Question: PLEASE ONLY ANSWER THE QUESTION WITH THE TABLE ABOUT QUARTERS The risk-free rate is 2.03% and a stock's adjusted systematic risk exposure is 0.87. If

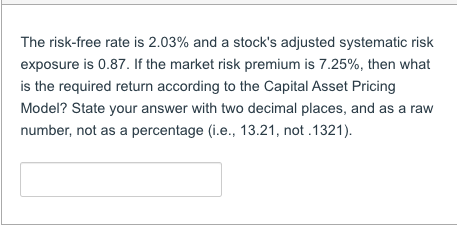

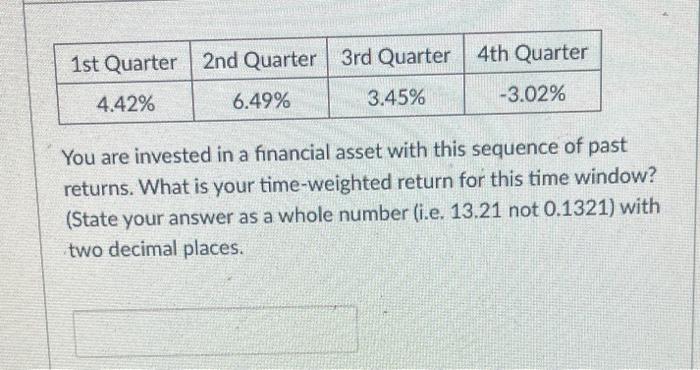

The risk-free rate is 2.03% and a stock's adjusted systematic risk exposure is 0.87. If the market risk premium is 7.25%, then what is the required return according to the Capital Asset Pricing Model? State your answer with two decimal places, and as a raw number, not as a percentage (i.e., 13.21, not 1321). 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 4.42% 6.49% 3.45% -3.02% You are invested in a financial asset with this sequence of past returns. What is your time-weighted return for this time window? (State your answer as a whole number (i.e. 13.21 not 0.1321) with two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts