Question: Please, only correct answers, no need in explanation! 1. Identify which of the following firms can face adversity in raising equity capital for fixed investments.

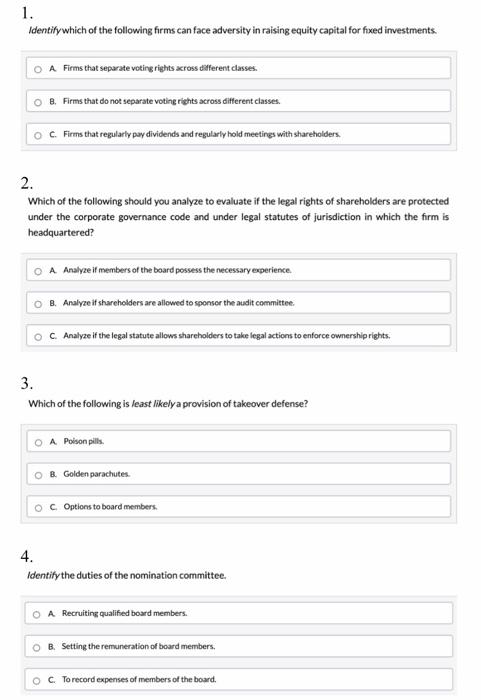

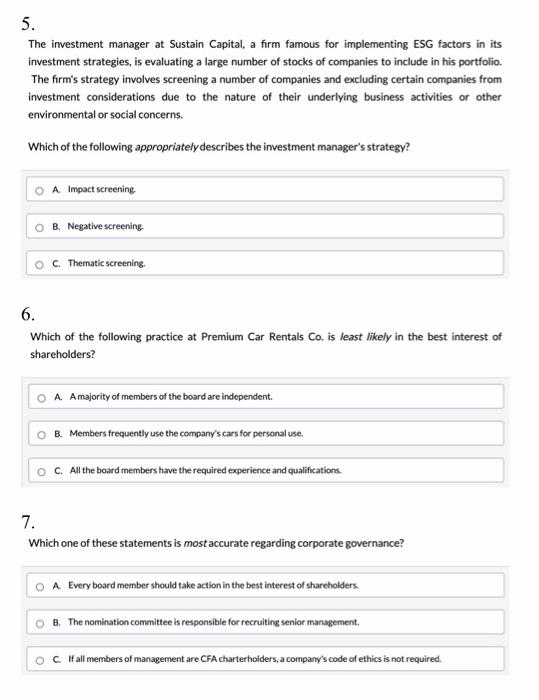

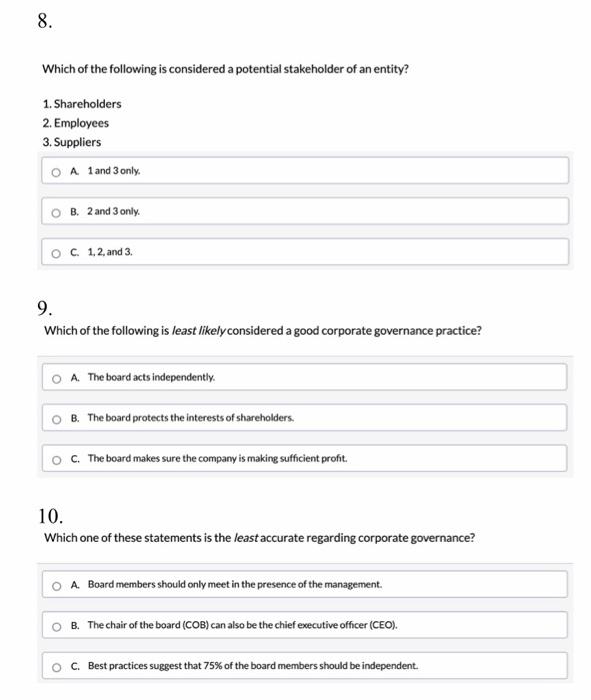

1. Identify which of the following firms can face adversity in raising equity capital for fixed investments. O A Firms that separate voting rights across different classes. 08. Firms that do not separate voting rights across different classes. O Firms that regularly pay dividends and regularly hold meetings with shareholders 2. Which of the following should you analyze to evaluate if the legal rights of shareholders are protected under the corporate governance code and under legal statutes of jurisdiction in which the firm is headquartered? O A. Analyze il members of the board possess the necessary experience. 08. Analyze if shareholders are allowed to sponsor the audit committee OC Analyze if the legal statute allows shareholders to take legal actions to enforce ownership rights. 3. Which of the following is least likely a provision of takeover defense? O A Poison pills O B. Golden parachutes Oc Options to board members. 4. Identify the duties of the nomination committee. A Recruiting qualified board members. O B. Setting the remuneration of board members. O C To record expenses of members of the board. 5. The investment manager at Sustain Capital, a firm famous for implementing ESG factors in its investment strategies, is evaluating a large number of stocks of companies to include in his portfolio The firm's strategy involves screening a number of companies and excluding certain companies from investment considerations due to the nature of their underlying business activities or other environmental or social concerns. Which of the following appropriately describes the investment manager's strategy? A. Impact screening B. Negative screening OC Thematic screening 6. Which of the following practice at Premium Car Rentals Co. is least likely in the best interest of shareholders? o A. A majority of members of the board are independent. O B. Members frequently use the company's cars for personal use. OC. All the board members have the required experience and qualifications 7. Which one of these statements is most accurate regarding corporate governance? A Every board member should take action in the best interest of shareholders. B. The nomination committee is responsible for recruiting senior management OC. If all members of management are CFA charterholders, a company's code of ethics is not required. 8. Which of the following is considered a potential stakeholder of an entity? 1. Shareholders 2. Employees 3. Suppliers A 1 and 3 only. O B. 2 and 3 only. O C. 1. 2. and 3. 9. Which of the following is least likely considered a good corporate governance practice? O A. The board acts independently. OB. The board protects the interests of shareholders. o C. The board makes sure the company is making sufficient profit. 10. Which one of these statements is the least accurate regarding corporate governance? O A. Board members should only meet in the presence of the management. OB. The chair of the board (COB) can also be the chief executive officer (CEO). C. Best practices suggest that 75% of the board members should be independent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts