Question: Please only work on this is you understand it. Please also provide how to solve using excel, thank you. 8-9 REQUIRED RATE OF RETURN Stock

Please only work on this is you understand it. Please also provide how to solve using excel, thank you.

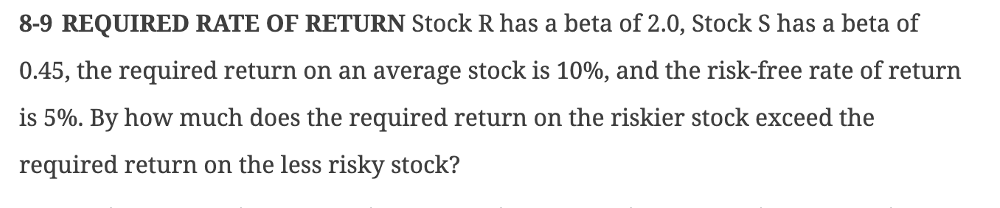

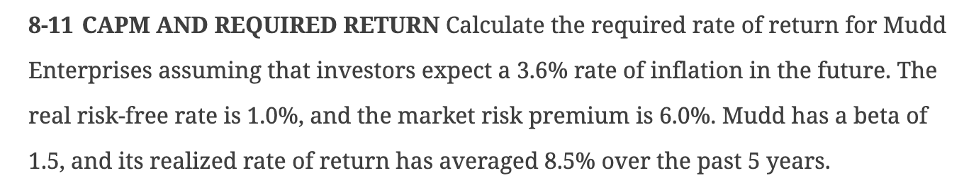

8-9 REQUIRED RATE OF RETURN Stock R has a beta of 2.0 , Stock S has a beta of 0.45 , the required return on an average stock is 10%, and the risk-free rate of return is 5%. By how much does the required return on the riskier stock exceed the required return on the less risky stock? 8-11 CAPM AND REQUIRED RETURN Calculate the required rate of return for Mudd Enterprises assuming that investors expect a 3.6% rate of inflation in the future. The real risk-free rate is 1.0%, and the market risk premium is 6.0%. Mudd has a beta of 1.5 , and its realized rate of return has averaged 8.5% over the past 5 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts