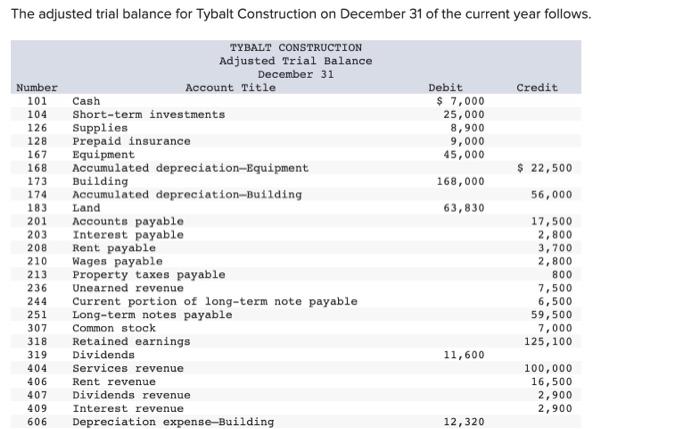

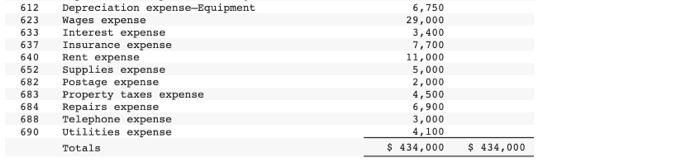

Question: PLEASE ORGANIZE ANSWER The adjusted trial balance for Tybalt Construction on December 31 of the current year follows. begin{tabular}{llr} 612 & Depreciation expense-Equipment & 6,750

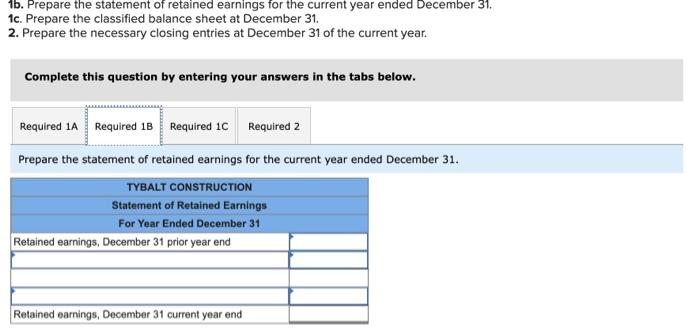

The adjusted trial balance for Tybalt Construction on December 31 of the current year follows. \begin{tabular}{llr} 612 & Depreciation expense-Equipment & 6,750 \\ 623 & Wages expense & 29,000 \\ 633 & Interest expense & 3,400 \\ 637 & Insurance expense & 7,700 \\ 640 & Rent expense & 11,000 \\ 652 & Supplies expense & 5,000 \\ 682 & Postage expense & 2,000 \\ 683 & Property taxes expense & 4,500 \\ 684 & Repairs expense & 6,900 \\ 688 & Telephone expense & 3,000 \\ 690 & Utilities expense & 4,100 \\ & Totals & $434,000 \\ \hline \end{tabular} 1b. Prepare the statement of retained earnings tor the current year ended December 31 . 1c. Prepare the classified balance sheet at December 31. 2. Prepare the necessary closing entries at December 31 of the current year. Complete this question by entering your answers in the tabs below. Prepare the statement of retained earnings for the current year ended December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts