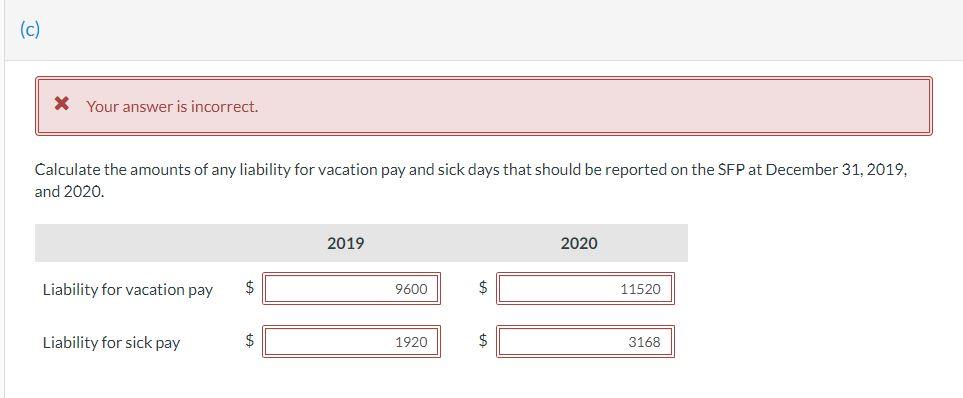

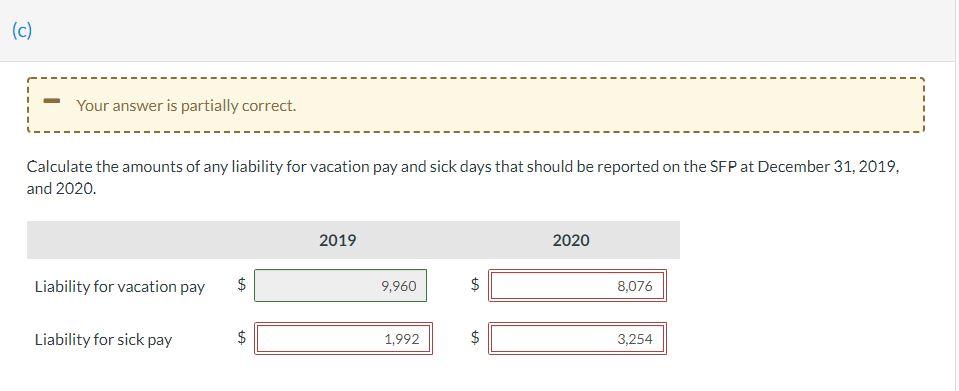

Question: Please only help with c) pls note that 9960 is correct answer for the first, all other answers are wrong listed above for c) 8076,1992,3254,11520,1920,3168

Please only help with c)

pls note that 9960 is correct answer for the first, all other answers are wrong listed above for c) 8076,1992,3254,11520,1920,3168 are all WRONG answers

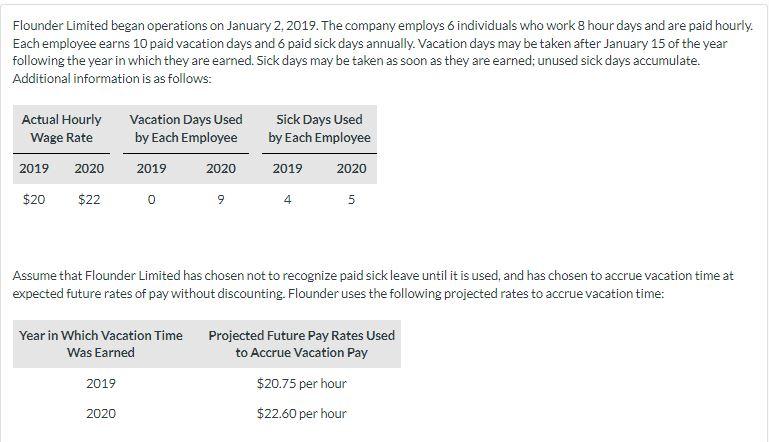

Flounder Limited began operations on January 2, 2019. The company employs 6 individuals who work 8 hour days and are paid hourly. Each employee earns 10 paid vacation days and 6 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows: Actual Hourly Vacation Days Used Sick Days Used by Each Employee Wage Rate by Each Employee 2019 2020 2019 2020 2019 2020 $20 $22 0 9 4 5 Assume that Flounder Limited has chosen not to recognize paid sick leave until it is used, and has chosen to accrue vacation time at expected future rates of pay without discounting. Flounder uses the following projected rates to accrue vacation time: Projected Future Pay Rates Used Year in which Vacation Time Was Earned to Accrue Vacation Pay 2019 $20.75 per hour 2020 $22.60 per hour (c) * Your answer is incorrect. Calculate the amounts of any liability for vacation pay and sick days that should be reported on the SFP at December 31, 2019, and 2020. 2019 2020 Liability for vacation pay $ 9600 $ 11520 Liability for sick pay $ 1920 $ 3168 (c) Your answer is partially correct. Calculate the amounts of any liability for vacation pay and sick days that should be reported on the SFP at December 31, 2019. and 2020. 2019 2020 Liability for vacation pay 9,960 8,076 Liability for sick pay 1,992 3,254 LA tA LA $ LA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts