Question: please only do B and show work! thanks! (a) A bank has risk-weighted assets of $175 and equity of $12.5. If regulators require a minimum

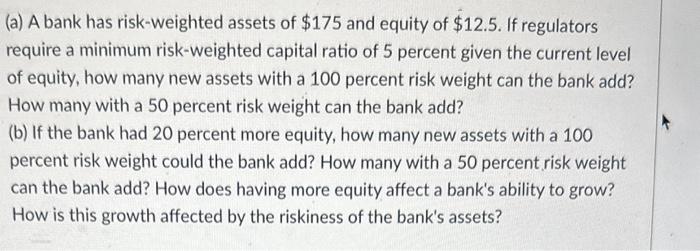

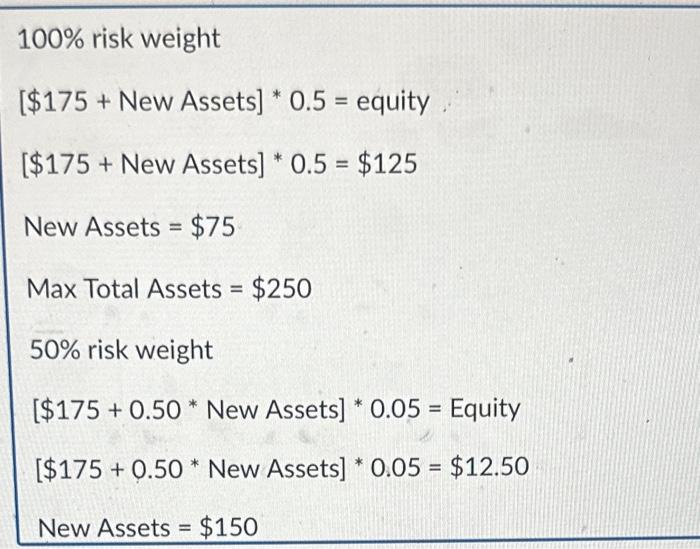

(a) A bank has risk-weighted assets of $175 and equity of $12.5. If regulators require a minimum risk-weighted capital ratio of 5 percent given the current level of equity, how many new assets with a 100 percent risk weight can the bank add? How many with a 50 percent risk weight can the bank add? (b) If the bank had 20 percent more equity, how many new assets with a 100 percent risk weight could the bank add? How many with a 50 percent risk weight can the bank add? How does having more equity affect a bank's ability to grow? How is this growth affected by the riskiness of the bank's assets? 100% risk weight [$175+NewAssets]0.5= equity [$175+NewAssets]0.5=$125 New Assets =$75 Max Total Assets =$250 50% risk weight [$175+0.50 New Assets ]0.05= Equity [$175+0.50 New Assets ] * 0.05=$12.50 New Assets =$150

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts