Question: Please only help with question 8, 7 is reference Q8. Now suppose that bull market (and hence the bear market) probabilities change to p= 0.60

Please only help with question 8, 7 is reference

Q8. Now suppose that bull market (and hence the bear market) probabilities change to p= 0.60 and q = 0.4. How does the stop loss change? Do a plot of a few such probabilities (p) versus their best stop losses. Does the plot make sense? Explain the relationship intuitively.

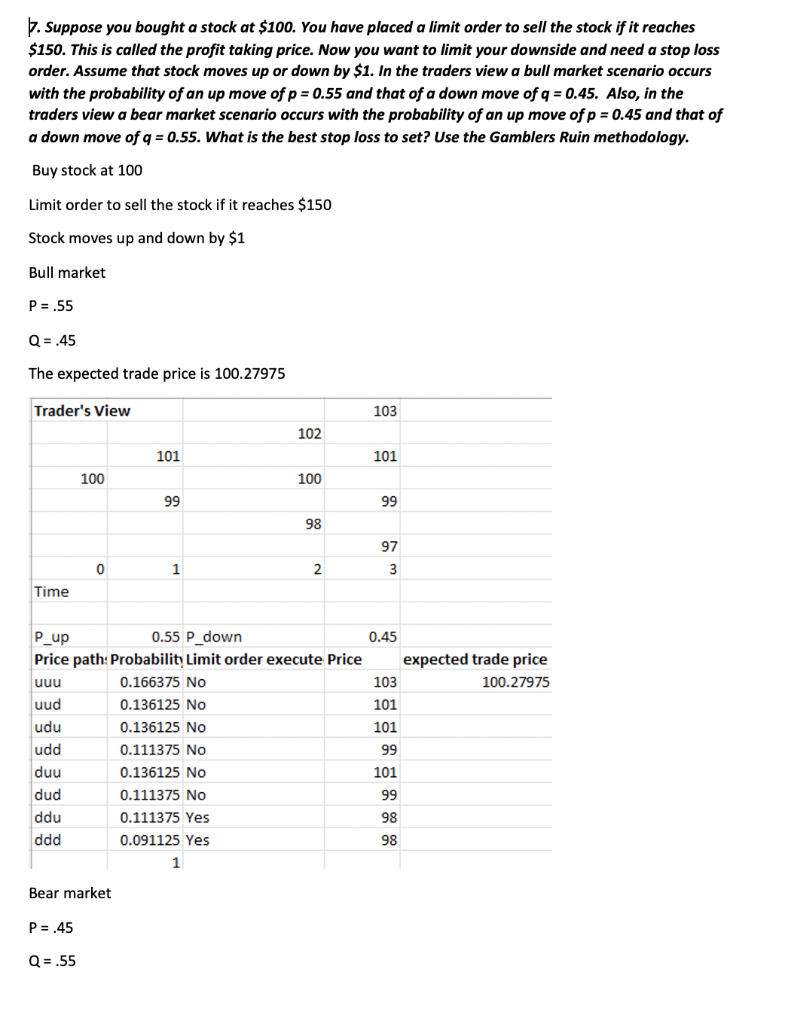

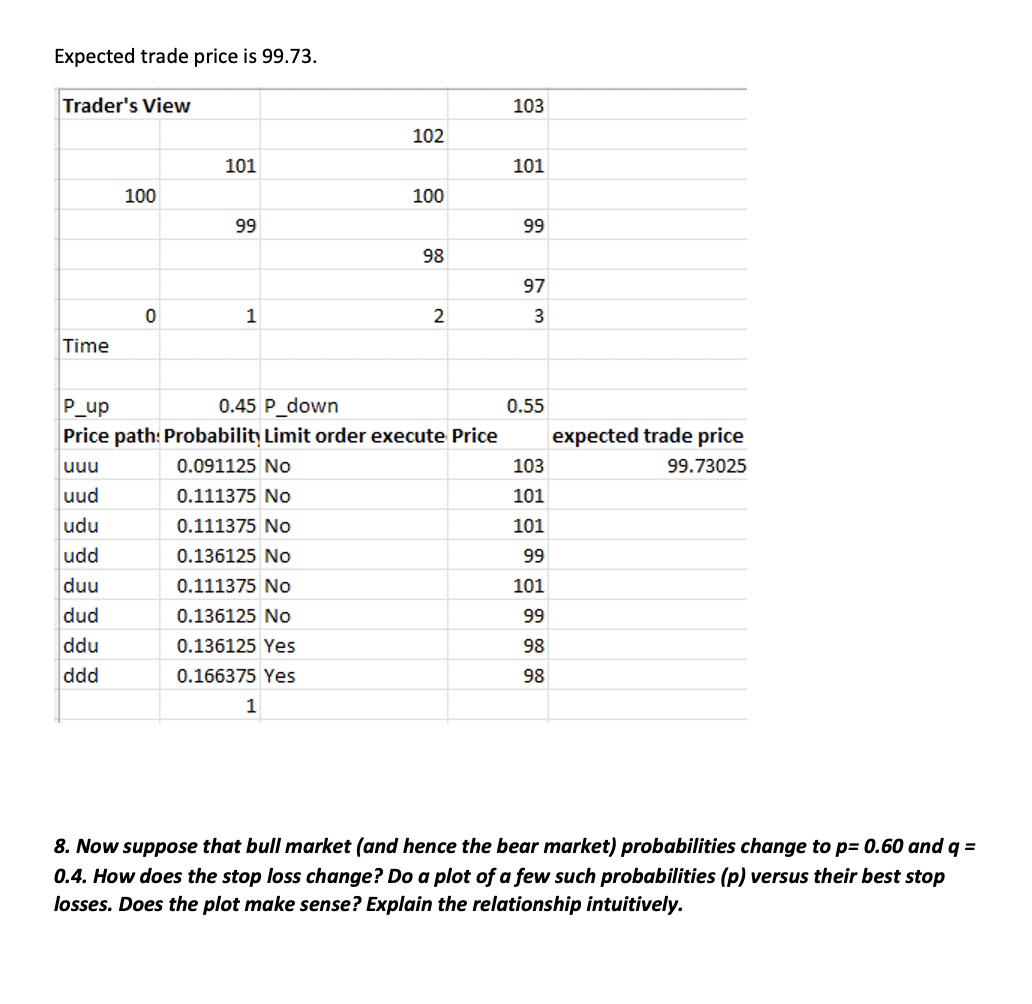

7. Suppose you bought a stock at $100. You have placed a limit order to sell the stock if it reaches $150. This is called the profit taking price. Now you want to limit your downside and need a stop loss order. Assume that stock moves up or down by $1. In the traders view a bull market scenario occurs with the probability of an up move of p = 0.55 and that of a down move of q = 0.45. Also, in the traders view a bear market scenario occurs with the probability of an up move of p = 0.45 and that of a down move of q = 0.55. What is the best stop loss to set? Use the Gamblers Ruin methodology. Buy stock at 100 Limit order to sell the stock if it reaches $150 Stock moves up and down by $1 Bull market P = .55 Q = .45 The expected trade price is 100.27975 Trader's View 103 102 101 101 100 100 99 99 98 97 0 1 2 3 Time P_up 0.55 P_down 0.45 Price path: Probability Limit order execute Price expected trade price uuu 0.166375 No 103 100.27975 uud 0.136125 No 101 udu 0.136125 No 101 udd 0.111375 No 99 duu 0.136125 No 101 dud 0.111375 No 99 ddu 0.111375 Yes 98 ddd 0.091125 Yes 98 1 Bear market P= .45 Q=.55 Expected trade price is 99.73. Trader's View 103 102 101 101 100 100 99 99 98 97 0 1 2 3 Time P_up 0.45 p_down 0.55 Price path: Probability Limit order execute Price expected trade price uuu 0.091125 No 103 99.73025 uud 0.111375 No 101 udu 0.111375 No 101 udd 0.136125 No 99 duu 0.111375 No 101 dud 0.136125 No 99 ddu 0.136125 Yes 98 ddd 0.166375 Yes 98 1 8. Now suppose that bull market (and hence the bear market) probabilities change to p=0.60 and q = 0.4. How does the stop loss change? Do a plot of a few such probabilities (p) versus their best stop losses. Does the plot make sense? Explain the relationship intuitively. 7. Suppose you bought a stock at $100. You have placed a limit order to sell the stock if it reaches $150. This is called the profit taking price. Now you want to limit your downside and need a stop loss order. Assume that stock moves up or down by $1. In the traders view a bull market scenario occurs with the probability of an up move of p = 0.55 and that of a down move of q = 0.45. Also, in the traders view a bear market scenario occurs with the probability of an up move of p = 0.45 and that of a down move of q = 0.55. What is the best stop loss to set? Use the Gamblers Ruin methodology. Buy stock at 100 Limit order to sell the stock if it reaches $150 Stock moves up and down by $1 Bull market P = .55 Q = .45 The expected trade price is 100.27975 Trader's View 103 102 101 101 100 100 99 99 98 97 0 1 2 3 Time P_up 0.55 P_down 0.45 Price path: Probability Limit order execute Price expected trade price uuu 0.166375 No 103 100.27975 uud 0.136125 No 101 udu 0.136125 No 101 udd 0.111375 No 99 duu 0.136125 No 101 dud 0.111375 No 99 ddu 0.111375 Yes 98 ddd 0.091125 Yes 98 1 Bear market P= .45 Q=.55 Expected trade price is 99.73. Trader's View 103 102 101 101 100 100 99 99 98 97 0 1 2 3 Time P_up 0.45 p_down 0.55 Price path: Probability Limit order execute Price expected trade price uuu 0.091125 No 103 99.73025 uud 0.111375 No 101 udu 0.111375 No 101 udd 0.136125 No 99 duu 0.111375 No 101 dud 0.136125 No 99 ddu 0.136125 Yes 98 ddd 0.166375 Yes 98 1 8. Now suppose that bull market (and hence the bear market) probabilities change to p=0.60 and q = 0.4. How does the stop loss change? Do a plot of a few such probabilities (p) versus their best stop losses. Does the plot make sense? Explain the relationship intuitively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts