Question: Please only provide answer for the two following problem accurately and i'll upvote you for solving BOTH! Procter and Gamble (PG) paid an annual dividend

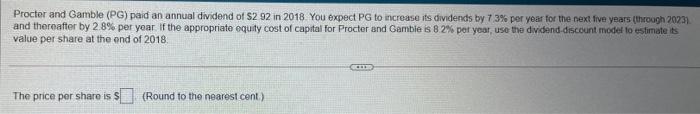

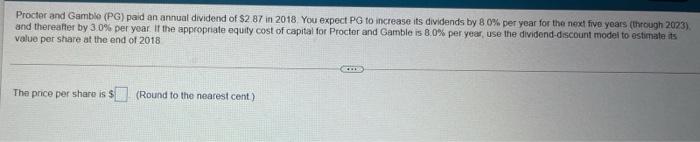

Procter and Gamble (PG) paid an annual dividend of S2 92 in 2018 You expect PG to increase its dividends by 73% per year for the next five years through 2023) and thereafter by 28% per year if the appropriate equity cost of capital for Procter and Gamble is 82% per year, use the dividend discount model to estimate its value per share at the end of 2018 The price per share is s {Round to the nearest cent) Proctor and Gamblo (PG) paid an annual dividend of $2 87 in 2018 You expect PG to increase its dividends by 80% per year for the next five years through 2023) and thereafter by 30% per year if the appropriate equity cost of capital for Procter and Gamble is 8.0% per year use the dividend discount model to estimate its value por share at the end of 2018 The price per share is s (Round to the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts