Question: Please only do the statement questions based off of the balance sheet! Fuzzy Button Clothing Company Balance Sheet for Year Ending December 31 (Millions of

Please only do the statement questions based off of the balance sheet!

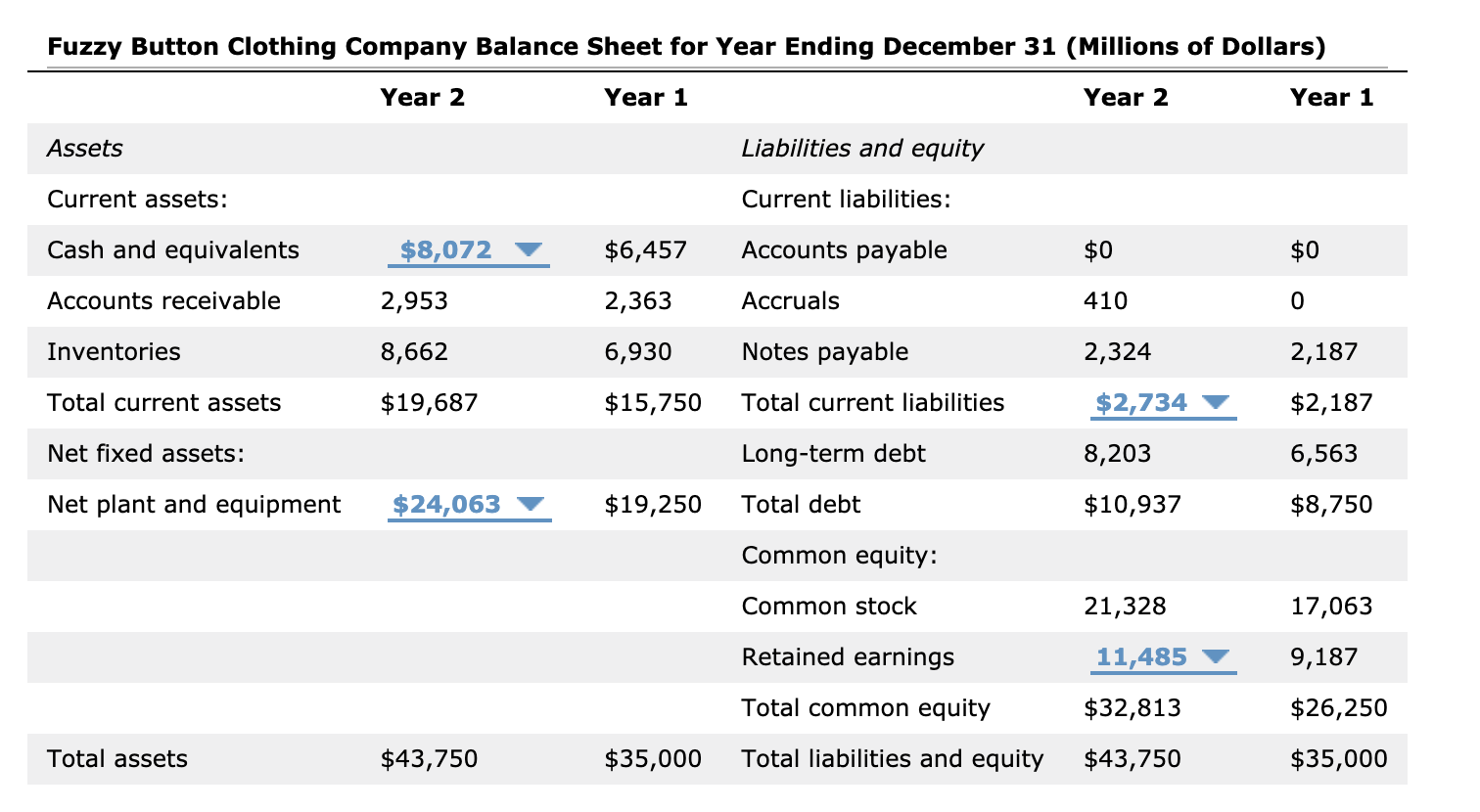

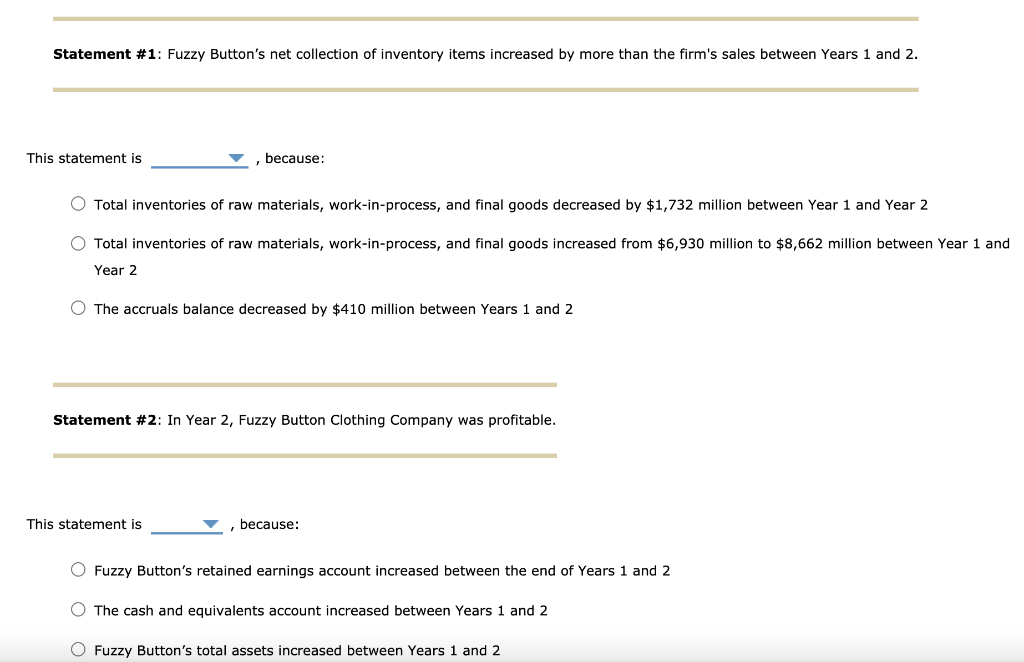

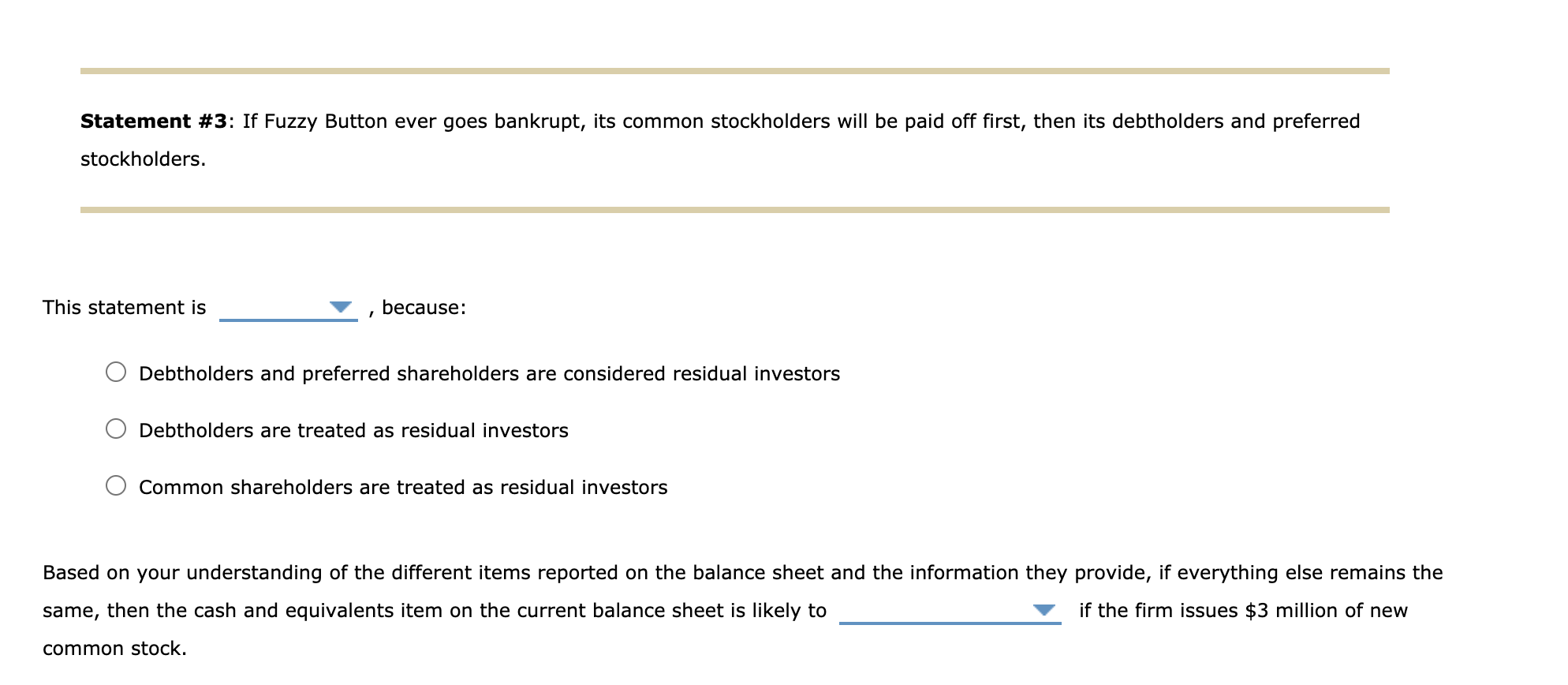

Fuzzy Button Clothing Company Balance Sheet for Year Ending December 31 (Millions of Dollars) Year 2 Year 1 Year 2 Year 1 Assets Liabilities and equity Current assets: Current liabilities: Cash and equivalents $8,072 $6,457 Accounts payable $0 $0 Accounts receivable 2,953 2,363 Accruals 410 0 Inventories 8,662 6,930 Notes payable 2,324 2,187 Total current assets $19,687 $15,750 Total current liabilities $2,734 $2,187 Net assets: Long-term del 8,203 6,563 Net plant and equipment $24,063 $19,250 Total debt $10,937 $8,750 Common equity: Common stock 21,328 17,063 Retained earnings 11,485 9,187 Total common equity $32,813 $26,250 Total assets $43,750 $35,000 Total liabilities and equity $43,750 $35,000 Statement #1: Fuzzy Button's net collection of inventory items increased by more than the firm's sales between Years 1 and 2. This statement is because: Total inventories of raw materials, work-in-process, and final goods decreased by $1,732 million between Year 1 and Year 2 O Total inventories of raw materials, work-in-process, and final goods increased from $6,930 million to $8,662 million between Year 1 and Year 2 The accruals balance decreased by $410 million between Years 1 and 2 Statement #2: In Year 2, Fuzzy Button Clothing Company was profitable. This statement is , because: Fuzzy Button's retained earnings account increased between the end of Years 1 and 2 The cash and equivalents account increased between Years 1 and 2 O Fuzzy Button's total assets increased between Years 1 and 2 Statement #3: If Fuzzy Button ever goes bankrupt, its common stockholders will be paid off first, then its debtholders and preferred stockholders. This statement is because: Debtholders and preferred shareholders are considered residual investors Debtholders are treated as residual investors Common shareholders are treated as residual investors Based on your understanding of the different items reported on the balance sheet and the information they provide, if everything else remains the same, then the cash and equivalents item on the current balance sheet is likely to if the firm issues $3 million of new common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts