Question: PLEASE ONLY SHOW WORK FOR QUESTION D and how to solve it no excel please! You have been asked to provide a financial analysis of

PLEASE ONLY SHOW WORK FOR QUESTION D and how to solve it no excel please!

PLEASE ONLY SHOW WORK FOR QUESTION D and how to solve it no excel please!

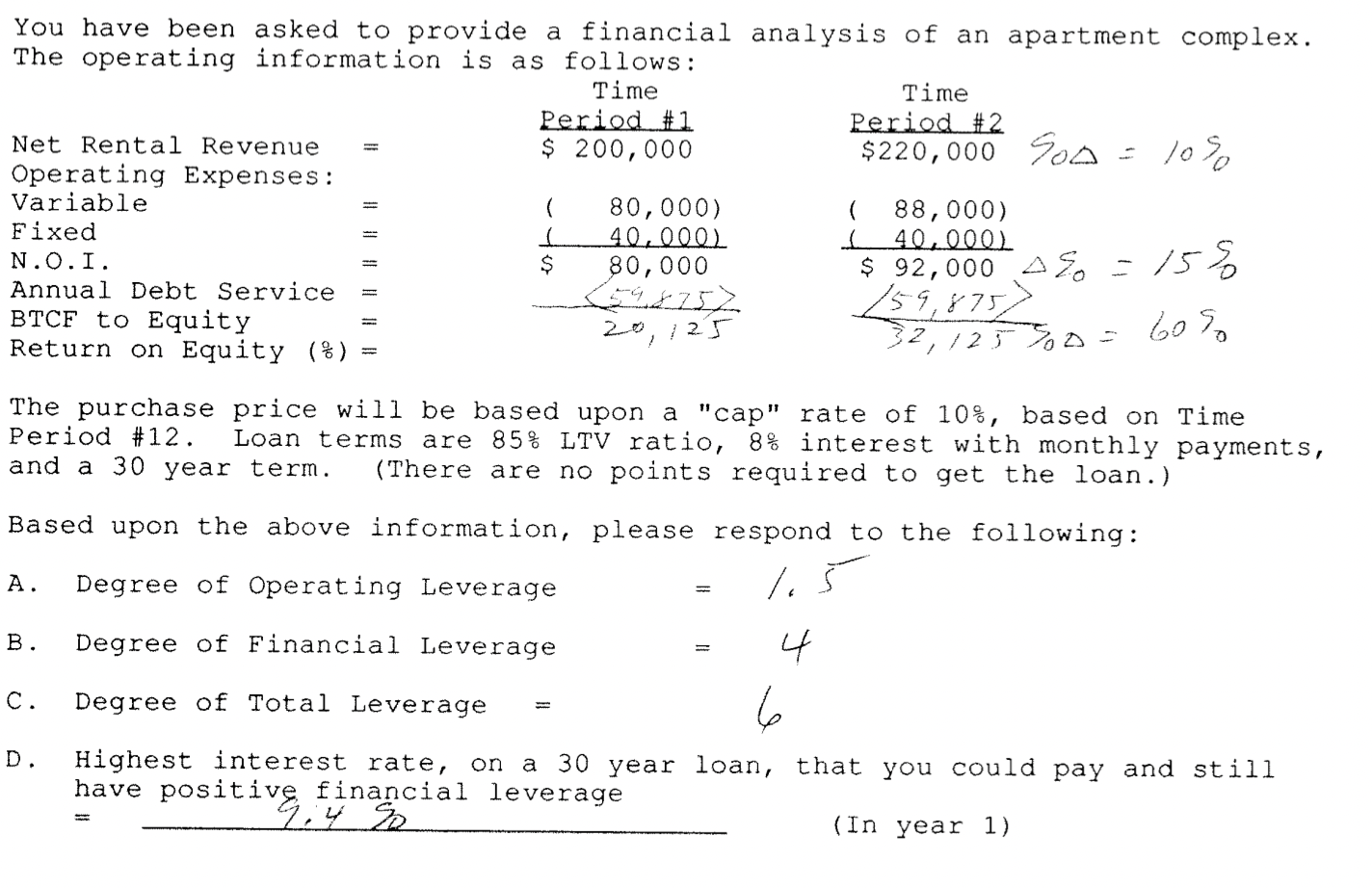

You have been asked to provide a financial analysis of an apartment complex. The operating information is as follows: Time Time Period #1 Period #2 Net Rental Revenue $ 200,000 $220,000 900 - 10% Operating Expenses: Variable ( 80,000) ( 88,000) Fixed 40_0002 . 40.000 N.O.I. $ 80,000 $ 92,000 - / Annual Debt Service 598752 /59,875) BTCF to Equity 20, 125 () Return on Equity (%) 32,125 30o = 60% The purchase price will be based upon a "cap" rate of 10%, based on Time Period #12. Loan terms are 85% LTV ratio, 8% interest with monthly payments, and a 30 year term. (There are no points required to get the loan.) Based upon the above information, please respond to the following: A. Degree of Operating Leverage / B. c. Degree of Financial Leverage 4 Degree of Total Leverage 6 Highest interest rate, on a 30 year loan, that you could pay and still have positive financial leverage 9.4 % (In year 1) D. You have been asked to provide a financial analysis of an apartment complex. The operating information is as follows: Time Time Period #1 Period #2 Net Rental Revenue $ 200,000 $220,000 900 - 10% Operating Expenses: Variable ( 80,000) ( 88,000) Fixed 40_0002 . 40.000 N.O.I. $ 80,000 $ 92,000 - / Annual Debt Service 598752 /59,875) BTCF to Equity 20, 125 () Return on Equity (%) 32,125 30o = 60% The purchase price will be based upon a "cap" rate of 10%, based on Time Period #12. Loan terms are 85% LTV ratio, 8% interest with monthly payments, and a 30 year term. (There are no points required to get the loan.) Based upon the above information, please respond to the following: A. Degree of Operating Leverage / B. c. Degree of Financial Leverage 4 Degree of Total Leverage 6 Highest interest rate, on a 30 year loan, that you could pay and still have positive financial leverage 9.4 % (In year 1) D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts