Question: Please only help if certain, I wil thumbs up if correct. In the 2016 Income statement it is noted that John wanted his food purchases

Please only help if certain, I wil thumbs up if correct.

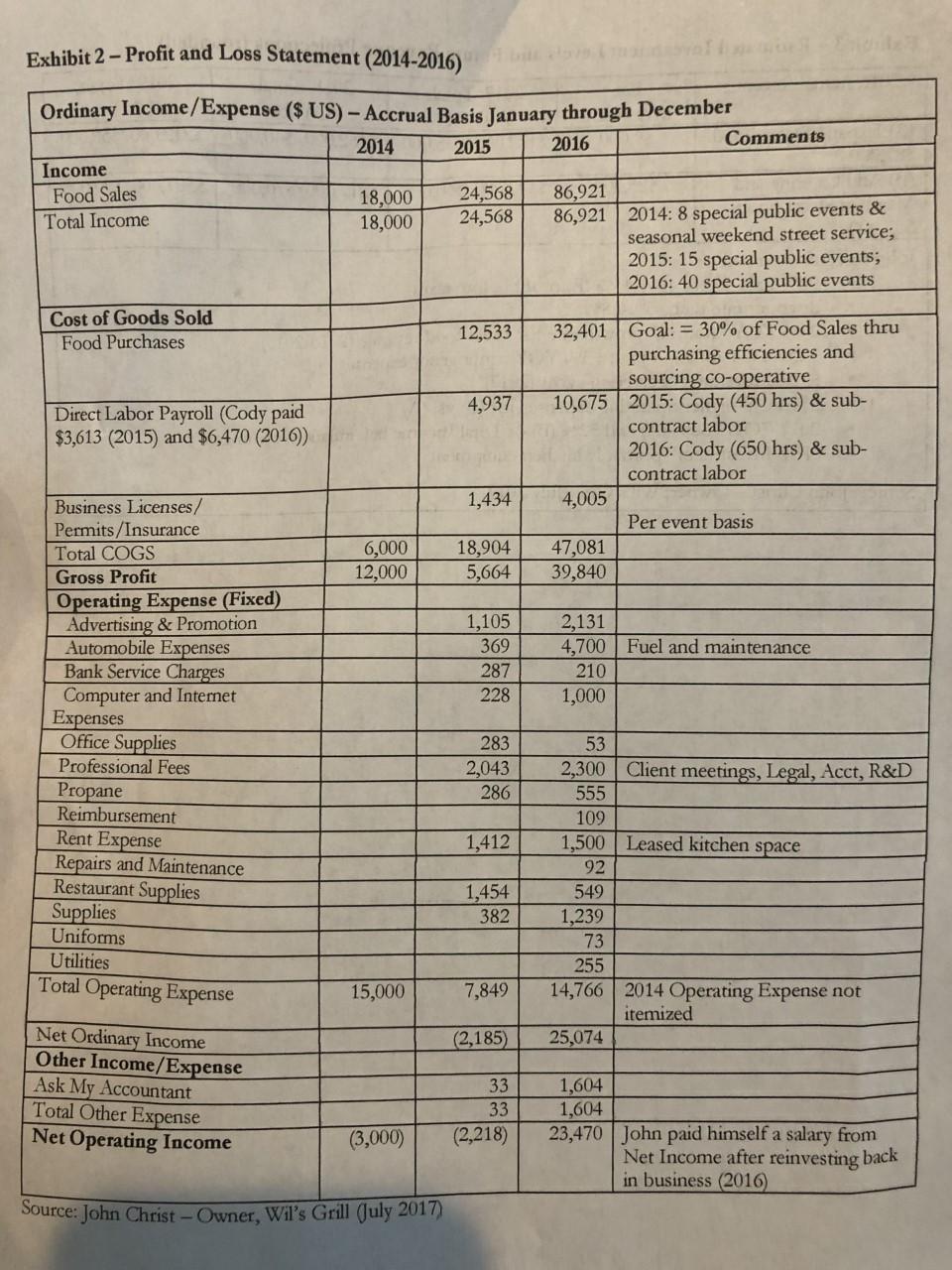

In the 2016 Income statement it is noted that John wanted his food purchases to be 30% of food sales. a. What was his percentage of food costs to food sales in 2016 b. what would his pre-tax profit be for 2016 if he had realized a 30% food cost to revenues? c. What would his pre-tax profit margin be if he had realized a 30% food cost to food sales?

Exhibit 2 Profit and Loss Statement (2014-2016) Ordinary Income/Expense ($ US) - Accrual Basis January through December Comments 2014 2015 2016 Income Food Sales Total Income 18,000 18,000 24,568 24,568 86,921 86,921 2014: 8 special public events & seasonal weekend street service; 2015: 15 special public events; 2016: 40 special public events Cost of Goods Sold Food Purchases 12,533 4,937 Direct Labor Payroll (Cody paid $3,613 (2015) and $6,470 (2016) 32,401 Goal: = 30% of Food Sales thru purchasing efficiencies and sourcing co-operative 10,675 2015: Cody (450 hrs) & sub- contract labor 2016: Cody (650 hrs) & sub- contract labor 4,005 Per event basis 47,081 39,840 1,434 6,000 12,000 18,904 5,664 1,105 369 287 2,131 4,700 Fuel and maintenance 210 1,000 228 Business Licenses/ Permits/Insurance Total COGS Gross Profit Operating Expense (Fixed) Advertising & Promotion Automobile Expenses Bank Service Charges Computer and Internet Expenses Office Supplies Professional Fees Propane Reimbursement Rent Expense Repairs and Maintenance Restaurant Supplies Supplies Uniforms Utilities 283 2,043 286 53 2,300 Client meetings, Legal, Acct, R&D 555 109 1,500 Leased kitchen space 92 549 1,412 1,454 382 1,239 Total Operating Expense 15,000 7,849 73 255 14,766 2014 Operating Expense not itemized 25,074 (2,185) Net Ordinary Income Other Income/Expense Ask My Accountant Total Other Expense Net Operating Income 33 33 (2,218) (3,000) 1,604 1,604 23,470 John paid himself a salary from Net Income after reinvesting back in business (2016) Source: John Christ - Owner, Wil's Grill (July 2017)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts