Question: Please only solve the last question, it is continued from the previous questions. Use the information to answer the following questions. A company is analyzing

Please only solve the last question, it is continued from the previous questions.

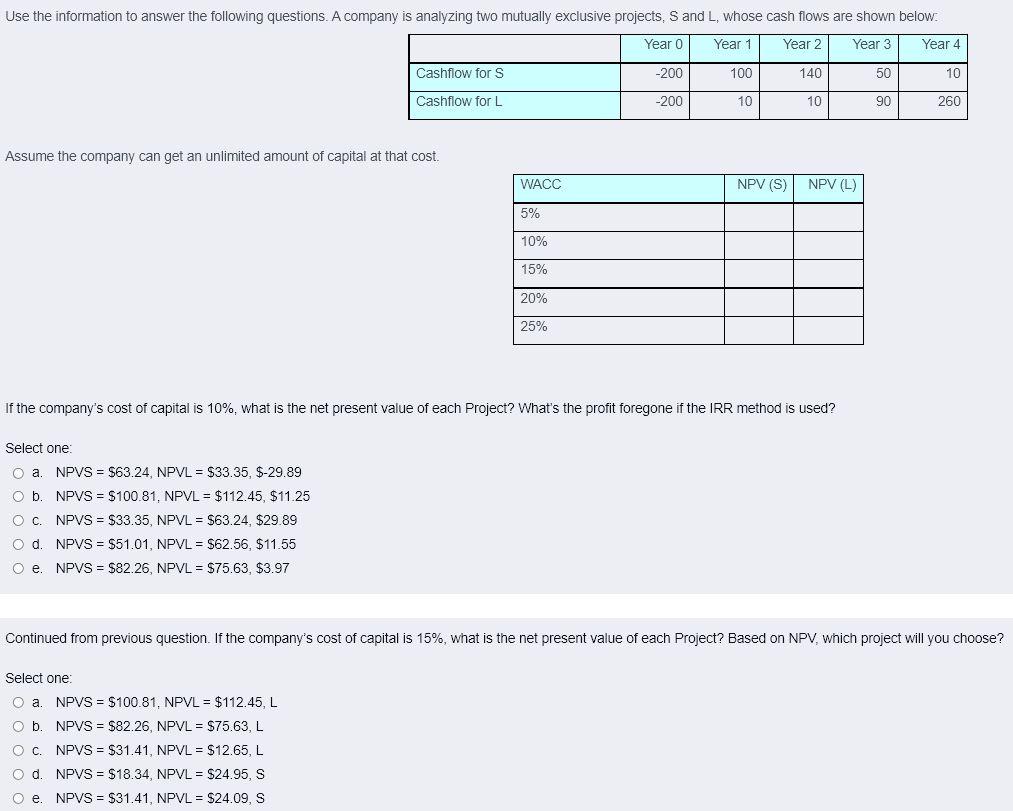

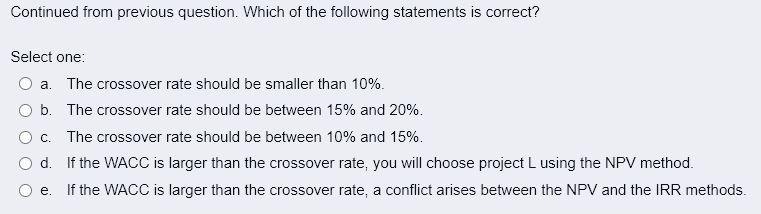

Use the information to answer the following questions. A company is analyzing two mutually exclusive projects, S and L, whose cash flows are shown below. Year 0 Year 1 Year 2 Year 3 Year 4 Cashflow for S -200 100 140 50 10 Cashflow for L -200 10 10 90 260 Assume the company can get an unlimited amount of capital at that cost. WACC NPV (S) NPV (L) 5% 10% 15% 20% 25% If the company's cost of capital is 10%, what is the net present value of each Project? What's the profit foregone if the IRR method is used? Select one: O a. NPVS = $63.24, NPVL = $33.35, $-29.89 O b. NPVS = $100.81, NPVL = $112.45, $11.25 O C. NPVS = $33.35, NPVL = $63.24, $29.89 O d. NPVS = $51.01, NPVL = $62.56, $11.55 . NPVS = $82.26, NPVL = $75.63, $3.97 Continued from previous question. If the company's cost of capital is 15%, what is the net present value of each Project? Based on NPV, which project will you choose? Select one O a. NPVS = $100.81, NPVL = $112.45, L b. NPVS = $82.26, NPVL = $75.63, L . NPVS = $31.41, NPVL = $12.65, L O d. NPVS = $18.34, NPVL = $24.95, S NPVS = $31.41, NPVL = $24.09, S Continued from previous question. Which of the following statements is correct? Select one: O a. The crossover rate should be smaller than 10%. O b. The crossover rate should be between 15% and 20%. OC. The crossover rate should be between 10% and 15%. d. If the WACC is larger than the crossover rate, you will choose project L using the NPV method. e. If the WACC is larger than the crossover rate, a conflict arises between the NPV and the IRR methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts