Question: Please Only do step 1 & 2 During the first month of operations, the following transactions were completed by ABC Corporation: Dec 1 Issued 25,000

Please Only do step 1 & 2

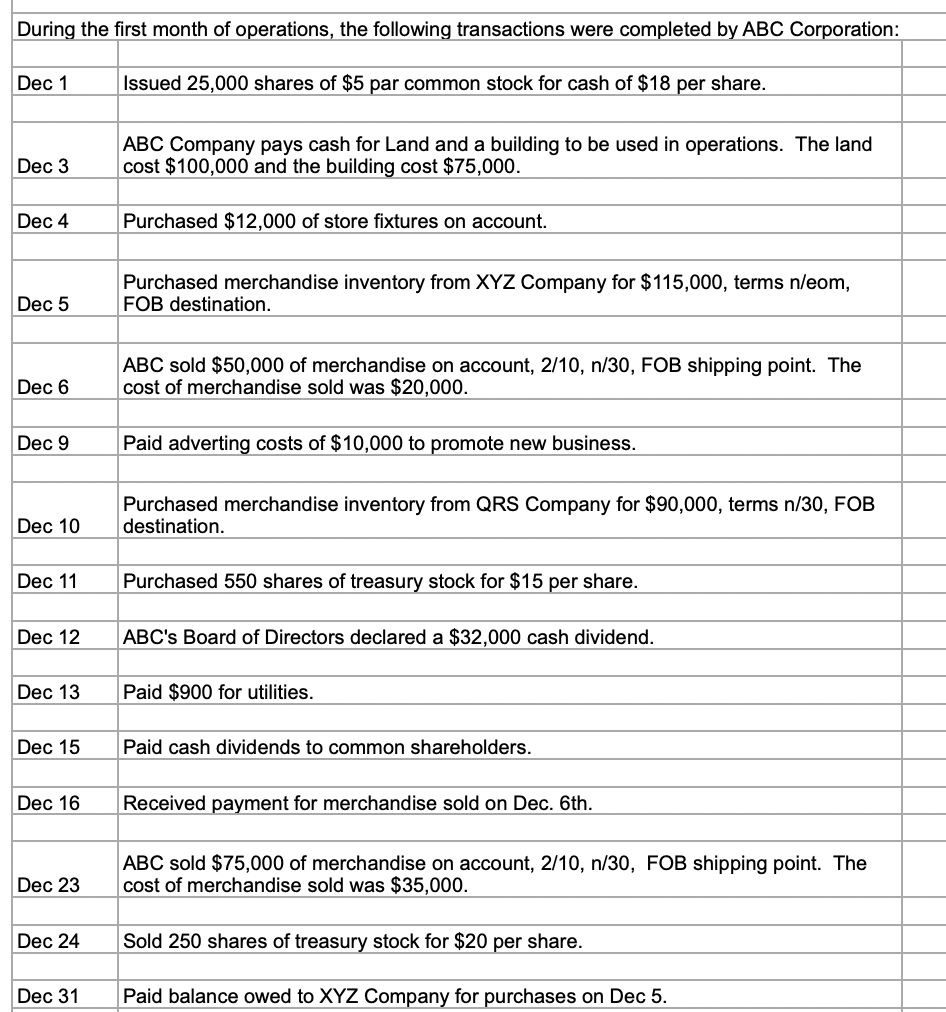

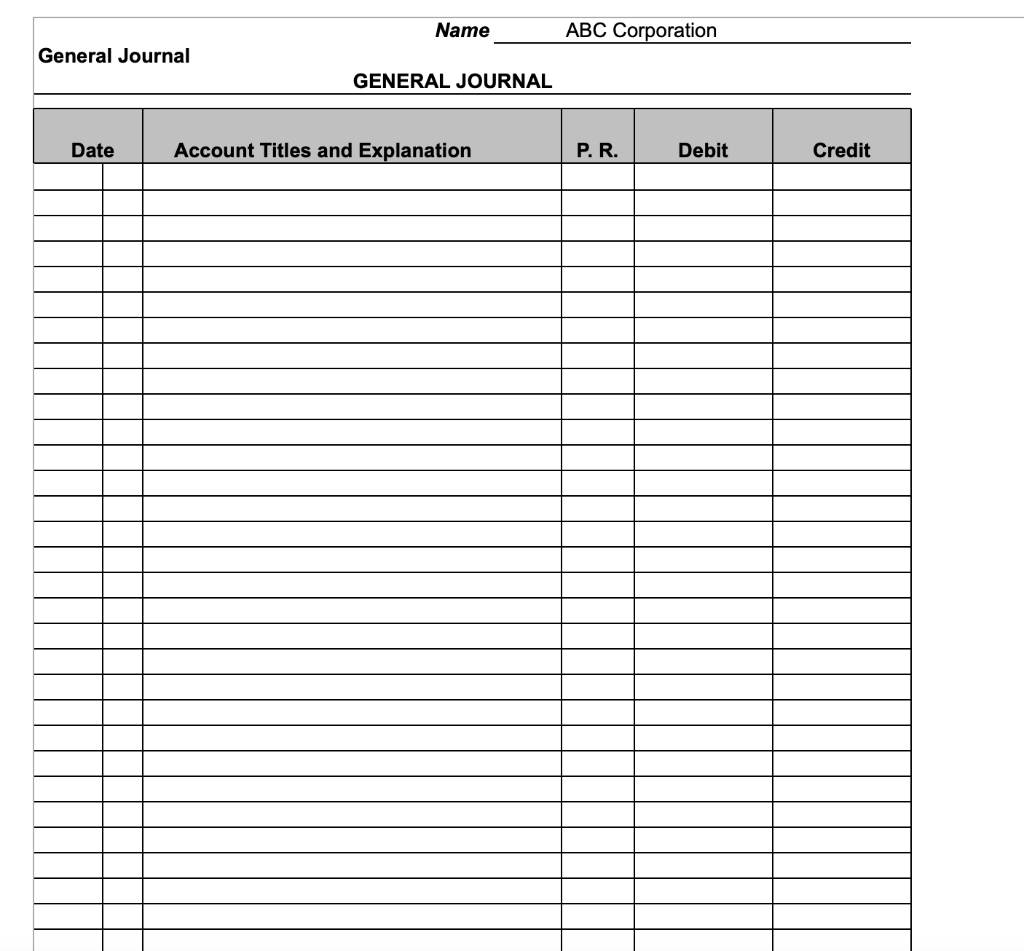

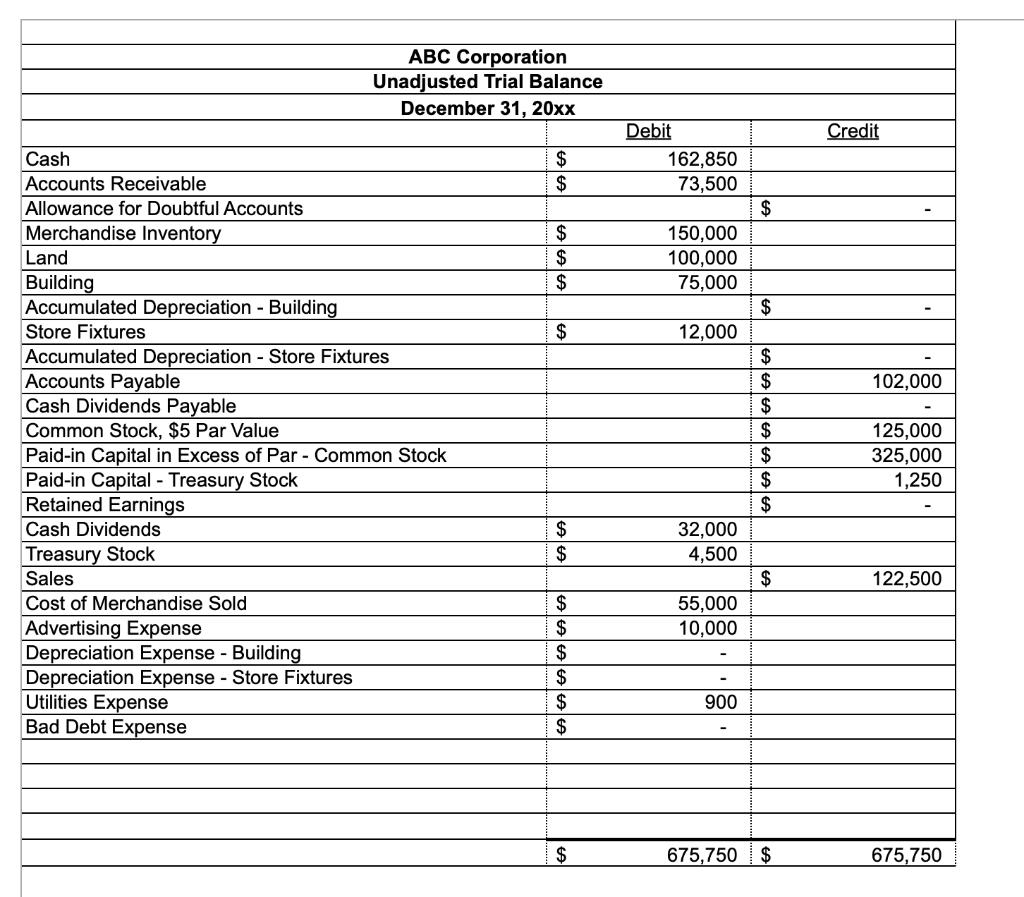

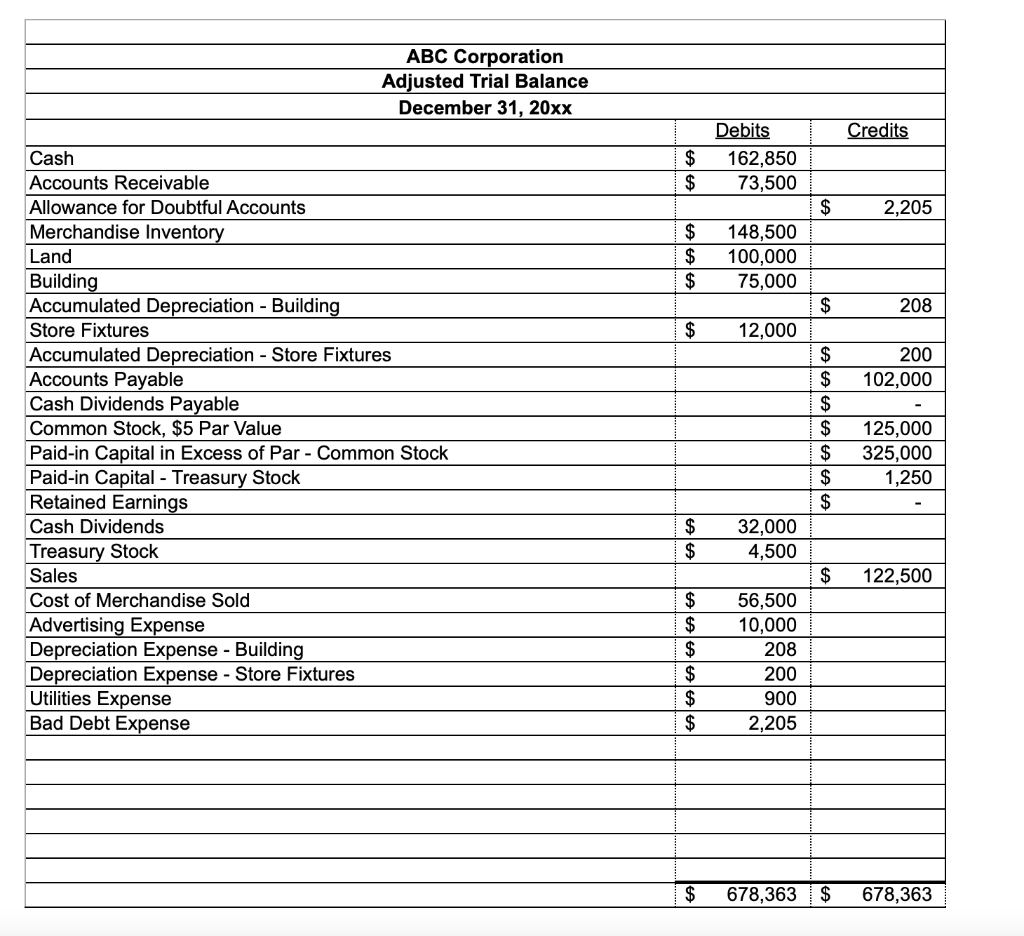

During the first month of operations, the following transactions were completed by ABC Corporation: Dec 1 Issued 25,000 shares of $5 par common stock for cash of $18 per share. ABC Company pays cash for Land and a building to be used in operations. The land cost $100,000 and the building cost $75,000. Dec 3 Dec 4 Purchased $12,000 of store fixtures on account. Purchased merchandise inventory from XYZ Company for $115,000, terms n/eom, FOB destination. Dec 5 ABC sold $50,000 of merchandise on account, 2/10, n/30, FOB shipping point. The cost of merchandise sold was $20,000. Dec 6 Dec 9 Paid adverting costs of $10,000 to promote new business. Purchased merchandise inventory from QRS Company for $90,000, terms n/30, FOB destination. Dec 10 Dec 11 Purchased 550 shares of treasury stock for $15 per share. Dec 12 ABC's Board of Directors declared a $32,000 cash dividend. Dec 13 Paid $900 for utilities. Dec 15 Paid cash dividends to common shareholders. Dec 16 Received payment for merchandise sold on Dec. 6th. ABC sold $75,000 of merchandise on account, 2/10, n/30, FOB shipping point. The cost of merchandise sold was $35,000. Dec 23 Dec 24 Sold 250 shares of treasury stock for $20 per share. Dec 31 Paid balance owed to XYZ Company for purchases on Dec 5. At the end of December, the following adjustment data were assembled. After a physical count of inventory, it was determined that $ 148,500 of inventory exists at December 31. a b Based on an analysis of A/R, ABC Company anticipates 3% of A/R to be uncollectible. Buildings are depreciated using the straight line method with no salvage value for 30 years. Round to the nearest dollar. Store Fixtures are depreciated using the straight-line method with no salvage value for 5 years. Round to the nearest dollar. d Directions: 1 Journalize the routine transactions above on the Journal-December tab. Use the Unadjusted Trial Balance and adjusting information provided above to journalize the 4 adjusting entries on the Journal - December tab (below the routine entries). 2 Use the Adjusted Trial Balance provided to prepare financial statments for ABC Corporation. You are only responsible for preparing the Income Statement, Statement of Retained Earnings, and classified Balance Sheet. These should be completed on the Financial Statements tab. 3 You should complete your final project in this Excel workbook using the following tabs: Journal- December and Financial Statements. You may use another spreadsheet program as long as Excel can open the file. Name ABC Corporation General Journal GENERAL JOURNAL Date Account Titles and Explanation P. R. Debit Credit ABC Corporation Unadjusted Trial Balance December 31, 20xx Credit $ $ Debit 162,850 73,500 $ $ $ $ 150,000 100,000 75,000 $ $ 12,000 102,000 Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Land Building Accumulated Depreciation - Building Store Fixtures Accumulated Depreciation - Store Fixtures Accounts Payable Cash Dividends Payable Common Stock, $5 Par Value Paid-in Capital in Excess of Par - Common Stock Paid-in Capital - Treasury Stock Retained Earnings Cash Dividends Treasury Stock Sales Cost of Merchandise Sold Advertising Expense Depreciation Expense - Building Depreciation Expense - Store Fixtures Utilities Expense Bad Debt Expense $ $ $ $ $ $ $ 125,000 325,000 1,250 $ $ 32,000 4,500 $ 122,500 55,000 10,000 $ $ $ $ $ $ 900 $ 675,750 $ 675,750 ABC Corporation Adjusted Trial Balance December 31, 20xx Credits $ $ Debits 162,850 73,500 $ 2,205 $ $ $ 148,500 100,000 75,000 $ 208 le 12,000 200 102,000 Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Land Building Accumulated Depreciation - Building Store Fixtures Accumulated Depreciation - Store Fixtures Accounts Payable Cash Dividends Payable Common Stock, $5 Par Value Paid-in Capital in Excess of Par - Common Stock Paid-in Capital - Treasury Stock Retained Earnings Cash Dividends Treasury Stock Sales Cost of Merchandise Sold Advertising Expense Depreciation Expense - Building Depreciation Expense - Store Fixtures Utilities Expense Bad Debt Expense $ $ $ $ $ $ $ 125,000 325,000 1,250 $ $ 32,000 4,500 $ 122,500 $ $ $ $ 56,500 10,000 208 200 900 2,205 $ 678,363 $ 678,363

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts