Question: Please only do parts which are not already done Last month when Holiday Creations, Incorporated, sold 38,000 units, total sales were $152,000, total variable expenses

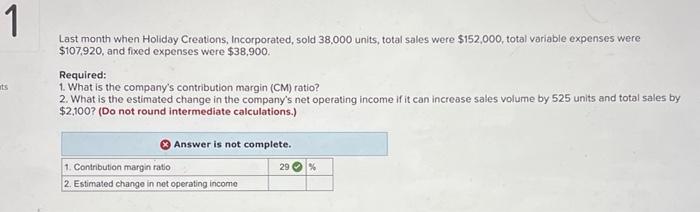

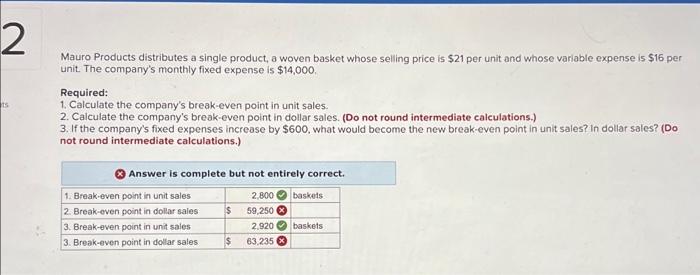

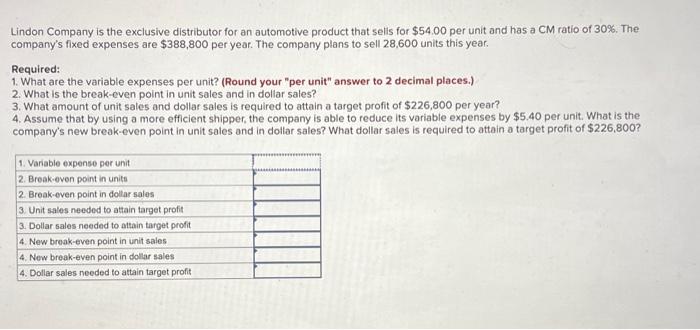

Last month when Holiday Creations, Incorporated, sold 38,000 units, total sales were $152,000, total variable expenses were $107,920, and fixed expenses were $38,900. Required: 1. What is the company's contribution margin (CM) ratio? 2. What is the estimated change in the company's net operating income if it can increase sales volume by 525 units and total sales by $2,100 ? (Do not round intermediate calculations.) Mauro Products distributes a single product, a woven basket whose selling price is $21 per unit and whose variable expense is $16 per unit. The company's monthly fixed expense is $14,000. Required: 1. Calculate the company's break-even point in unit sales. 2. Calculate the company's break-even point in dollar sales. (Do not round intermediate calculations.) 3. If the company's fixed expenses increase by $600, what would become the new break-even point in unit sales? In dollar sales? (Do not round intermediate calculations.) Lindon Company is the exclusive distributor for an automotive product that selis for $54.00 per unit and has a CM ratio of 30%. The company's fixed expenses are $388,800 per year. The company plans to sell 28,600 units this year. Required: 1. What are the variable expenses per unit? (Round your "per unit" answer to 2 decimal places.) 2. What is the break-even point in unit sales and in dollar sales? 3. What amount of unit sales and dollar sales is required to attain a target profit of $226,800 per year? 4. Assume that by using a more efficient shipper, the company is able to reduce its variable expenses by $5.40 per unit. What is the company's new break-even point in unit sales and in dollar sales? What dollar sales is required to attain a target profit of $226,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts