Question: please only provide the correct answer without further explanation 29. The relationship between a bond's sales price and the yield to maturity A. changes at

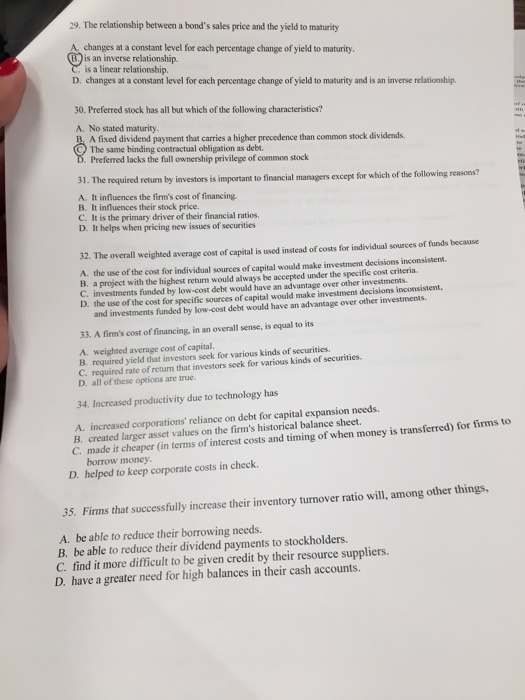

29. The relationship between a bond's sales price and the yield to maturity A. changes at a constant level for each percentage change of yield to maturity. B) is an inverse relationship. C. is a linear relationship D. changes at a constant level for each percentage change of yield to maturity and is an inverse relationship 30. Preferred stock has all but which of the following characteristics? A. No stated maturity. B. A fixed dividend payment that carries a higher precedence than common stock dividends. C) The same binding contractual obligation as debi. D. Preferred lacks the full ownership privilege of common stock 31. The required return by investors is important to financial managers except for which of the following reasons? A. It influences the firm's cost of financing. B. It influences their stock price. C. It is the primary driver of their financial ratios. D. It helps when pricing new issues of securities 32. The overall weighted average cost of capital is used instead of costs for individual sources of funds because A. the use of the cost for individual sources of capital would make investment decisions inconsisteni. B a project with the highest return would always be accepted under the specific cost criteria. C investments funded by low-cost debt would have an advantage over other investments D. the use of the cost for specific sources of capital would make investment decisions inconsistent and investments funded by low-cost debt would have an advantage over other investments. 33. A firm's cost of financing in an overall sense, is equal to its A weighted average cost of capital B required yield that investors seek for various kinds of securities. C. required rate of return that investors seek for various kinds of securities D. all of these options are true. 34. Increased productivity due to technology has A. increased corporations' reliance on debt for capital expansion needs. B. created larger asset values on the firm's historical balance sheet. C made it cheaper (in terms of interest costs and timing of when money is transferred) for firms to borrow money. D. helped to keep corporate costs in check. 35. Firms that successfully increase their inventory turnover ratio will, among other things, A. be able to reduce their borrowing needs. B. be able to reduce their dividend payments to stockholders. C. find it more difficult to be given credit by their resource suppliers. D. have a greater need for high balances in their cash accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts