Question: please only use the account below Cullumber Ltd. began operations on January 2, 2024. During the year, the following transactions affected shareholders' equity: 1. Cullumber's

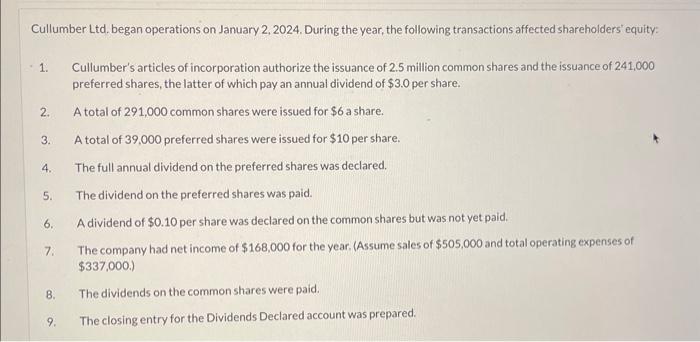

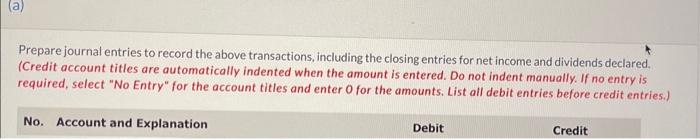

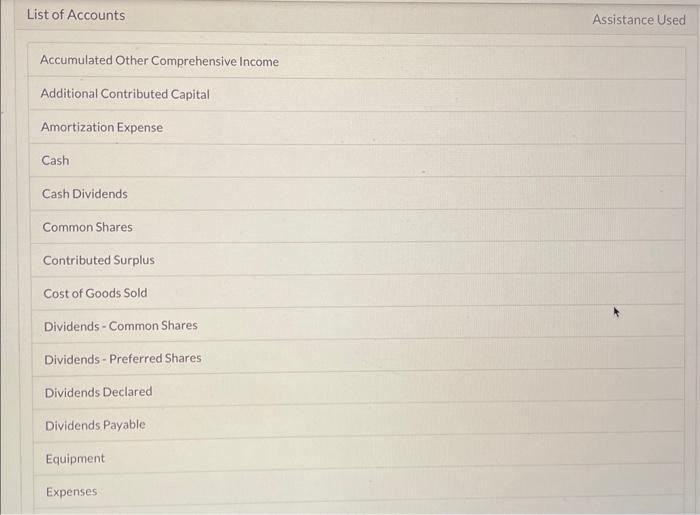

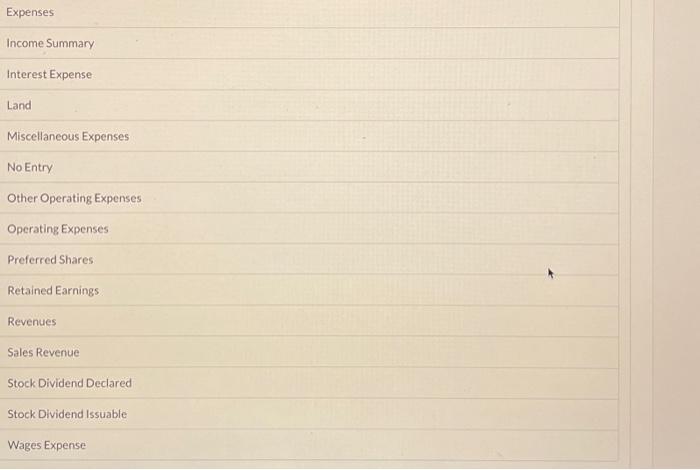

Cullumber Ltd. began operations on January 2, 2024. During the year, the following transactions affected shareholders' equity: 1. Cullumber's articles of incorporation authorize the issuance of 2.5 million common shares and the issuance of 241,000 preferred shares, the latter of which pay an annual dividend of $3.0 per share. 2. A total of 291,000 common shares were issued for $6 a share. 3. A total of 39,000 preferred shares were issued for $10 per share. 4. The full annual dividend on the preferred shares was declared. 5. The dividend on the preferred shares was paid. 6. A dividend of $0.10 per share was declared on the common shares but was not yet paid. 7. The company had net income of $168,000 for the year. (Assume sales of $505,000 and total operating expenses of $337,000. 8. The dividends on the common shares were paid. 9. The closing entry for the Dividends Declared account was prepared. Prepare journal entries to record the above transactions, including the closing entries for net income and dividends declared. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) List of Accounts Assistance Used Accumulated Other Comprehensive Income Additional Contributed Capital Amortization Expense Cash Cash Dividends Common Shares Contributed Surplus Cost of Goods Sold Dividends - Common Shares Dividends - Preferred Shares Dividends Declared Dividends Payable Equipment Expenses Expenses Income Summary Interest Expense Land Miscellaneous Expenses No Entry Other Operating Expenses Operating Expenses Preferred Shares Retained Earnings Revenues Sales Revenue Stock Dividend Declared Stock Dividend Issuable Wages Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts