Question: PLEASE ONLY ANSWER USING EXCEL FORMULAS/CELLS - DO NOT GIVE NUMBERS AS THE ANSWER. Calculating WACC Excel FILE HOME INSERT PAGE FORMULAS DATA REVIEW VIEW

PLEASE ONLY ANSWER USING EXCEL FORMULAS/CELLS - DO NOT GIVE NUMBERS AS THE ANSWER.

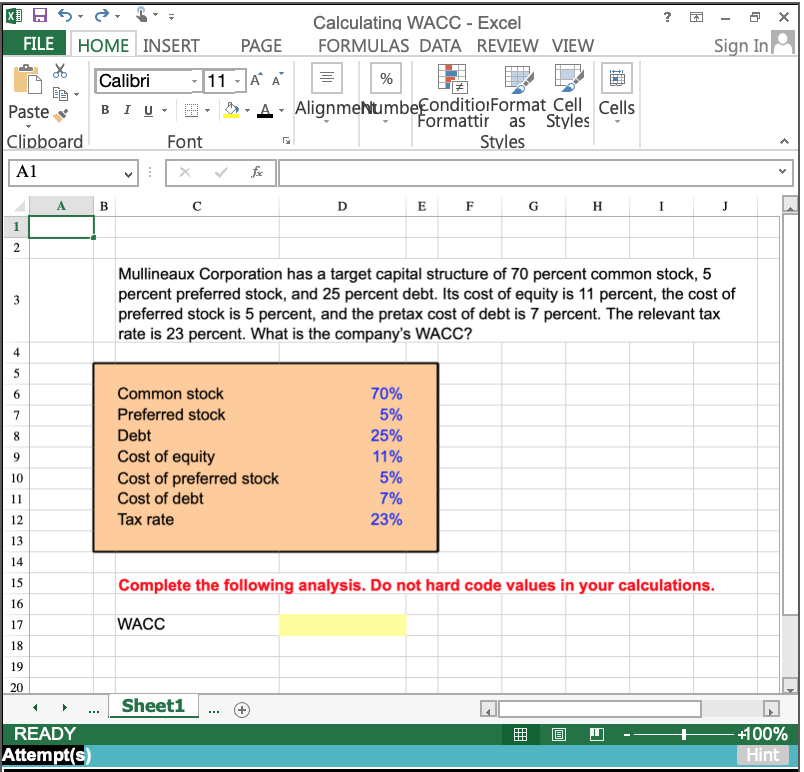

Calculating WACC Excel FILE HOME INSERT PAGE FORMULAS DATA REVIEW VIEW Sign In Calibri B l u. m. > 11 A A . AlignmeNumbeEonditio!Format Cell Cells Paste ormattir as Styles Styles Clipboard Font A1 Mullineaux Corporation has a target capital structure of 70 percent common stock, 5 percent preferred stock, and 25 percent debt. Its cost of equity is 11 percent, the cost of preferred stock is 5 percent, and the pretax cost of debt is 7 percent. The relevant tax rate is 23 percent. What is the company's WACC? 70% 5% 25% 11% 5% Common stock Preferred stock Debt Cost of equity Cost of preferred stock Cost of debt Tax rate 23% 12 13 15 Complete the following analysis. Do not hard code values in your calculations 16 WACC 18 19 Sheet1... > +1 00% READY Attempt(s in Calculating WACC Excel FILE HOME INSERT PAGE FORMULAS DATA REVIEW VIEW Sign In Calibri B l u. m. > 11 A A . AlignmeNumbeEonditio!Format Cell Cells Paste ormattir as Styles Styles Clipboard Font A1 Mullineaux Corporation has a target capital structure of 70 percent common stock, 5 percent preferred stock, and 25 percent debt. Its cost of equity is 11 percent, the cost of preferred stock is 5 percent, and the pretax cost of debt is 7 percent. The relevant tax rate is 23 percent. What is the company's WACC? 70% 5% 25% 11% 5% Common stock Preferred stock Debt Cost of equity Cost of preferred stock Cost of debt Tax rate 23% 12 13 15 Complete the following analysis. Do not hard code values in your calculations 16 WACC 18 19 Sheet1... > +1 00% READY Attempt(s in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts