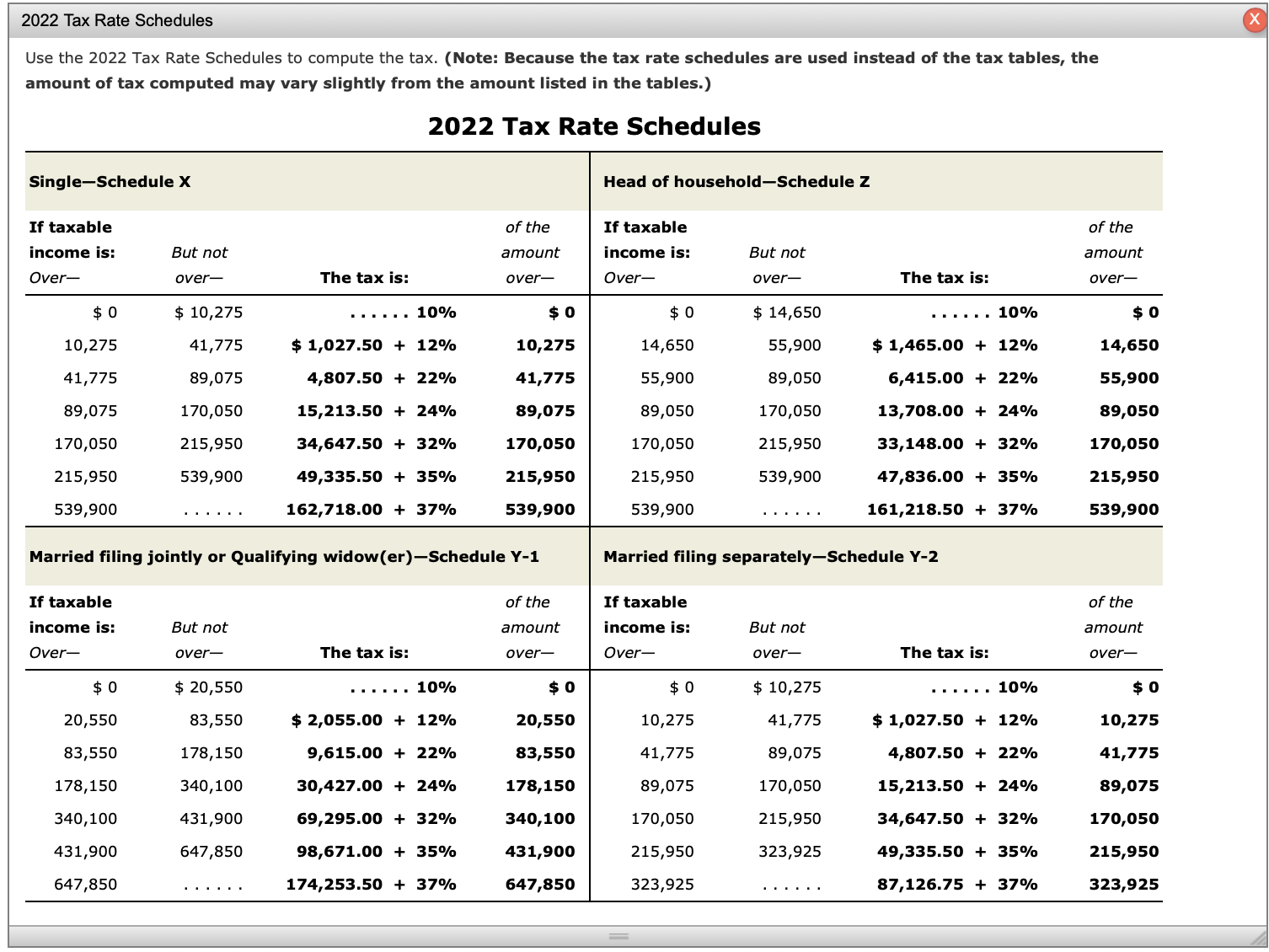

Note: This problem is for the 2022 tax year. Alfred E. Old and Beulah A. Crane, each age 42, married on September 7, 2020. Alfred and Beulah will file a joint return for 2022. Alfred's Social Security number is 111-11-1109. Beulah's Social Security number is 123-45-6780, and she has chosen to use "Old" as her married name. They live at 211 Brickstone Drive, Atlanta, GA 30304. Alfred was divorced from Sarah Old in March 2017. Under the divorce agreement, Alfred is to pay Sarah $1,250 per month for the next 10 years or until Sarah's death, whichever occurs first. Alfred paid Sarah $15,000 in 2022. In addition, in January 2022, Alfred paid Sarah $50,000, which is designated as being for her share of the marital property. Also, Alfred is responsible for all prior years' income taxes. Sarah's Social Security number is 123-45-6788. Alfred's salary for 2022 is $150,000. He is an executive working for Cherry, Inc. (Federal I.D. No. 98-7654321). As part of his compensation package, Cherry provides him with group term life insurance equal to twice his annual salary. His employer withheld $22,800 for Federal income taxes and $8,000 for state income taxes. The proper amounts were withheld for FICA taxes. Beulah recently graduated from law school and is employed by Legal Aid Society, Inc. (Federal I.D. No. 11-1111111), as a public defender. She received a salary of $42,000 in 2022. Her employer withheld $6,300 for Federal income taxes and $2,400 for state income taxes. The proper amounts were withheld for FICA taxes. Alfred and Beulah received taxable interest income of $500. Alfred and Beulah received a $1,900 refund on their 2021 state income taxes; they claimed the standard deduction on their 2021 Federal income tax return. Alfred and Beulah paid $4,500 interest and $1,450 property taxes on their personal residence in 2022. They paid sales taxes of $1,400, for which they maintain the receipts. Alfred and Beulah have never owned or used any digital assets, and they do not want to contribute to the Presidential Election Campaign. Required: Compute the Olds' net tax payable (or refund due) for 2022. Use Form 1040 and Schedule 1 to complete this tax return. + It may be necessary to complete the tax schedule and worksheet before completing Form 1040. * Enter all amounts as positive numbers. * If an amount box does not require an entry or the answer is zero, enter "0". * Make realistic assumptions about any missing data. * When computing the tax liability, do not round your immediate calculations. If required round your final answers to the nearest dollar. * Use the 2022 Tax Rate Schedule provided. Do not use the Tax Tables. Schedule 1 Complete Olds' Schedule 1 for 2022. SCHEDULE 1 OMB No. 1545-0074 (Form 1040) Additional Income and Adjustments to Income 2022 Department of the Treasury Attach to Form 1040, 1040-SR, or 1040-NR. Attachment Internal Revenue Service Go to www.irs.gov/Form1040 for instructions and the latest information. Sequence No. 01 Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number Alfred E. and Beulah A. Old 111-11-1109 Part I Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes . 2a Alimony received . . 2a Date of original divorce or separation agreement (see instructions): 3 Business income or (loss). Attach Schedule C . . 3 4 Other gains or (losses). Attach Form 4797 . . 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E . . . 5 6 Farm income or (loss). Attach Schedule F . . . . . 6 7 Unemployment compensation . . . . 7 8 Other income: a Net operating loss . . 8a b Gambling . . 8b c Cancellation of debt . . 8c d Foreign earned income exclusion from Form 2555 8d e Income from Form 8853 f Income from Form 8889 8fSchedule 1 X n Section 951(a) inclusion (see instructions) . . . 8n Section 951A(a) inclusion (see instructions) . 80 p Section 461(1) excess business loss adjustment . . . . 8p q Taxable distributions from an ABLE account (see instructions) . . . . . . . 8q r Scholarship and fellowship grants not reported on Form W-2 . . 8r s Nontaxable amount of Medicaid waiver payments included on Form 1040, line la or id . . . 8s t Pension or annuity from a nonqualifed deferred compensation plan or a nongovernmental section 457 plan . . . 8+ u Wages earned while incarcerated . . 8u z Other income. List type and amount: 87 0 X 9 Total other income. Add lines 8a through 8z . . . 500 X 10 Combine lines 1 through 7 and 9. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 8 . . . . . . . . 10 192,500 X For Paperwork Reduction Act Notice, see your tax return instructions. Schedule 1 (Form 1040) 2022 Schedule 1 (Form 1040) (2022) Alfred E. and Beulah A. Old 111-11-1109 Part II Adjustments to Income Educator expenses . . 11 11 12 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 . . . 12 Health savings account deduction. Attach Form 8889 132106 . . 12 Health savings account deduction. Attach Form 8889 13 13 14 Moving expenses for members of the Armed Forces. Attach Form 3903 14 15 Deductible part of self-employment tax. Attach Schedule SE . . . . 15 16 Self-employed SEP, SIMPLE, and qualified plans . . 16 17 Self-employed health insurance deduction . . . 17 18 Penalty on early withdrawal of savings . . 18 19a Alimony paid . . . 19a 15,000 b Recipient's SSN . . 123-45-6788 c Date of original divorce or separation agreement (see instructions): 03/2017 20 IRA deduction . . . . 20 21 Student loan interest deduction . . . . . . . 21 22 Reserved for future use . . 22 Archer MSA deduction . . . 23 23 24 Other adjustments: Jury duty pay (see instructions) . . . a 24a b Deductible expenses related to income reported on line 81 from the rental of personal property engaged in for profit . . 24b c Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize25 26 Deductible expenses related to income reported on line 8| from the rental of personal property engaged in for profit . . . . Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money reported on line8m . ............ Reforestation amortization and expenses . . . Repayment of supplemental unemployment benefits under the Trade Act of 1974 . Contributions to section 501(c)(18)(D) pensionplans. .. .. .. .. ... Contributions by certain chaplains to section 403(b) plans . . . .. .. ........... Attorney fees and court costs for actions involving certain unlawful discrimination claims (see instructions) . . . . .. ......... Attorney fees and court costs you paid in connection with an award from the IRS for information you provided that helped the IRS detect tax law violations . . . . . . Housing deduction from Form 2555 .. ... .. Excess deductions of section 67(e) expenses from Schedule K-1 (Form 1041) .. .. Other adjustments. List type and amount: Total other adjustments. Add lines 24a through 24z . . . . . . .. .. i i e Add lines 11 through 23 and 25. These are your adjustments to income. Enter here and on Form 1040 or 1040-SR, line 10, or Form 1040-NR, line 10a ---------------------------------------------- 65'000 x Schedule 1 (Form 1040) 2022 2022 Tax Rate Schedules Use the 2022 Tax Rate Schedules to compute the tax. (Note: Because the tax rate schedules are used instead of the tax tables, the amount of tax computed may vary slightly from the amount listed in the tables.) 2022 Tax Rate Schedules SingleSchedule X Head of householdSchedule Z If taxable of the If taxable of the income is: But not amount income is: But not amount Over over The tax is: over Over over The tax is: over $0 $ 10,275 cere.. 10% $0 $0 $ 14,650 $0 10,275 41,775 $1,027.50 + 12% 10,275 14,650 55,900 $ 1,465.00 14,650 41,775 89,075 4,807.50 + 22% 41,775 55,900 89,050 6,415.00 55,900 89,075 170,050 15,213.50 + 24% 89,075 89,050 170,050 13,708.00 89,050 170,050 215,950 34,647.50 + 32% 170,050 170,050 215,950 33,148.00 170,050 215,950 539,900 49,335.50 + 35% 215,950 215,950 539,900 47,836.00 215,950 539,900 162,718.00 + 37% 539,900 539,900 161,218.50 539,900 Married filing jointly or Qualifying widow(er)Schedule Y-1 Married filing separatelySchedule Y-2 If taxable of the If taxable of the income is: But not amount income is: But not amount Over over The tax is: over Over over The tax is: over $0 $ 20,550 caseae 10% $0 $0 $ 10,275 $0 20,550 83,550 $ 2,055.00 + 12% 20,550 10,275 41,775 $1,027.50 10,275 83,550 178,150 9,615.00 + 22% 83,550 41,775 89,075 4,807.50 41,775 340,100 431,900 69,295.00 + 32% 340,100 170,050 215,950 34,647.50 170,050 431,900 647,850 98,671.00 + 35% 431,900 215,950 323,925 49,335.50 215,950 + + 178,150 340,100 30,427.00 + 24% 178,150 89,075 170,050 15,213.50 + 89,075 + + + 647,850 174,253.50 + 37% 647,850 323,925 87,126.75 323,925

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts