Question: Please Only do E 2-2. E 2-1 Transaction analysis U LO2-1 The following transactions occurred during March 2024 for the Right Corporation. The company operates

Please Only do E 2-2.

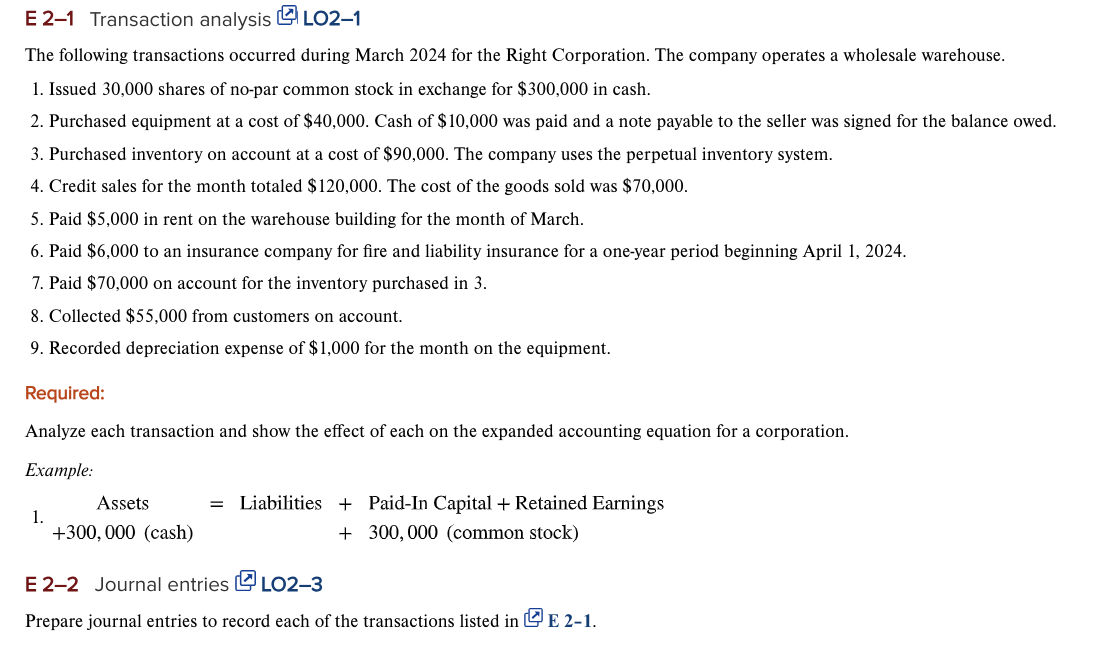

E 2-1 Transaction analysis U LO2-1 The following transactions occurred during March 2024 for the Right Corporation. The company operates a wholesale warehouse. 1. Issued 30,000 shares of no-par common stock in exchange for $300,000 in cash. 2. Purchased equipment at a cost of $40,000. Cash of $10,000 was paid and a note payable to the seller was signed for the balance owed. 3. Purchased inventory on account at a cost of $90,000. The company uses the perpetual inventory system. 4. Credit sales for the month totaled $120,000. The cost of the goods sold was $70,000. 5. Paid $5,000 in rent on the warehouse building for the month of March. 6. Paid $6,000 to an insurance company for fire and liability insurance for a one-year period beginning April 1, 2024. 7. Paid $70,000 on account for the inventory purchased in 3. 8. Collected $55,000 from customers on account. 9. Recorded depreciation expense of $1,000 for the month on the equipment. Required: Analyze each transaction and show the effect of each on the expanded accounting equation for a corporation. Example: 1.Assets=Liabilities+Paid-InCapital+RetainedEarnings+300,000(cash)+300,000(commonstock) E 2-2 Journal entries 4023 Prepare journal entries to record each of the transactions listed in E 2-1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts