Question: please only provide correct answer for all the required material for a thumbs up! Kohler Corporation reports the following components of stockholders' equity at December

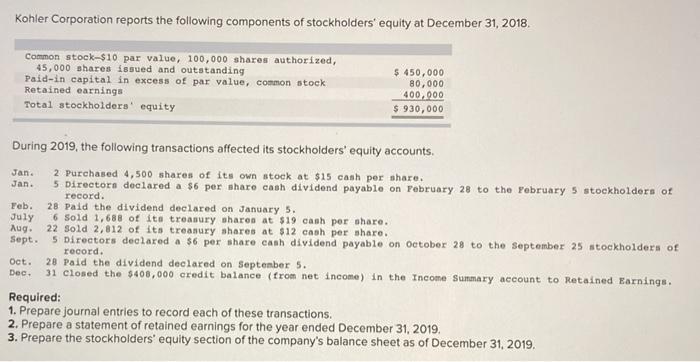

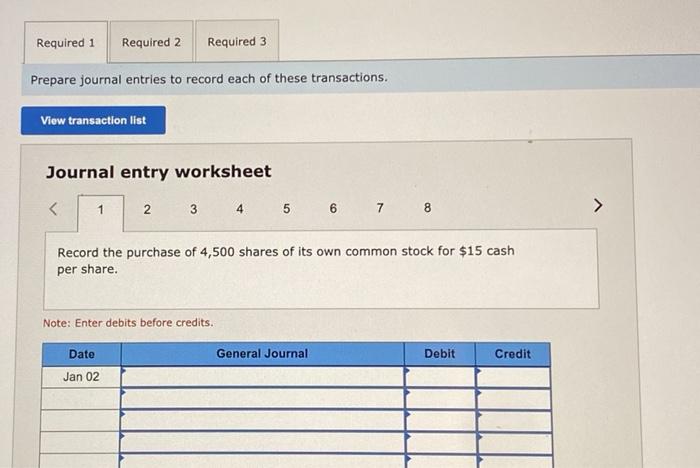

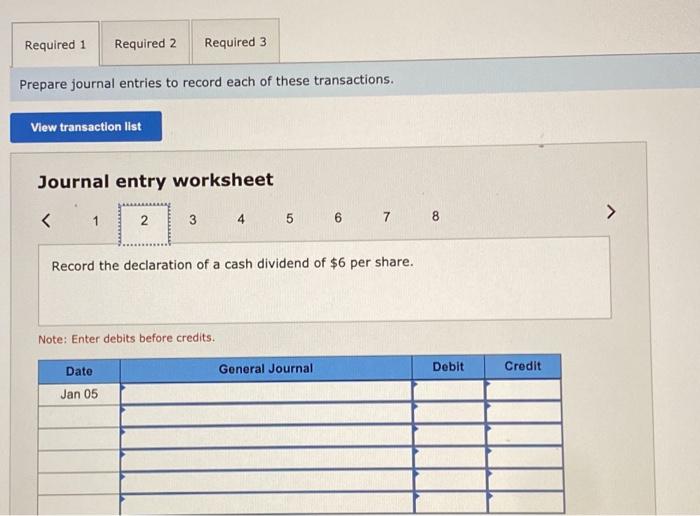

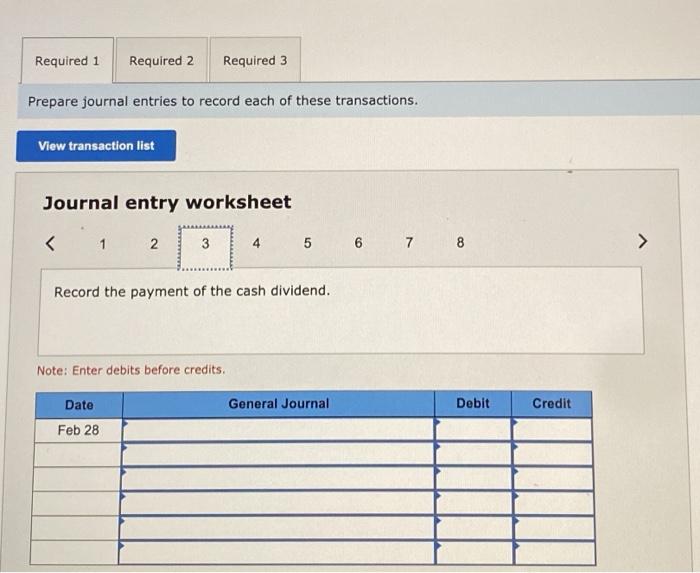

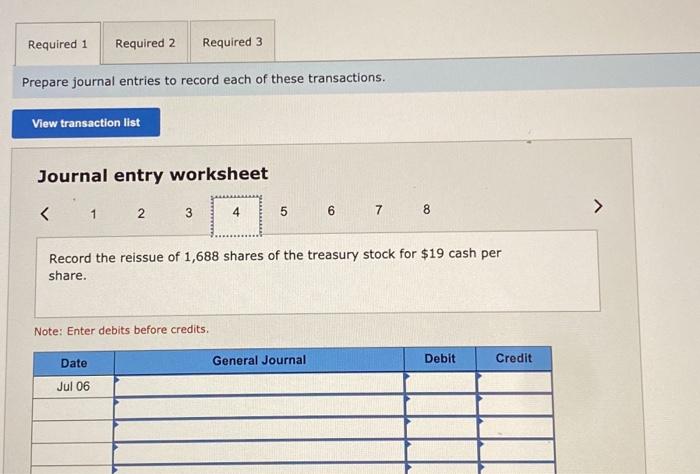

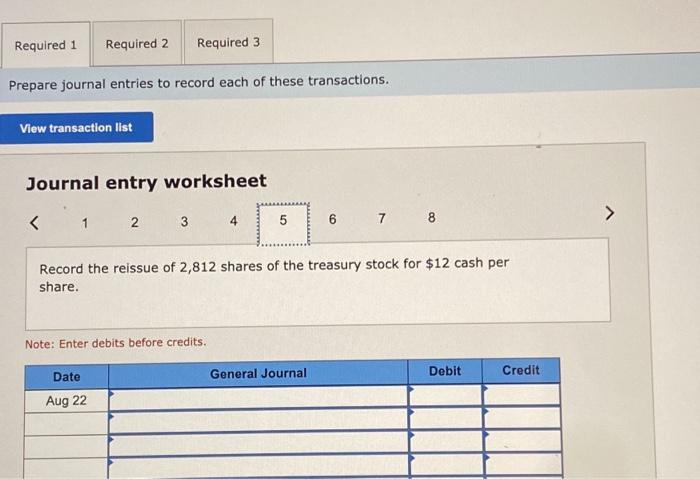

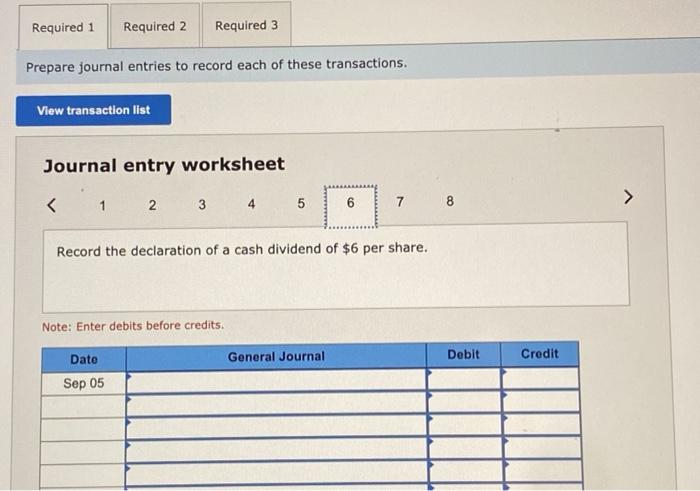

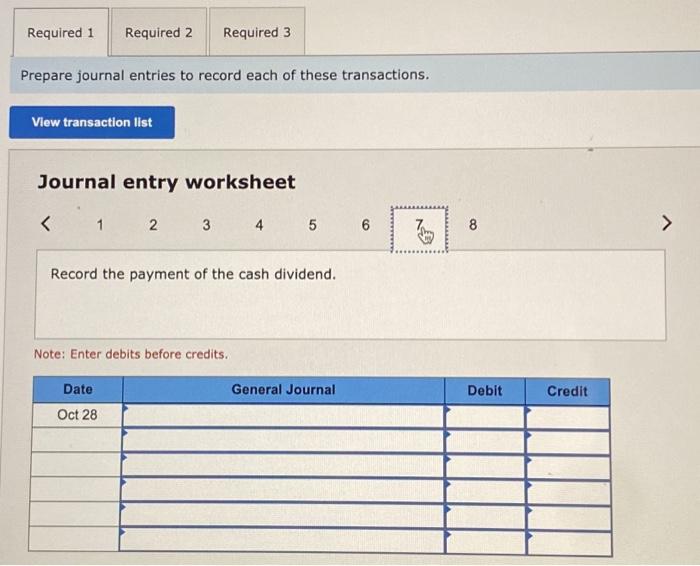

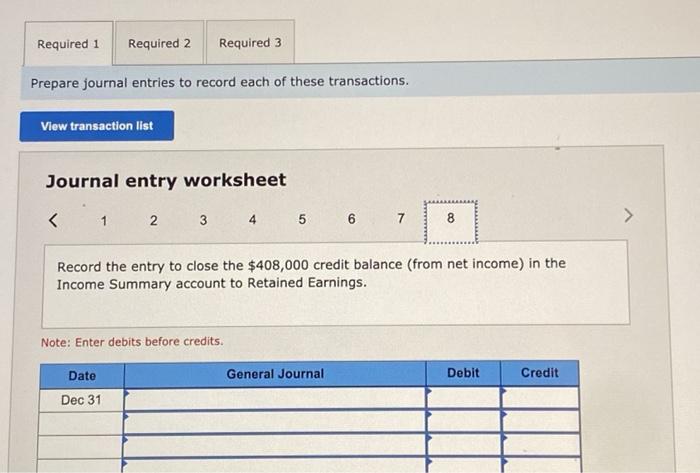

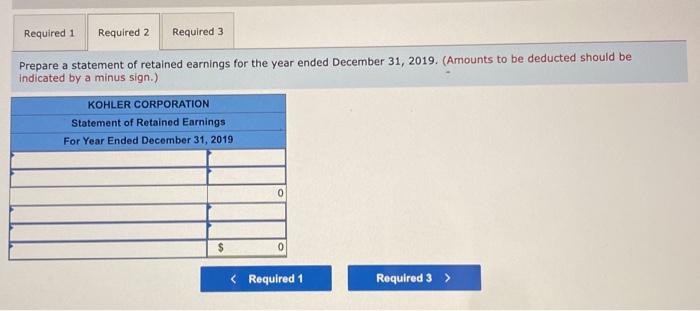

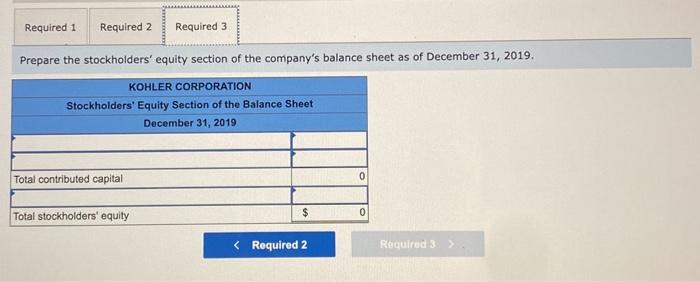

Kohler Corporation reports the following components of stockholders' equity at December 31, 2018 Common stock-$10 par value, 100,000 sharos authorized, 45,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $ 450,000 80,000 400.000 $ 930,000 Feb. During 2019, the following transactions affected its stockholders' equity accounts. Jan. 2 Purchased 4,500 shares of its own stock at $15 cash per share. Jan. 5 Directora declared a $6 per share cash dividend payable on February 28 to the Pebruary 5 stockholders of record. 28 Paid the dividend declared on January 5. July 6 Sold 1,688 of its treasury sharon at $19 cash per share. Aug. 22 Sold 2,812 of its treasury shares at $12 cash per share. Sept. 5 Directors declared a $6 per share cash dividend payablo on October 28 to the September 25 stockholders of Oct. 28 Paid the dividend declared on September 5. Dec. 31 closed the $400,000 credit balance (from net income) in the Income Summary account to Retained Earnings. Required: 1. Prepare journal entries to record each of these transactions. 2. Prepare a statement of retained earnings for the year ended December 31, 2019, 3. Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2019. Required 1 Required 2 Required 3 Prepare journal entries to record each of these transactions. View transaction list Journal entry worksheet Record the purchase of 4,500 shares of its own common stock for $15 cash per share. Note: Enter debits before credits. General Journal Debit Credit Date Jan 02 Required 1 Required 2 Required 3 Prepare journal entries to record each of these transactions. View transaction list Journal entry worksheet Record the reissue of 1,688 shares of the treasury stock for $19 cash per share. Note: Enter debits before credits General Journal Debit Credit Date Jul 06 Required 1 Required 2 Required 3 Prepare journal entries to record each of these transactions. View transaction list Journal entry worksheet 1 2 3 6 7 8 5 Record the reissue of 2,812 shares of the treasury stock for $12 cash per share. Note: Enter debits before credits. Date General Journal Debit Credit Aug 22 Required 1 Required 2 Required 3 Prepare journal entries to record each of these transactions. View transaction list Journal entry worksheet 1 2 Record the entry to close the $408,000 credit balance (from net income) in the Income Summary account to Retained Earnings. Note: Enter debits before credits. General Journal Debit Credit Date Dec 31 Required 1 Required 2 Required 3 Prepare a statement of retained earnings for the year ended December 31, 2019. (Amounts to be deducted should be Indicated by a minus sign.) KOHLER CORPORATION Statement of Retained Earnings For Year Ended December 31, 2019 0 $ Required 1 Required 2 Required 3 Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2019. KOHLER CORPORATION Stockholders' Equity Section of the Balance Sheet December 31, 2019 Total contributed capital 0 $ Total stockholders' equity 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts