Question: Please only attempt if you can solve the question with a proper explanation. Please do not copy from Chegg. A review of Bradley's Year 2

Please only attempt if you can solve the question with a proper explanation. Please do not copy from Chegg.

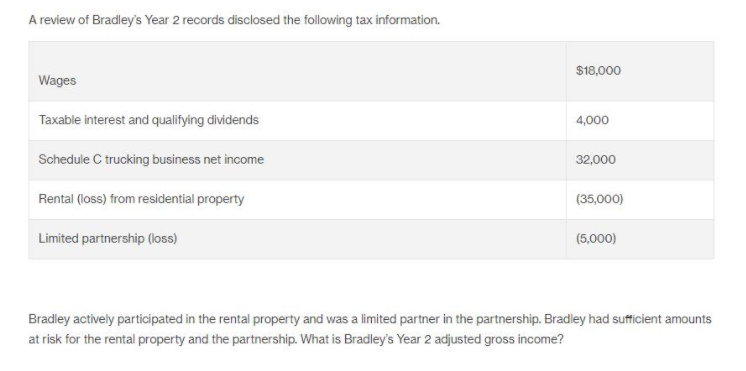

A review of Bradley's Year 2 records disclosed the following tax information. $18,000 Wages Taxable interest and qualifying dividends 4,000 Schedule C trucking business net income 32,000 Rental (loss) from residential property (35,000) Limited partnership (loss) (5,000) Bradley actively participated in the rental property and was a limited partner in the partnership. Bradley had sufficient amounts at risk for the rental property and the partnership. What is Bradley's Year 2 adjusted gross income? A review of Bradley's Year 2 records disclosed the following tax information. $18,000 Wages Taxable interest and qualifying dividends 4,000 Schedule C trucking business net income 32,000 Rental (loss) from residential property (35,000) Limited partnership (loss) (5,000) Bradley actively participated in the rental property and was a limited partner in the partnership. Bradley had sufficient amounts at risk for the rental property and the partnership. What is Bradley's Year 2 adjusted gross income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts