Question: Please only answer when you have the correct answer. if you answer is incorrect or irrelevant, I will report it to chegg and leave a

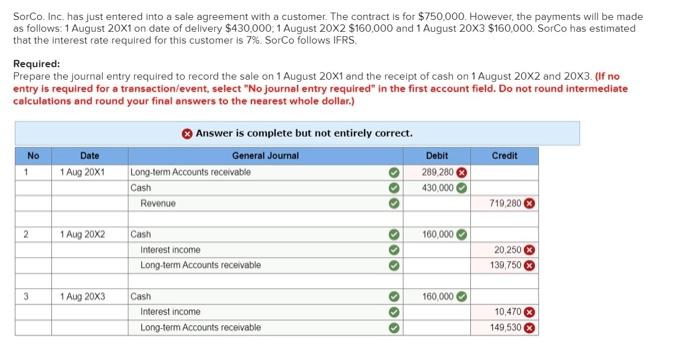

SorCo. Inc, has just entered into a sale agreement with a customer. The contract is for $750,000. However, the payments will be made as follows: 1 August 201 on date of delivery $430,000,1 August 202$160,000 and 1 August 203$160,000. SorCo has estimated that the interest rate required for this customer is 7%. SorCo follows IFRS. Required: Prepare the journal entry required to record the sale on 1 August 201 and the receipt of cash on 1 August 202 and 203. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations and round your final answers to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts