Question: Please only help with Question 13 value? 11-17. CAPITAL BUDGETING CRITERIA A company has an 11% WACC and is considering two mutually exclusive investments that

Please only help with Question 13

Please only help with Question 13

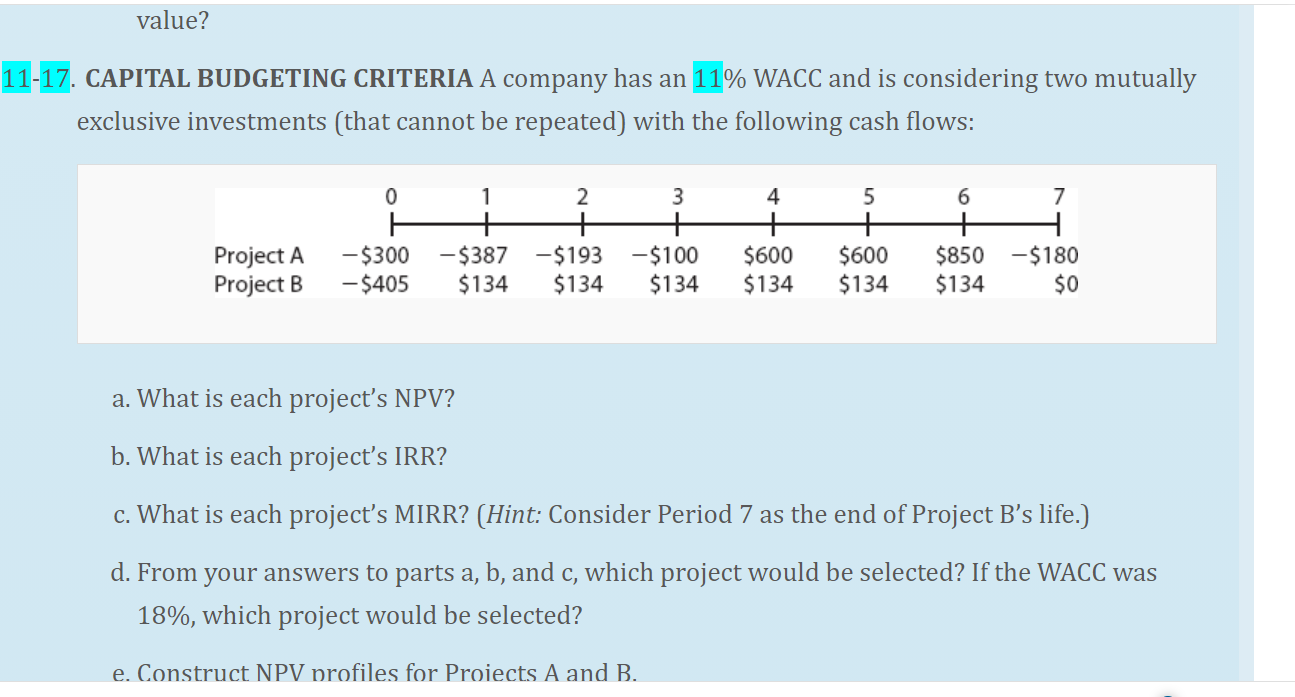

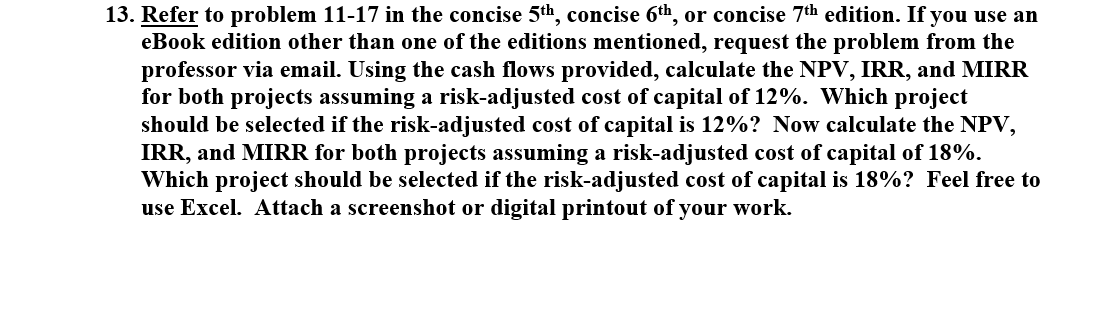

value? 11-17. CAPITAL BUDGETING CRITERIA A company has an 11% WACC and is considering two mutually exclusive investments that cannot be repeated) with the following cash flows: 0 1 2 + -$193 $134 3 + -$100 $134 4 + $600 $134 5 + $600 $134 6 7 + $850 - $180 $134 $0 Project A Project B - $300 - $405 - $387 $134 a. What is each project's NPV? b. What is each project's IRR? c. What is each project's MIRR? (Hint: Consider Period 7 as the end of Project B's life.) d. From your answers to parts a, b, and c, which project would be selected? If the WACC was 18%, which project would be selected? e. Construct NPV profiles for Projects A and B. 13. Refer to problem 11-17 in the concise 5th, concise 6th, or concise 7th edition. If you use an eBook edition other than one of the editions mentioned, request the problem from the professor via email. Using the cash flows provided, calculate the NPV, IRR, and MIRR for both projects assuming a risk-adjusted cost of capital of 12%. Which project should be selected if the risk-adjusted cost of capital is 12%? Now calculate the NPV, IRR, and MIRR for both projects assuming a risk-adjusted cost of capital of 18%. Which project should be selected if the risk-adjusted cost of capital is 18%? Feel free to use Excel. Attach a screenshot or digital printout of your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts