Question: Please only select the correct option Section A. Multiple choices a. VAT is a tax levied by the govemment on the supply of goods and

Please only select the correct option

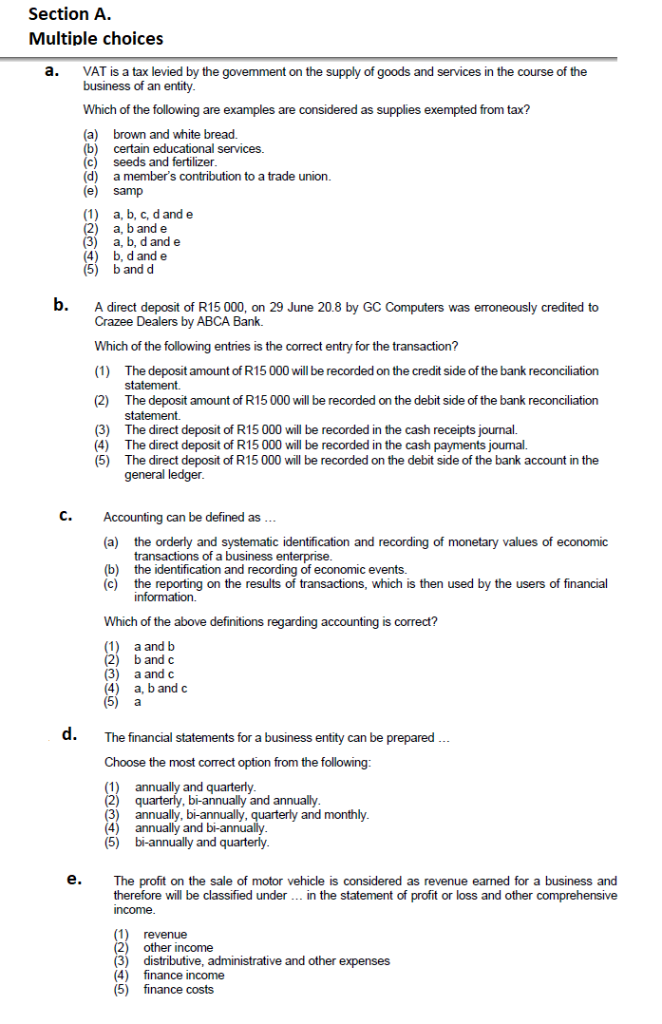

Section A. Multiple choices a. VAT is a tax levied by the govemment on the supply of goods and services in the course of the business of an entity Which of the following are examples are considered as supplies exempted from tax? (a) brown and white bread. (b) certain educational services. (c) seeds and fertilizer (d) a member's contribution to a trade union. (e) samp (1) (2) (3) (4) (5) a, b, c, d and e a, b and e a, b, d and e b, d and e b and d . A direct deposit of R15 000, on 29 June 20.8 by GC Computers was erroneously credited to Crazee Dealers by ABCA Bank. Which of the following entries is the correct entry for the transaction? (1) The deposit amount of R15 000 will be recorded on the credit side of the bank reconciliation (2) The deposit amount of R15 000 will be recorded on the debit side of the bank reconciliation statement (3) (4) (5) statement. The direct deposit of R15 000 will be recorded in the cash receipts journal. The direct deposit of R15 000 will be recorded in the cash payments joumal. The direct deposit of R15 000 will be recorded on the debit side of the bank account in the general ledger C. Accounting can be defined as. (a) the orderly and systematic identification and recording of monetary values of economic (b) the identification and recording of economic events transactions of a business enterprise (c) the reporting on the results of transactions, which is then used by the users of financial Which of the above definitions regarding accounting is correct? 1 a and b (3) (4) b and c a and c a, b and c d. The financial statements for a business entity can be prepared Choose the most correct option from the following (1) annually and quarterly (2) quarterly, bi-annually and annually (3) annually, bi-annually, quarterly and monthly (4) annually and bi-annually (5) bi-annually and quarterly e.The profit on the sale of motor vehicle is considered as revenue earned for a business and therefore will be classified under .in the statement of profit or loss and other comprehensive income (1) revenue other income ) distributive, administrative and other expenses (4) finance income (5) finance costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts