Question: PLEASE only do the question if you can do it right!!! I have had so many questions that have been incorrect lately! End-of-Period Spreadsheet The

PLEASE only do the question if you can do it right!!! I have had so many questions that have been incorrect lately!

PLEASE only do the question if you can do it right!!! I have had so many questions that have been incorrect lately!

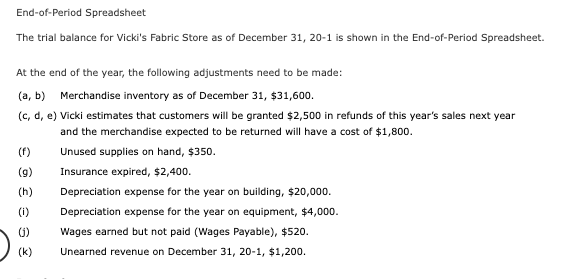

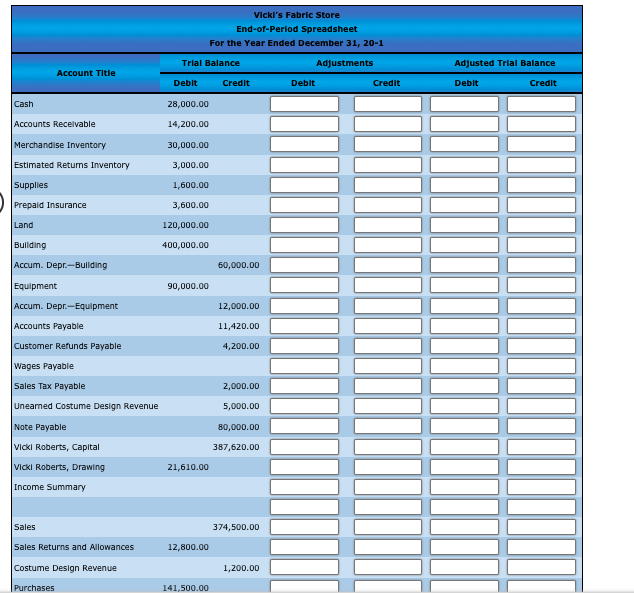

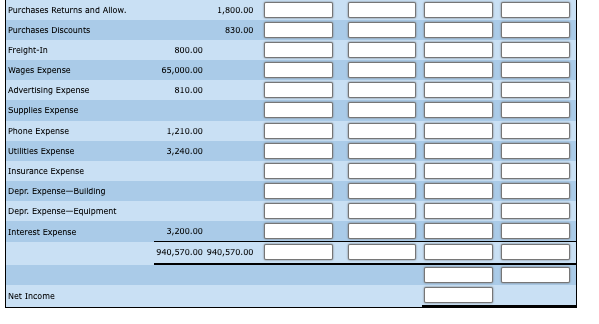

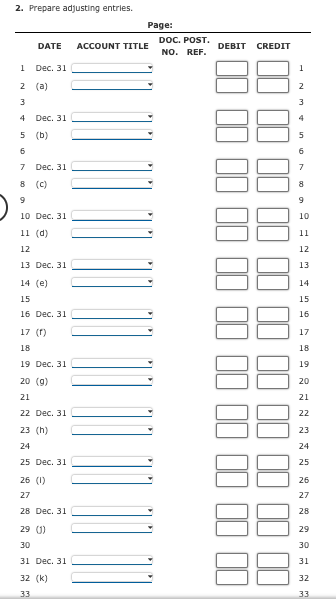

End-of-Period Spreadsheet The trial balance for Vicki's Fabric Store as of December 31, 20-1 is shown in the End-of-Period Spreadsheet. At the end of the year, the following adjustments need to be made: (a, b) Merchandise inventory as of December 31, $31,600. (c, d, e) Vicki estimates that customers will be granted $2,500 in refunds of this year's sales next year and the merchandise expected to be returned will have a cost of $1,800. (f) Unused supplies on hand, $350. (9) Insurance expired, $2,400. Depreciation expense for the year on building, $20,000. (0) Depreciation expense for the year on equipment, $4,000. 6) Wages earned but not paid (Wages Payable), $520. (k) Unearned revenue on December 31, 20-1, $1,200. (h) Vicki's Fabric Store End-of-Period Spreadsheet For the Year Ended December 31, 20-1 Trial Balance Adjustments Adjusted Trial Balance Account Title Debit Credit Debit Credit Debit Credit Cash 28,000.00 14,200.00 Accounts Receivable 30,000.00 3,000.00 Merchandise Inventory Estimated Returns Inventory Supplies Prepaid Insurance 1,600.00 3,600.00 Land 120,000.00 Building 400,000.00 Accum. Depr.-Building 60,000.00 90,000.00 12,000.00 11,420.00 4,200.00 Equipment Accum. Depr.- Equipment Accounts Payable Customer Refunds Payable Wages Payable Sales Tax Payable uneared Costume Design Revenue Note Payable 2,000.00 5,000.00 80,000.00 Vicki Roberts, Capital 387,620.00 Vicki Roberts, Drawing 21,610.00 Income Summary Sales 374,500.00 Sales Returns and Allowances 12,800.00 Costume Design Revenue 1,200.00 Purchases 141,500.00 Purchases Returns and Allow. 1,800.00 Purchases Discounts 830.00 Freight-in 800.00 Wages Expense 65,000.00 Advertising Expense 810.00 Supplies Expense Phone Expense 1,210.00 Utilities Expense 3,240.00 Insurance Expense Depr. Expense-Building Depr. Expense-Equipment Interest Expense 3,200.00 940,570.00 940,570.00 Net Income 2. Prepare adjusting entries. Page: DOC. POST. DATE ACCOUNT TITLE NO. REF. DEBIT CREDIT 1 Dec. 31 1 2 (a) 2 3 3 4 Dec. 31 4 5 (b) 6 7 Dec. 31 8 (C) 9 10 Dec. 31 11 (d) II II I 9 10 11 12 12 13 Dec. 31 13 14 (e) 14 15 15 16 16 Dec. 31 17 (1) 18 17 18 19 Dec. 31 19 20 (9) 20 21 22 Dec. 31 21 22 23 23 (h) 24 24 25 Dec. 31 25 11 26 (0) 27 26 27 28 Dec. 31 28 29 29 0) 30 In 30 31 Dec. 31 31 32 32 (k) 33 33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts