Question: PLEASE ONLY NEED THE ANSWER NO EXPLANATIONS Question 18 (0.5 points) Assume that you sell short 1,000 shares of common stock at $35 per share,

PLEASE ONLY NEED THE ANSWER NO EXPLANATIONS

PLEASE ONLY NEED THE ANSWER NO EXPLANATIONS

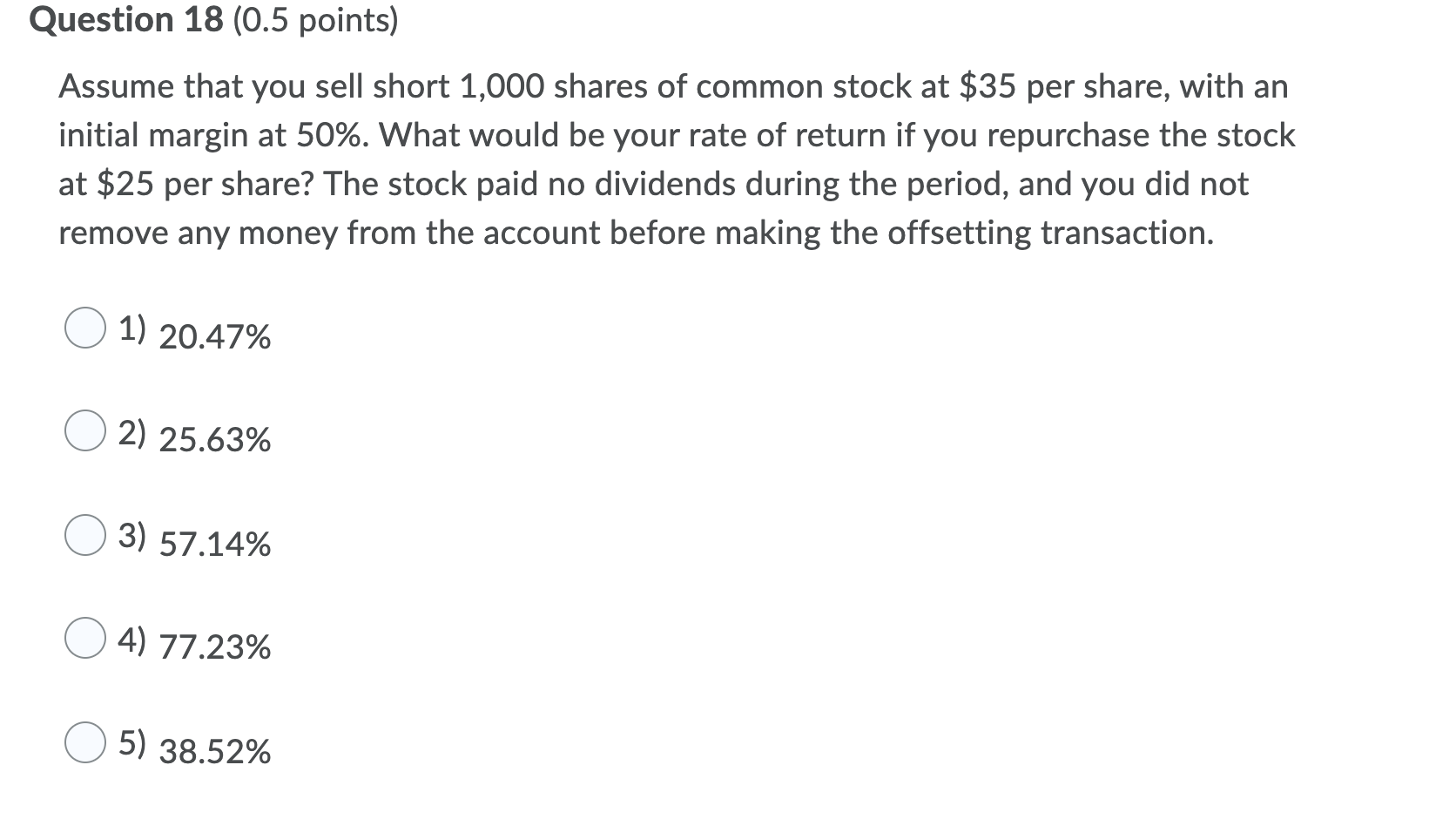

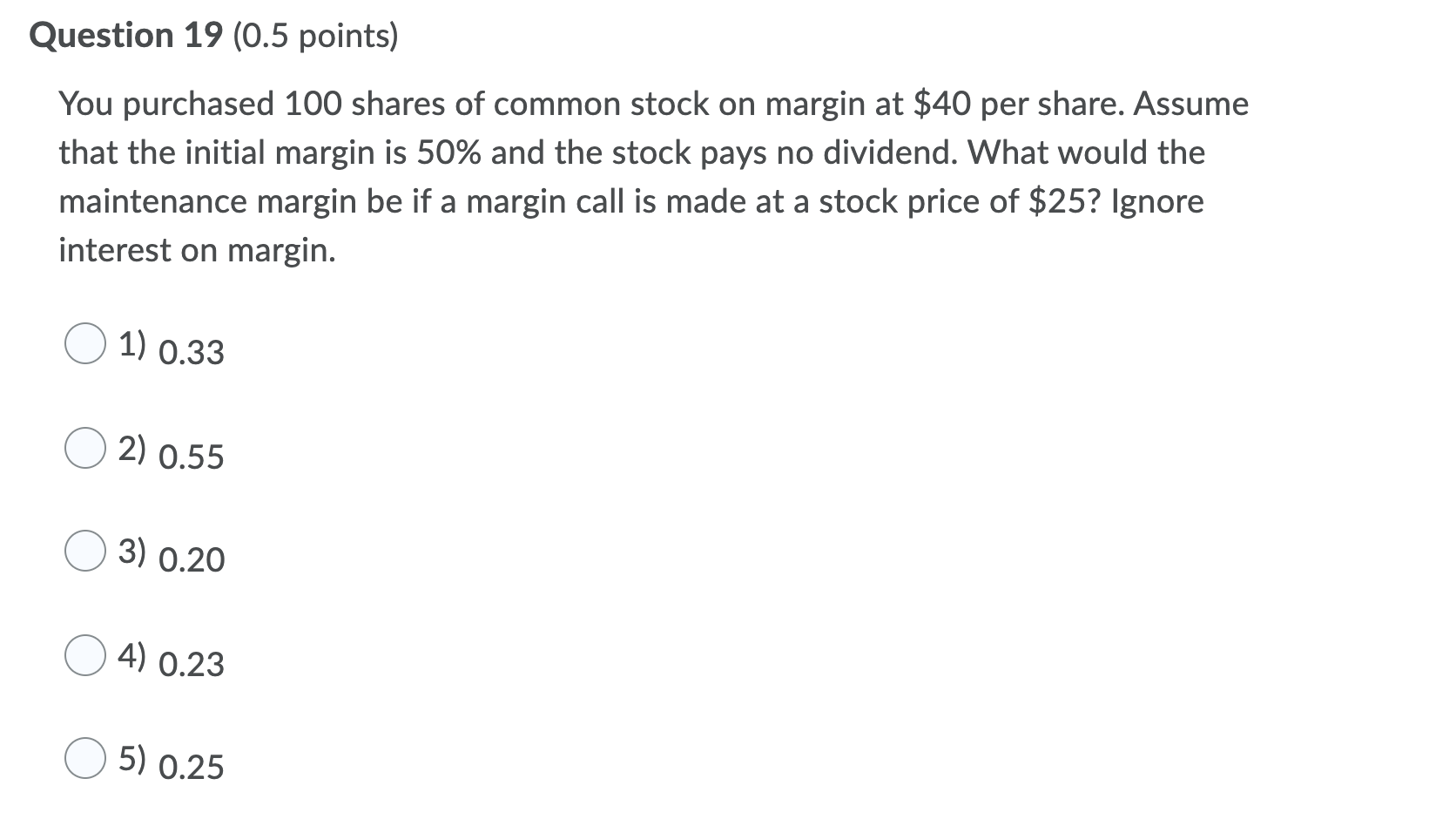

Question 18 (0.5 points) Assume that you sell short 1,000 shares of common stock at $35 per share, with an initial margin at 50%. What would be your rate of return if you repurchase the stock at $25 per share? The stock paid no dividends during the period, and you did not remove any money from the account before making the offsetting transaction. 1) 20.47% 2) 25.63% 3) 57.14% 4) 77.23% 5) 38.52% Question 19 (0.5 points) You purchased 100 shares of common stock on margin at $40 per share. Assume that the initial margin is 50% and the stock pays no dividend. What would the maintenance margin be if a margin call is made at a stock price of $25? Ignore interest on margin. 1) 0.33 2) 0.55 3) 0.20 4) 0.23 5) 0.25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts