Question: Please only solve Exercise 16-10. ONLY 16-10. Both A and B Please. Again, only 16-10 and no other question. 4. If a partner with a

Please only solve Exercise 16-10. ONLY 16-10. Both A and B Please. Again, only 16-10 and no other question.

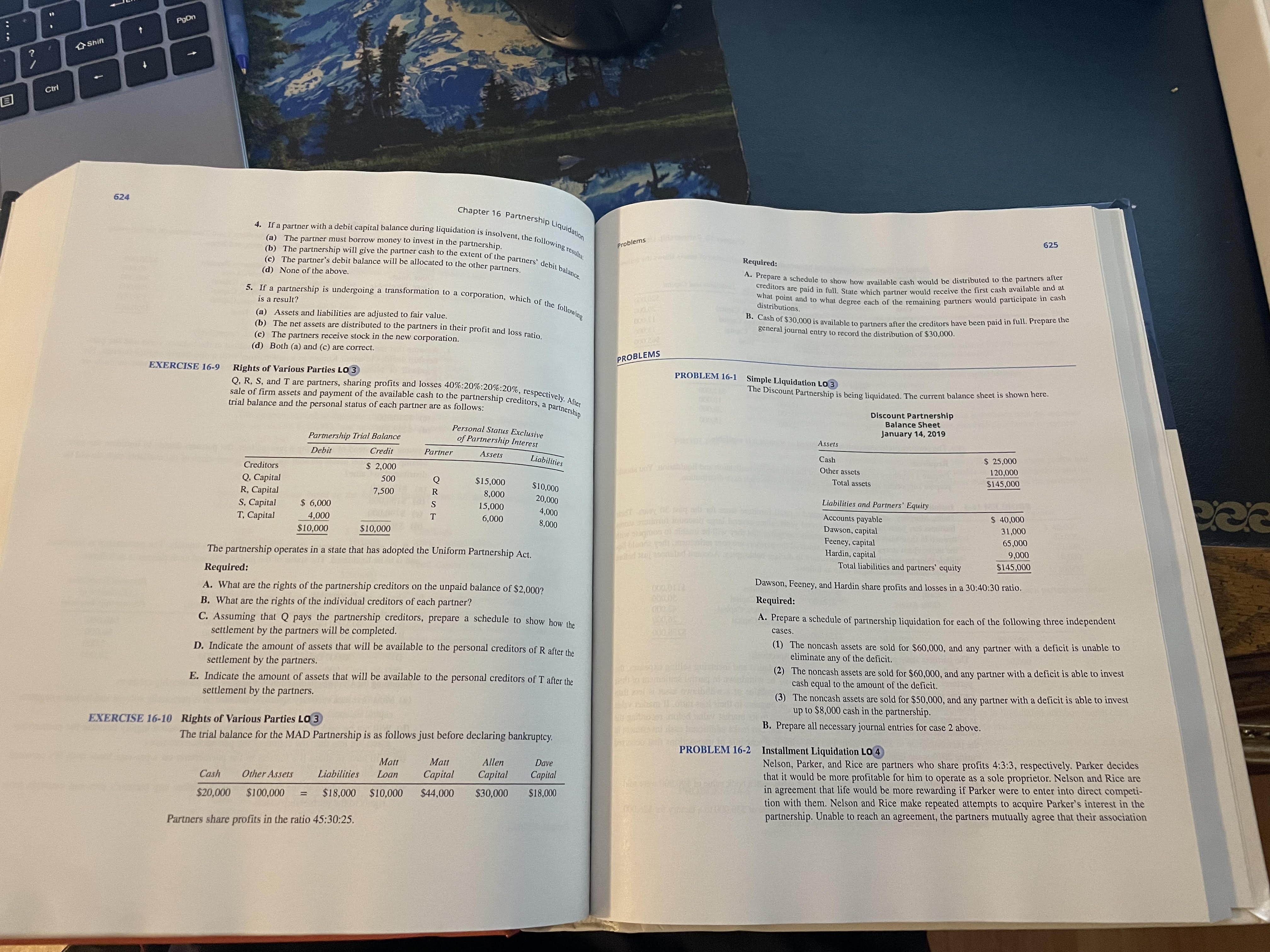

4. If a partner with a debit capital balance during liquidation is insolvent (a) The partner must borrow money to invest in the partnership. (b) The partnership will give the partner cash to the extent of the (c) The partner's debit balance will be allocated to the other partners. (d) None of the above. problems 625 5. If a partnership is undergoing a transformation to a corporation, which of the following is a result? (a) Assets and liabilities are adjusted to fair value. (b) The net assets are distributed to the partners in their profit and loss ratio. (c) The partners receive stock in the new corporation. (d) Both (a) and (c) are correct. EXERCISE 16-9 Rights of Various Parties LO 3 Q, R, S, and T are partners, sharing profits and losses 40%:20%:20%:20%, respectively. After sale of firm assets and payment of the available cash to the partnership creditors, a parthership trial balance and the personal status of each partner are as follows: The partnership operates in a state that has adopted the Uniform Partnership Act. Required: A. What are the rights of the partnership creditors on the unpaid balance of $2,000 ? B. What are the rights of the individual creditors of each partner? C. Assuming that Q pays the partnership creditors, prepare a schedule to show how the settlement by the partners will be completed. D. Indicate the amount of assets that will be available to the personal creditors of R after the settlement by the partners. E. Indicate the amount of assets that will be available to the personal creditors of T after the settlement by the partners. EXERCISE 16-10 Rights of Various Parties LO 3 The trial balance for the MAD Partnership is as follows just before declaring bankruptcy. Partners share profits in the ratio 45:30:25. Required: A. Prepare a schedule to show how available cash would be distributed to the partners after creditors are paid in full. State which partner would receive the first cash available and at what point and to what degree each of the remaining partners would participate in cash distributions distributions B. Cash of $30,000 is available to partners after the creditors have been paid in full. Prepare the general journal entry to record the distribution of $30,000. PROBLEMS PROBLEM 16-1 Simple Liquidation LO 3 The Discount Partnership is being liquidated. The current balance sheet is shown here. Dawson, Feeney, and Hardin share profits and losses in a 30:40:30 ratio. Required: A. Prepare a schedule of partnership liquidation for each of the following three independent cases. (1) The noncash assets are sold for $60,000, and any partner with a deficit is unable to eliminate any of the deficit. (2) The noncash assets are sold for $60,000, and any partner with a deficit is able to invest cash equal to the amount of the deficit. (3) The noncash assets are sold for $50,000, and any partner with a deficit is able to invest up to $8,000 cash in the partnership. B. Prepare all necessary journal entries for case 2 above. PROBLEM 16-2 Installment Liquidation LO 4 Nelson, Parker, and Rice are partners who share profits 4:3:3, respectively. Parker decides that it would be more profitable for him to operate as a sole proprietor. Nelson and Rice are in agreement that life would be more rewarding if Parker were to enter into direct competition with them. Nelson and Rice make repeated attempts to acquire Parker's interest in the partnership. Unable to reach an agreement, the partners mutually agree that their association

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts