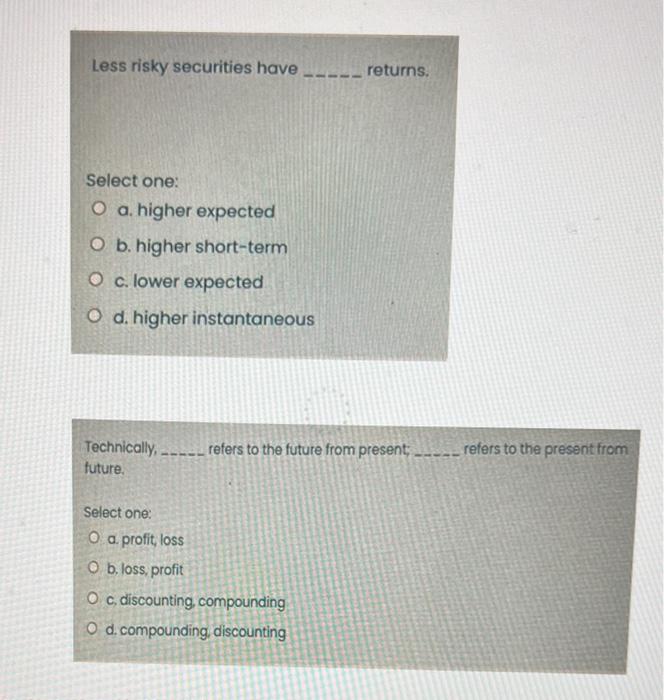

Question: please only i need anwers without explaination Less risky securities have returns. Select one: a. higher expected b. higher short-term c. lower expected d. higher

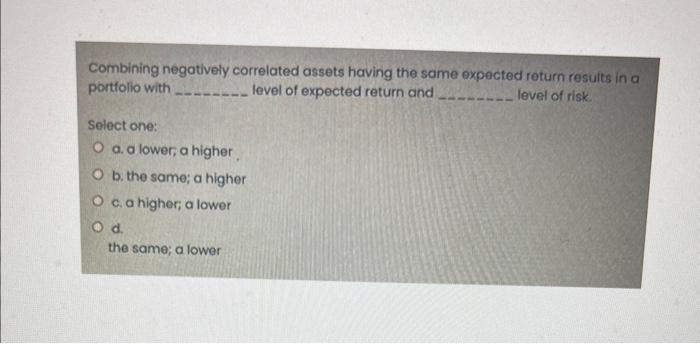

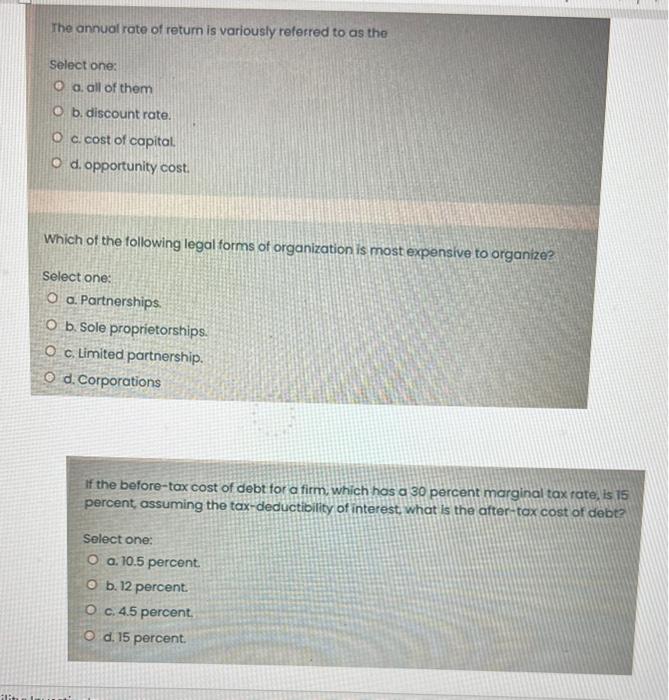

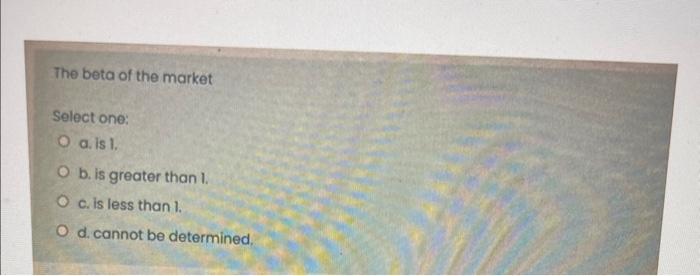

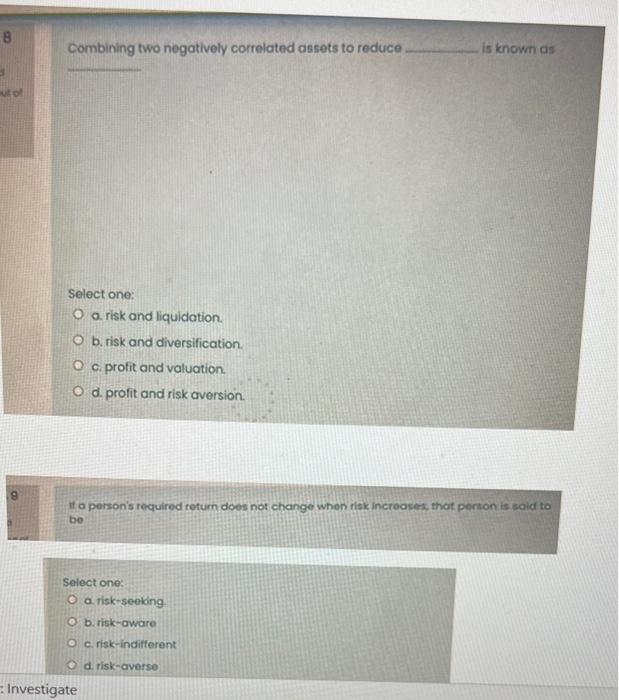

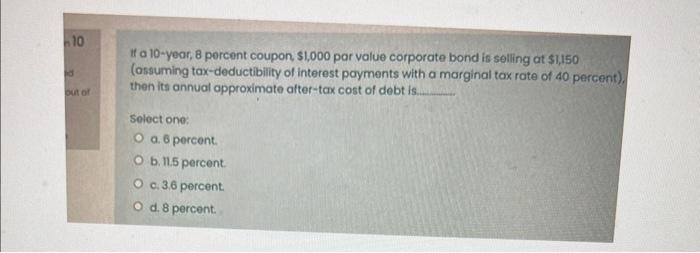

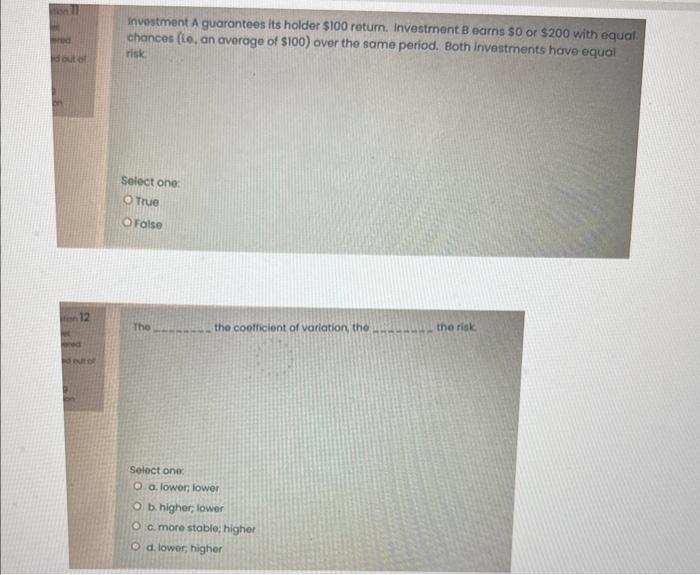

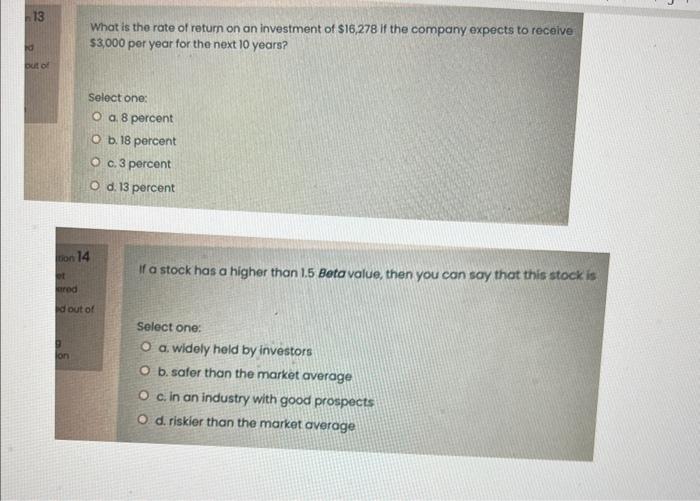

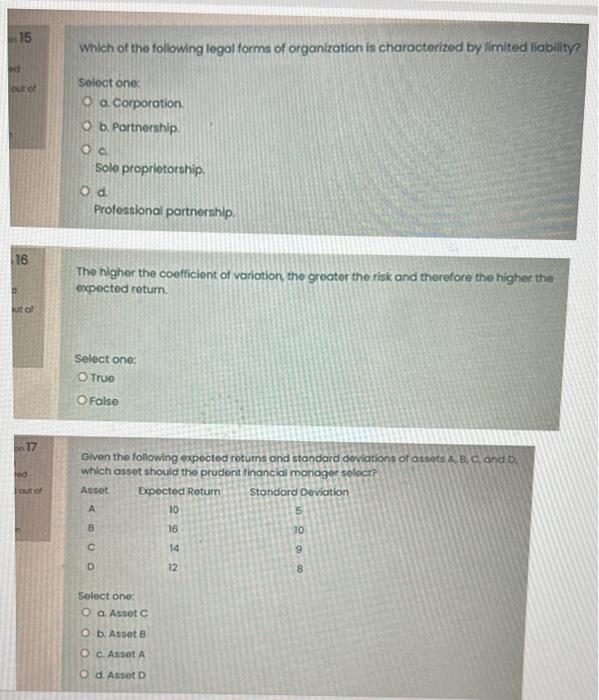

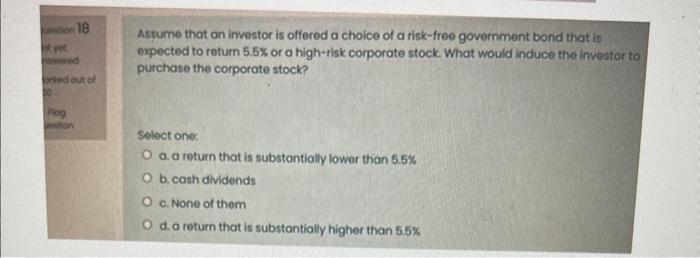

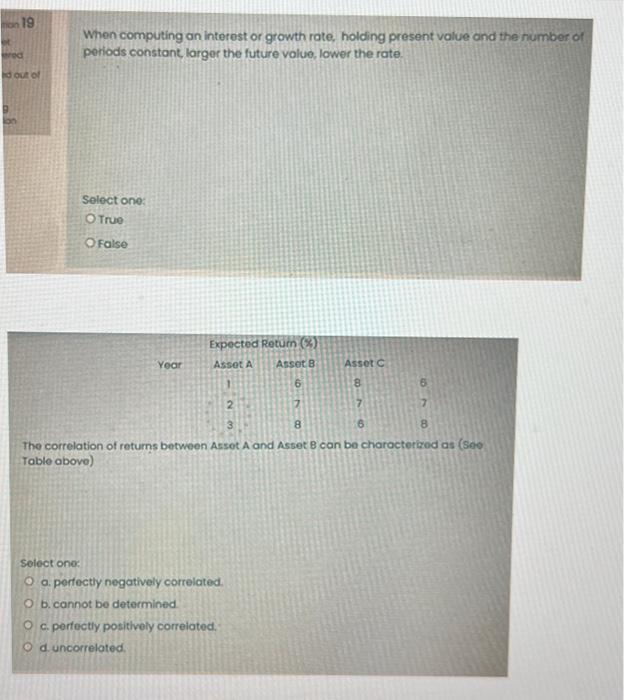

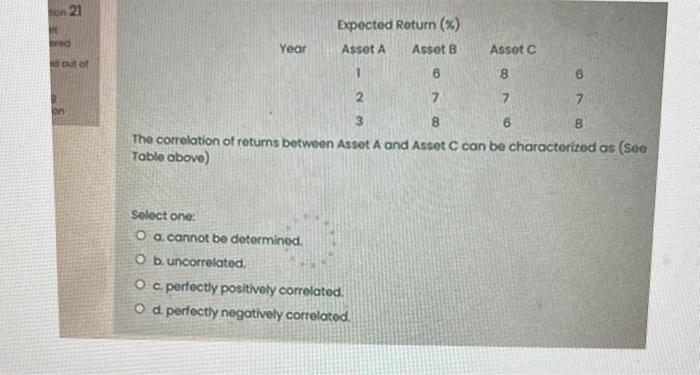

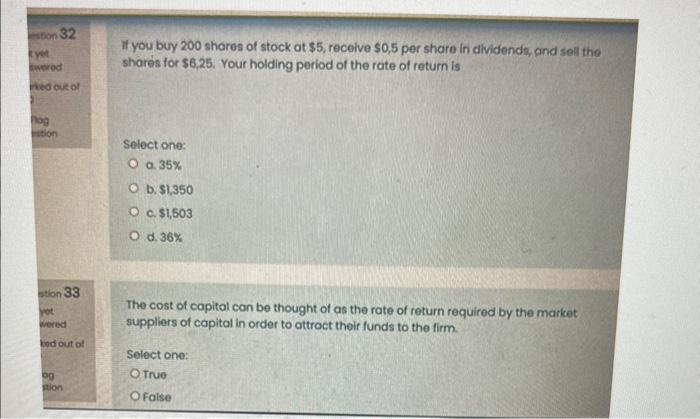

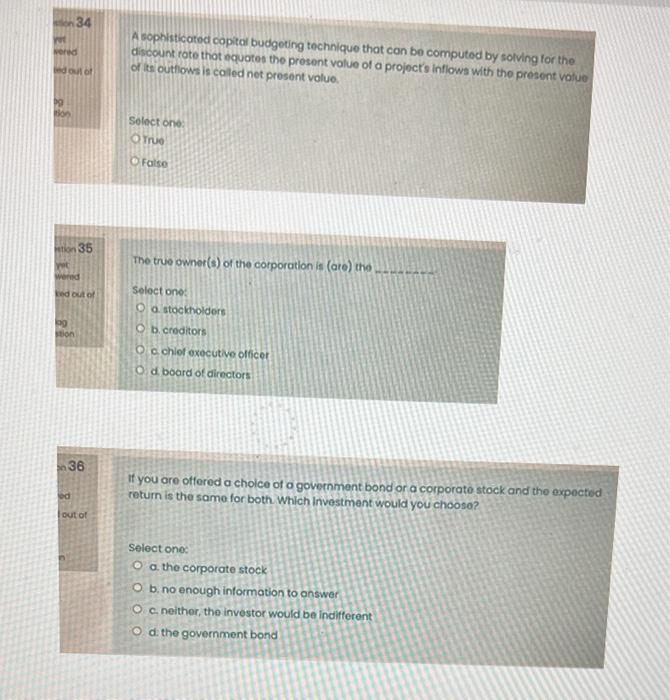

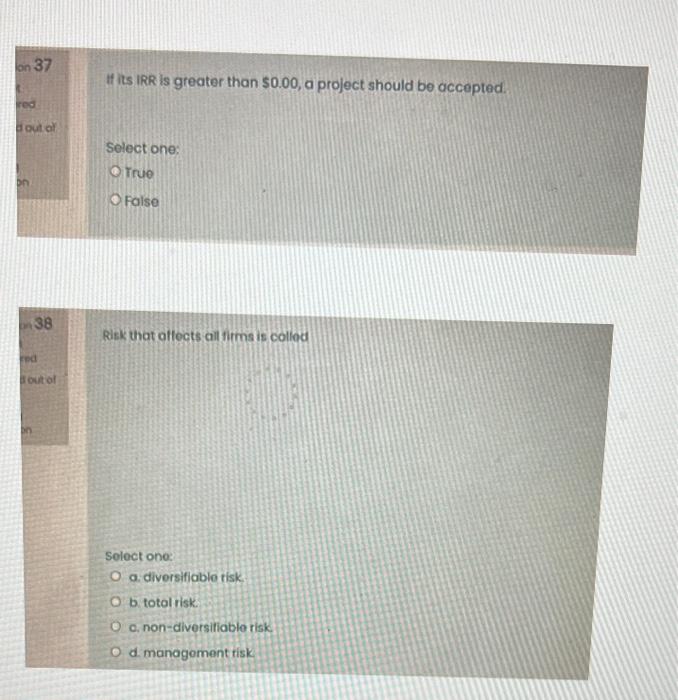

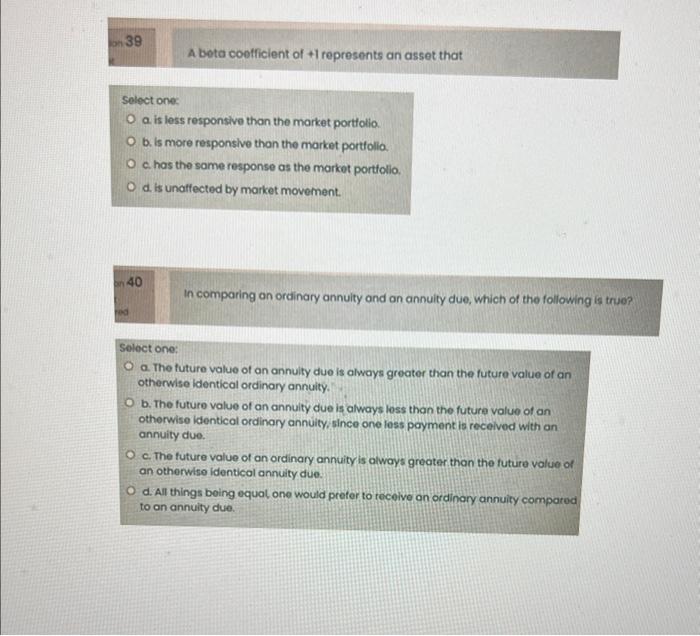

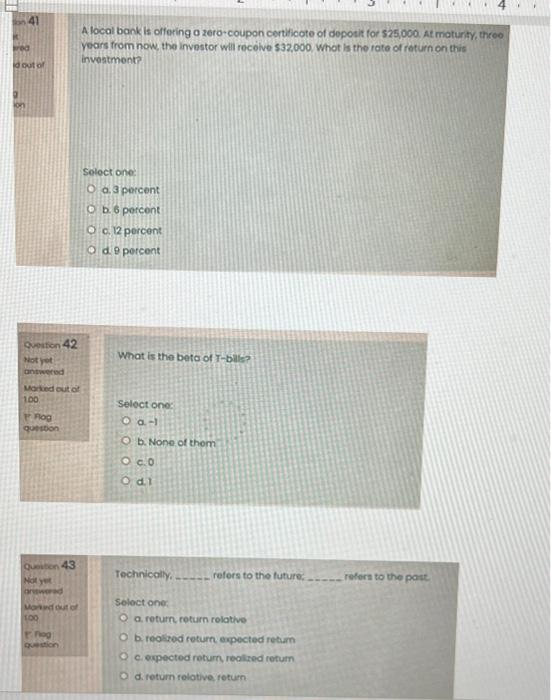

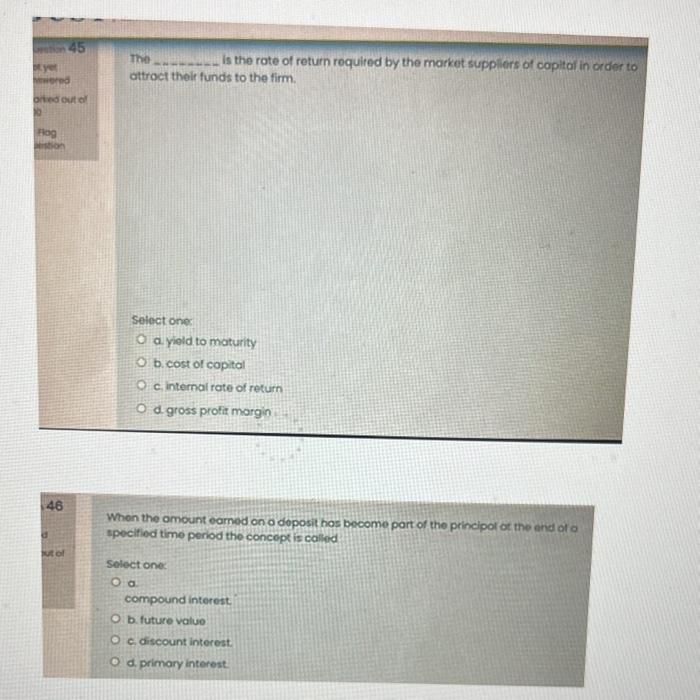

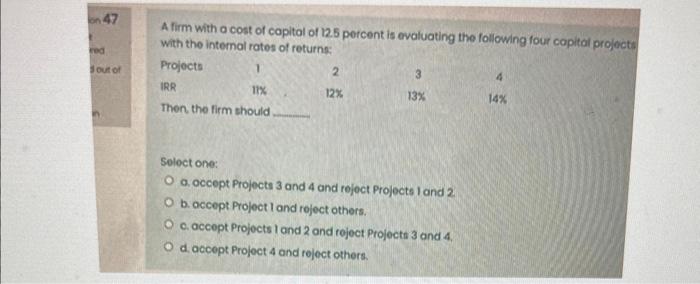

Less risky securities have returns. Select one: a. higher expected b. higher short-term c. lower expected d. higher instantaneous Technically, refers to the future from present: refers to the present from tuture. Select one: a. profit, loss b. loss, profit c. discounting, compounding d. compounding, discounting Combining negatively correlated assets having the same expected return results in a portfolio with level of expected return and level of risk. Select one: a. a lower; a higher b. the same; a higher c. a higher; a lower d. the same; a lower The annual rote of return is variously referred to as the Select one: a. all of them b. discount rate. c. cost of capital. d. opportunity cost. Which of the following legal forms of organization is most expensive to organize? Select one: a. Partnerships. b. Sole proprietorships. c. Limited partnership. d. Corporations If the before-tax cost of debt for a firm, which has a 30 percent marginal tax rate, is 15 percent, assuming the tax-deductibility of interest what is the after-tox cost of debt? Select one: a. 10.5 percent b. 12 percent. c. 4.5 percent. d. 15 percent. The beta of the market Select one: a. is 1. b. is greater than 1. c. is less than 1. d. cannot be determined. Combining two negatively correlated assets to reduce is known as Select one: a risk and liquidation. b. risk and diversification. c. profit and valuation. d. profit and risk aversion. It o person's required rotum does not change whon risk incroases, thot person is soid to bo Select one: a. risk-seeking b. risk-oware c. risk-indifterent d. risk-averse If a 10 -yeor, 8 percent coupon, \$1,000 par value corporate bond is selling at $1,150 (assuming tax-deductibility of interest payments with a marginal tax rate of 40 percent), then its annual opproximate after-tax cost of debt is. Seloct one: a. 6 percent. b. 11.5 percent. c. 3.6 percent. d. 8 percent. investment A guarantees its holder $100 return. Investment B earns $0 or $200 with equal. chances (ie, an average of $100 ) over the same period. Both investments have equal risk. Select one: True False The the coetticient of variation the the risk: Select one. a. lower lower b. higher, lower c. more stable; higher d. lower, higher What is the rate of retum on an investment of $16,278 if the company expects to recaive $3,000 per year for the next 10 years? Select one: a. 8 percent b. 18 percent c. 3 percent d. 13 percent 14 If a stock has a higher than 1.5 Beta value, then you can say that this stock is Select one: a. widely held by investors b. safer than the market average c. in an industry with good prospects d. riskier than the market averoge Which of the following legal forms of organization is characterized by limited liability? Soloct one: a. Corporation. b. Portnorship Solo proprietorship. d. Prolessional partnership. The higher the coefficient of variation the greater the risk and therefore the higher the expected return. Select one: True False Given the following expected returns and standard deviations of ossots A B, CG, and D. which asset should the prudent inanciai manager soloct? Select one: a. Asset C b. Asset B c. Asset A d. Asset D Assume that on investor is offered a choice of a risk-free government bond that is expected to return 5.5% or a high-risk corporate stock. What would induce the investor to purchose the corporate stock? Select one: a. a return that is substantially lower than 5.5% b. cosh dividends c. None of them d. a return that is substantially higher than 5.5% When computing on interest or growth rate, holding present value and the number of periods constant, larger the future volue, lower the rate. Select one: True false The correlation of returns between Assot A and Asset B can be characterized as (see Table abovo) Soloct ono: a. perfectly negatively correlated. b. cannot be determined c. pertectly positively correiated. d. uncorrelated. The correlation of returns between Asset A and Assot C can be characterized as (Seo foble obovo) Soloct one: a. cannot be determined. b. uncorrelated. c. perfectly positively correlated. d. perfectly negatively corteiated. If you buy 200 shares of stock at $5, recelve $0,5 per share in dividends, and sell the shares for $6,25. Your holding period of the rate of return is Select one: a. 35% b. $1,350 c. $1,503 d. 36% The cost of capital can be thought of as the rate of return required by the market suppliers of capital in order to attroct their funds to the firm. Select one: True False A sophliticatod copital budgeting technique that can be computed by solving for the discount rote thot equotes the present volue of a projocts inflows with the present vofue of ite outfiows is caled net present volue. Solect one: Iruo False The true owner(s) of the corporation is (are) the Seloct one: a. stockholdors b. creditors c. chlof axecutive officer d. board of directors If you are offered a choice of a government bond or a corporato stock and the expected return is the same for both. Which Investment would you chooso? Select onec a. the corporate stock b. no enough information to onswer c. neither, the investor would be indifferent d. the government bond If its IRR is greater than $0.00, a project should be accepted. Select one: True Faise Risk that oflects ail fitms is collod Soloct ono: a. diversifiable tisk b. totol risk. c. non-diversitiable risk d. management risk A beta coofficient of +1 represents an asset that solect one: a is less responsive than the market portfolio. b. is more responsive than the market portfolia. c. has the same response as the market portiolio. d. is unaffected by market movement. 40 In comparing on ordinary annuity and an annuity due, which of the following is true? Soloct one: a. The future value of an annuity due is always greater than the future value of an otherwise identical ordinary annuity. b. The future value of an annuity due is always less than the future value of an otherwise identicol ordinary annuity, since one less poyment is received with an annuity due. c. The future value of an ordinary annuity is olways greater than the future value of an otherwise identicol annuity due. d. All things being equat one would prefer to receive on ordinary annuity compared to on annuity due. Alocal bank is offering o zero-coupon certilicote of deposit for 525,000. At maturity, throo years from now the investor will recelve $32,000. Whot is the rate of roturn on this invostment? Soloct one: a. 3 porcent b. 6 porcont c. 12 porcent d. 9 percent What is the beto of r-bils? Seloct one: a -1 b. None of them c. 0 d.1 Technicoly, ...... refers to the future: refers to the patt. Soloct one: a return, roturn relative b. reolied return expected return ce expected return reolited retum d. roturn relotive return The target capital structure is the desired optimal mix of dobt and equity financing that most firms attempt to ochiove ond maintain. Seloct one: True False The is the rote of return required by the market suppliors of copita in order to attroct their funds to the firm. Seiect ones a. yield to maturity b. cost of copital c. internal rate of return d. gross profir margin When the omount earned on o deposit has become part of the principol of the erid of a specifiod time period the concopt is calied Select oner a. compound interest: b. future value c. discount interest. d. primary interest. A firm with a cost of capital of 12.5 petcent is evaluating the following four copital projocts with the internol rates of returng: Soloct one: a. occept Projects 3 and 4 and roject Projects 1 and 2 b. accept Project l and reject others. c. accept Projects I and 2 and roject Projocts 3 and 4. d. occept Project 4 and roject others

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts