Question: PLEASE ONLY SOLVE THE RED MARK QUESTION. THANK YOU Chapter 11: Valuation and Risk of Stocks 275 b. Determine how the maximum expected loss on

PLEASE ONLY SOLVE THE RED MARK QUESTION.

THANK YOU

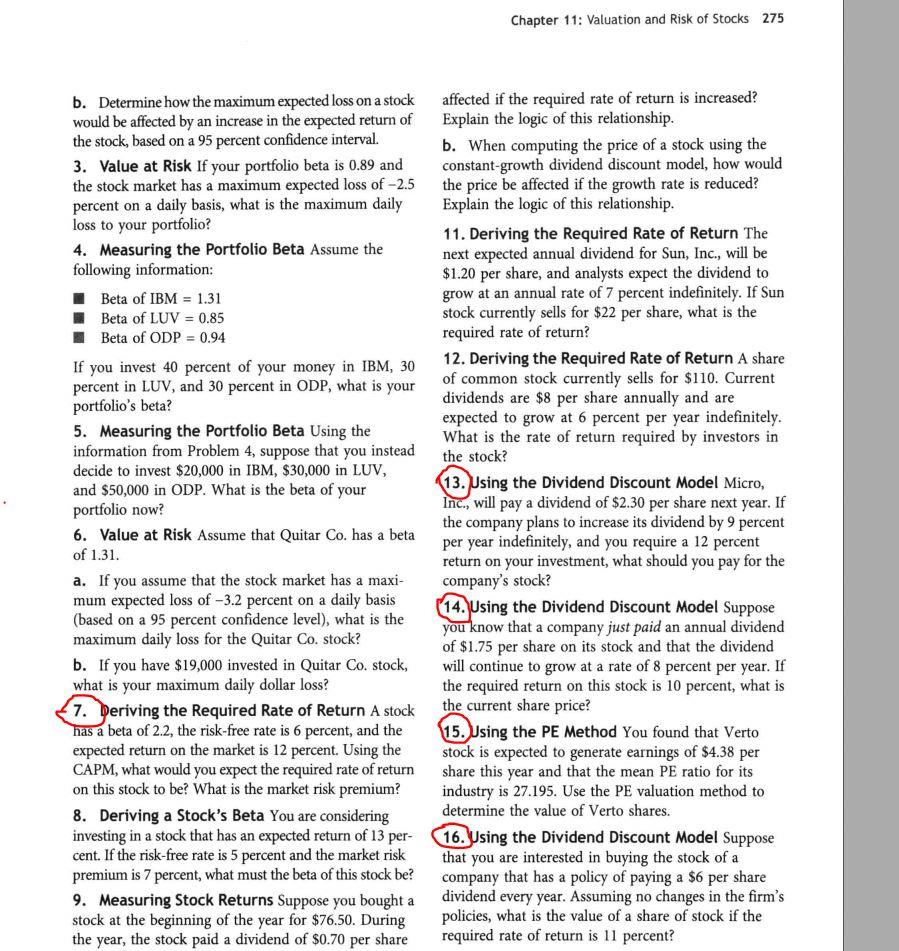

Chapter 11: Valuation and Risk of Stocks 275 b. Determine how the maximum expected loss on a stock would be affected by an increase in the expected return of the stock, based on a 95 percent confidence interval. 3. Value at Risk If your portfolio beta is 0.89 and the stock market has a maximum expected loss of -2.5 percent on a daily basis, what is the maximum daily loss to your portfolio? 4. Measuring the Portfolio Beta Assume the following information: Beta of IBM = 1.31 Beta of LUV = 0.85 Beta of ODP = 0.94 If you invest 40 percent of your money in IBM, 30 percent in LUV, and 30 percent in ODP, what is your portfolio's beta? 5. Measuring the Portfolio Beta Using the information from Problem 4, suppose that you instead decide to invest $20,000 in IBM, $30,000 in LUV, and $50,000 in ODP. What is the beta of your portfolio now? 6. Value at Risk Assume that Quitar Co. has a beta of 1.31. a. If you assume that the stock market has a maxi- mum expected loss of -3.2 percent on a daily basis (based on a 95 percent confidence level), what is the maximum daily loss for the Quitar Co. stock? b. If you have $19,000 invested in Quitar Co. stock, what is your maximum daily dollar loss? 7. Deriving the required Rate of Return A stock has a beta of 2.2, the risk-free rate is 6 percent, and the expected return on the market is 12 percent. Using the CAPM, what would you expect the required rate of return on this stock to be? What is the market risk premium? 8. Deriving a Stock's Beta You are considering investing in a stock that has an expected return of 13 per- cent. If the risk-free rate is 5 percent and the market risk premium is 7 percent, what must the beta of this stock be? 9. Measuring Stock Returns Suppose you bought a stock at the beginning of the year for $76.50. During the year, the stock paid a dividend of $0.70 per share affected if the required rate of return is increased? Explain the logic of this relationship. b. When computing the price of a stock using the constant-growth dividend discount model, how would the price be affected if the growth rate is reduced? Explain the logic of this relationship. 11. Deriving the required Rate of Return The next expected annual dividend for Sun, Inc., will be $1.20 per share, and analysts expect the dividend to grow at an annual rate of 7 percent indefinitely. If Sun stock currently sells for $22 per share, what is the required rate of return? 12. Deriving the Required Rate of Return A share of common stock currently sells for $110. Current dividends are $8 per share annually and are expected to grow at 6 percent per year indefinitely. What is the rate of return required by investors in the stock? 13. Using the Dividend Discount Model Micro, Inc., will pay a dividend of $2.30 per share next year. If the company plans to increase its dividend by 9 percent per year indefinitely, and you require a 12 percent return on your investment, what should you pay for the company's stock? (14. Using the Dividend Discount Model Suppose you know that a company just paid an annual dividend of $1.75 per share on its stock and that the dividend will continue to grow at a rate of 8 percent per year. If the required return on this stock is 10 percent, what is the current share price? 15. Using the PE Method You found that Verto stock is expected to generate earnings of $4.38 per share this year and that the mean PE ratio for its industry is 27.195. Use the PE valuation method to determine the value of Verto shares. 16. Using the Dividend Discount Model Suppose that you are interested in buying the stock of a company that has a policy of paying a $6 per share dividend every year. Assuming no changes in the firm's policies, what is the value of a share of stock if the required rate of return is 11 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts