Question: please only post the answer for each thank you 7 10 points In practice, a common way to value a share of stock when a

please only post the answer for each thank you

please only post the answer for each thank you

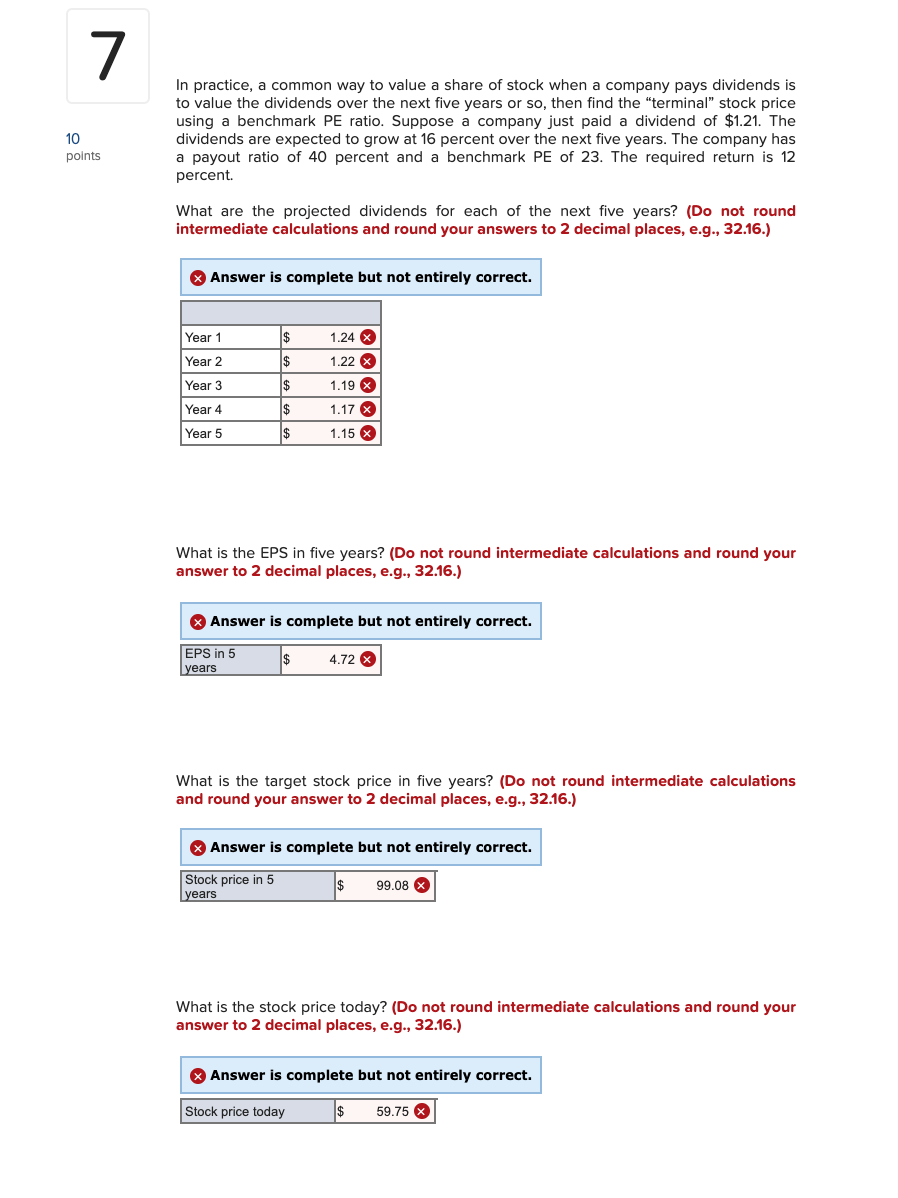

7 10 points In practice, a common way to value a share of stock when a company pays dividends is to value the dividends over the next five years or so, then find the "terminal" stock price using a benchmark PE ratio. Suppose a company just paid a dividend of $1.21. The dividends are expected to grow at 16 percent over the next five years. The company has a payout ratio of 40 percent and a benchmark PE of 23. The required return is 12 percent. What are the projected dividends for each of the next five years? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. $ $ Year 1 Year 2 Year 3 Year 4 Year 5 $ $ $ 1.24 X 1.22 X 1.19 X 1.17 X 1.15 X What is the EPS in five years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. EPS in 5 years 4.72 X What is the target stock price in five years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. Stock price in 5 years $ 99.08 x What is the stock price today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. Stock price today $ 59.75 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts