Question: please pass the question to another expert. I've resent this question two times already and there's absolutely no way that you still can't see. QUESTION

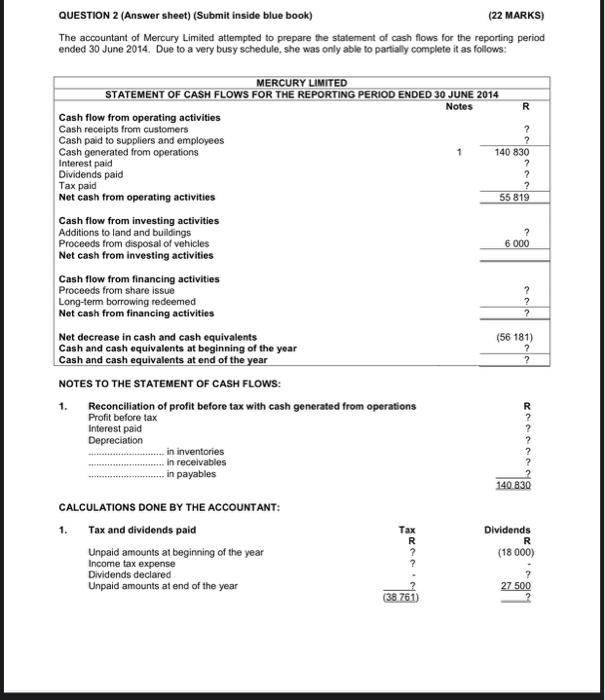

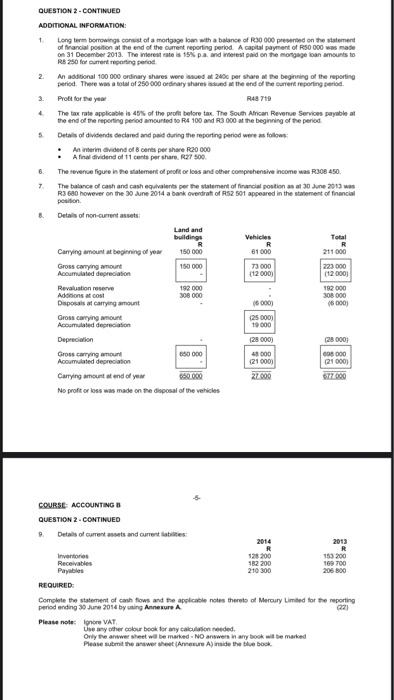

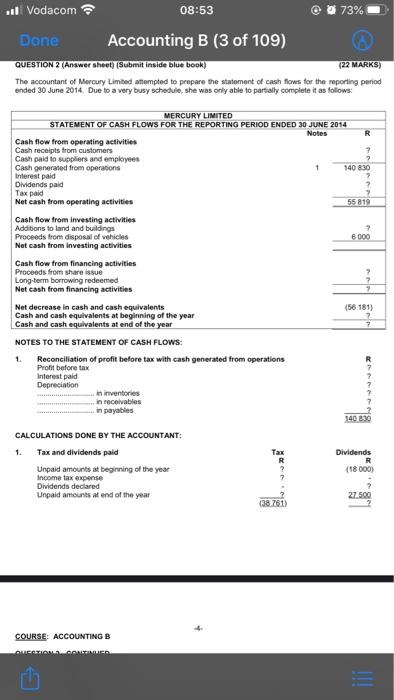

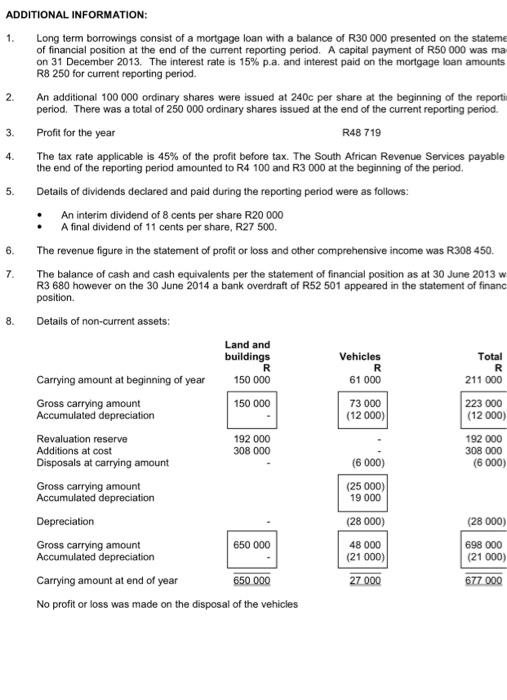

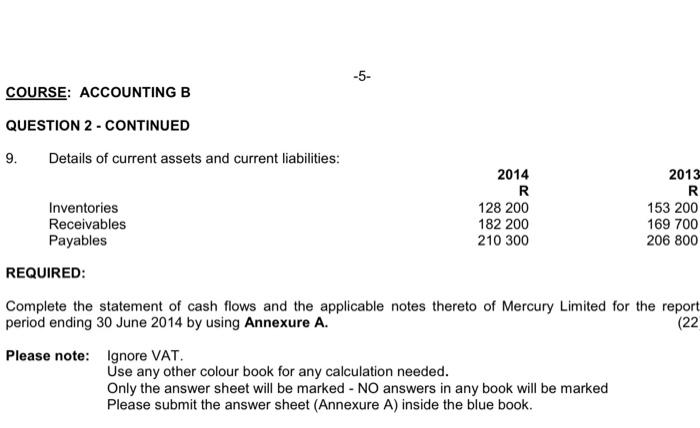

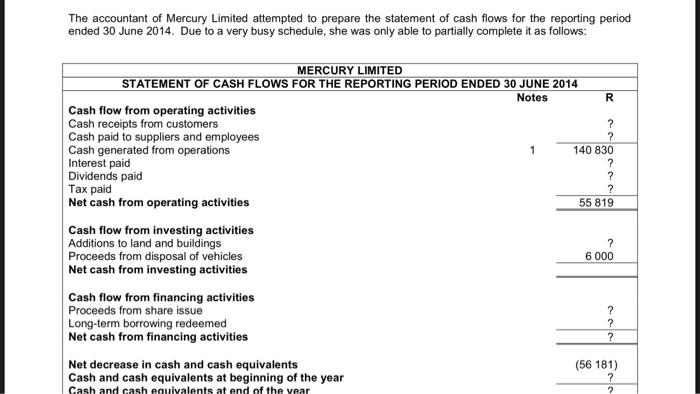

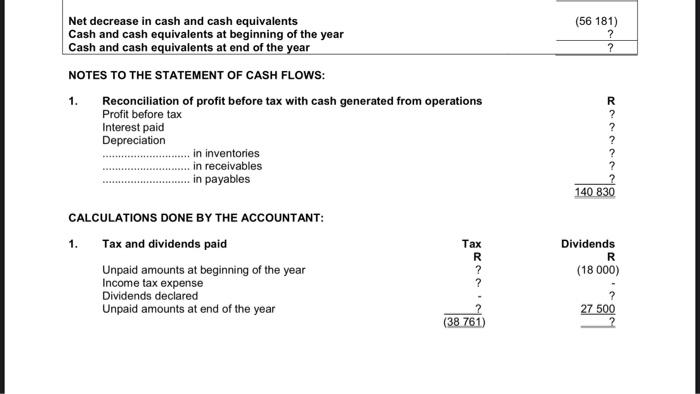

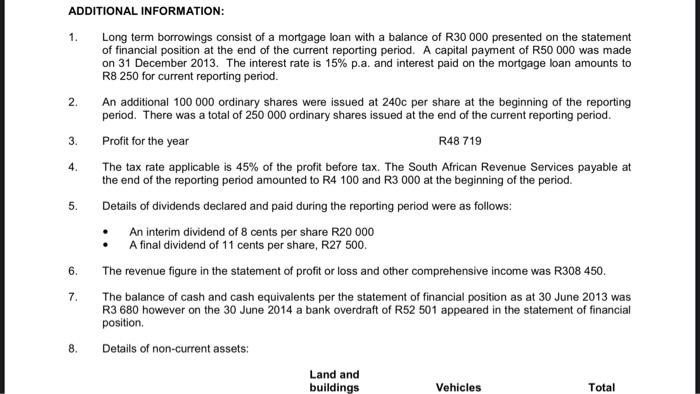

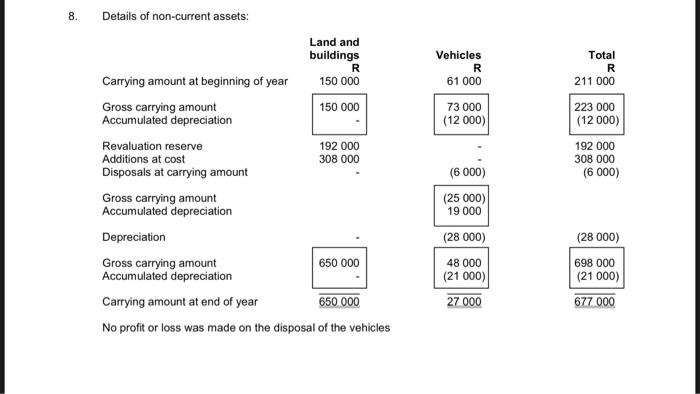

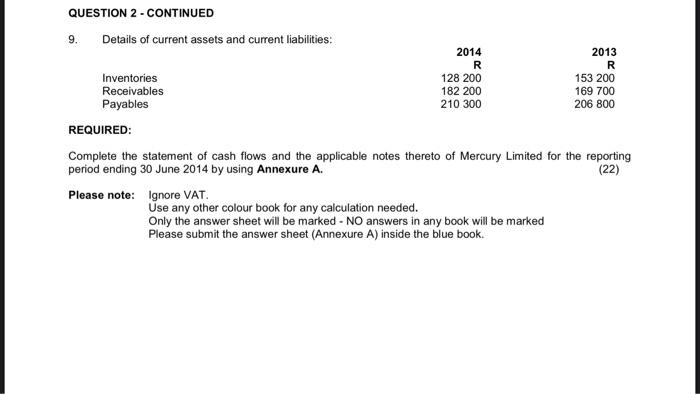

QUESTION 2 (Answer sheet) (Submit inside blue book) (22 MARKS) The accountant of Mercury Limited attempted to prepare the statement of cash flows for the reporting period ended 30 June 2014. Due to a very busy schedule, she was only able to partially complete it as follows: R ? ? ? MERCURY LIMITED STATEMENT OF CASH FLOWS FOR THE REPORTING PERIOD ENDED 30 JUNE 2014 Notes Cash flow from operating activities Cash receipts from customers ? Cash paid to suppliers and employees ? Cash generated from operations 1 140 830 Interest paid Dividends paid 2 Tax paid Net cash from operating activities 55 819 Cash flow from investing activities Additions to land and buildings ? Proceeds from disposal of vehicles 6 000 Net cash from investing activities Cash flow from financing activities Proceeds from share issue ? Long-term borrowing redeemed ? Net cash from financing activities Net decrease in cash and cash equivalents (56 181) Cash and cash equivalents at beginning of the year ? Cash and cash equivalents at end of the year ? NOTES TO THE STATEMENT OF CASH FLOWS: 1. Reconciliation of profit before tax with cash generated from operations R Profit before tax ? Interest paid ? Depreciation in inventories ? in receivables in payables 140.830 CALCULATIONS DONE BY THE ACCOUNTANT: 1. Tax and dividends paid Tax Dividends R R Unpaid amounts at beginning of the year (18000) Income tax expense Dividends declared Unpaid amounts at end of the year 27 500 (38 761) QUESTION 2 - CONTINUED ADDITIONAL INFORMATION 1 Long term borrowing cost of a mortgage loan with a balance of R30 000 presend on the statement of financial position at the end of the current reporting period. A capital payment of RS 000 was made on 31 December 2013. The Worstrate is 15% pa and meet paid on the monggean amounts to RB 250 for Durering period 2 An additional 100 000 ordinary shares were woed at 2400 per share the beginning of the reporting period. There was a total of 250 000 ordinary shared the end of the current reporting period R48 710 The tax rate applicable in 45% of the profit before tax. The South African Revenue Services payable at the end of the reporting period amounted to R4 100 and R3000 at the beginning of the period Details of dividende declared and paid during the reporting period were as follows: Anterim vidend of 8 cents per share R20 000 A final dividend of 11 counts per share. R27500 B. The revenue ligure in the statement of peolt or loss and other comprehensive income was R308 450. 7 The balance of cash and cash equivalents per the statement official position as at 30 June 2013 R3 680 however on the 30 June 2014 a bankoverdraft of 52 501 appeared in the statement of financial position 8 Details of non-currentes Land and buildings Vehicles Total R R R Carrying amount at beginning of you 150 000 61000 211 000 Gross carrying amount 150 000 73000 223000 Accumulated depreciation (120001 112.000 Revaluation reserve 192000 182000 Adicions cos 308 000 308 000 Disposals of carrying amount 6000) (6000) Grom cargot Acomated depreciation 19.000 Depreciation 128 000) (28000) Gross carrying amount 680000 13000 008000 Accumulated depreciation (21000) (21000) Carrying amount and of your 27000 No proft or loss was made on the disposal of the vehicles 5000 COURSE ACCOUNTING QUESTION 2. CONTINUED 8 Details of current sets and currenties 2014 2013 R R Inventor 525 200 153200 Receivables 182 200 169700 Payables 210 300 205 800 REQUIRED: Complete the statement of cash flows and the applicable notes thereo of Mercury Limited for the reporting period ording 30 June 2014 by ing Annexure A Please note onore VAT Use any other colour book for any readed. Orly we alwwer sheet wo be marked - NO anwwer in any book will be marked Please submit the answer sheet Anne Amide the blue back Il Vodacom 0 73% 08:53 Accounting B (3 of 109) Done QUESTION 2 (Answer sheet Submit inside blue book) (22 MARKS) The accountant of Mercury Limited attempted to prepare the statement of cash flows for the reporting period ended 30 June 2014. Due to a very busy schedule, she was only able to partially complete it as follows: 2 MERCURY LIMITED STATEMENT OF CASH FLOWS FOR THE REPORTING PERIOD ENDED 30 JUNE 2014 Notes R Cash flow from operating activities Cash receipts from customers ? Cash paid to suppliers and employees Cash generated from operations 1 140 830 Interest paid ? Dividends paid ? Tax paid Net cash from operating activities 55 819 Cash flow from investing activities Additions to land and buildings ? Proceeds from disposal of vehicles 6000 Net cash from investing activities Cash flow from financing activities Proceeds from share issue ? Long-term borrowing redeemed Net cash from financing activities Net decrease in cash and cash equivalents (56 181) Cash and cash equivalents at beginning of the year 7 Cash and cash equivalents at end of the year NOTES TO THE STATEMENT OF CASH FLOWS: 1. Reconciliation of profit before tax with cash generated from operations Profit before tax Interest paid Depreciation in inventories In receivables in payables 140 8.30 CALCULATIONS DONE BY THE ACCOUNTANT: 1. Tax and dividends paid Tax Dividends R Unpaid amounts at beginning of the year (18000) Income tax expense Dividends declared Unpaid amounts at end of the year 27.500 (38.761) 7 COURSE: ACCOUNTING B QUOTIAN CONTO 1. 2. 5. 6. ADDITIONAL INFORMATION: Long term borrowings consist of a mortgage loan with a balance of R30 000 presented on the stateme of financial position at the end of the current reporting period. A capital payment of R50 000 was ma on 31 December 2013. The interest rate is 15% p.a. and interest paid on the mortgage loan amounts R8 250 for current reporting period. An additional 100 000 ordinary shares were issued at 240c per share at the beginning of the reporti period. There was a total of 250 000 ordinary shares issued at the end of the current reporting period. 3. Profit for the year R48 719 4. The tax rate applicable is 45% of the profit before tax. The South African Revenue Services payable the end of the reporting period amounted to R4 100 and R3 000 at the beginning of the period. Details of dividends declared and paid during the reporting period were as follows: An interim dividend of 8 cents per share R20 000 A final dividend of 11 cents per share, R27 500. The revenue figure in the statement of profit or loss and other comprehensive income was R308 450. 7. The balance of cash and cash equivalents per the statement of financial position as at 30 June 2013 w R3 680 however on the 30 June 2014 a bank overdraft of R52 501 appeared in the statement of financ position Details of non-current assets: Land and buildings Vehicles Total Carrying amount at beginning of year 150 000 61 000 Gross carrying amount 150 000 73 000 223 000 Accumulated depreciation (12000) (12 000) Revaluation reserve 192 000 192 000 Additions at cost 308 000 308 000 Disposals at carrying amount (6 000) (6 000) Gross carrying amount (25000) Accumulated depreciation 19 000 Depreciation (28 000) (28 000) Gross carrying amount 650 000 48 000 698 000 Accumulated depreciation (21 000) (21 000) Carrying amount at end of year 650 000 27 000 677 000 No profit or loss was made on the disposal of the vehicles 8. R R R 211 000 -5- COURSE: ACCOUNTING B QUESTION 2 - CONTINUED 9. Details of current assets and current liabilities: Inventories Receivables Payables REQUIRED: 2014 R 128 200 182 200 210 300 2013 R 153 200 169 700 206 800 Complete the statement of cash flows and the applicable notes thereto of Mercury Limited for the report period ending 30 June 2014 by using Annexure A. (22 Please note: Ignore VAT. Use any other colour book for any calculation needed. Only the answer sheet will be marked - NO answers in any book will be marked Please submit the answer sheet (Annexure A) inside the blue book. The accountant of Mercury Limited attempted to prepare the statement of cash flows for the reporting period ended 30 June 2014. Due to a very busy schedule, she was only able to partially complete it as follows: R ? MERCURY LIMITED STATEMENT OF CASH FLOWS FOR THE REPORTING PERIOD ENDED 30 JUNE 2014 Notes Cash flow from operating activities Cash receipts from customers ? Cash paid to suppliers and employees ? Cash generated from operations 140 830 Interest paid ? Dividends paid Tax paid ? Net cash from operating activities 55 819 Cash flow from investing activities Additions to land and buildings ? Proceeds from disposal of vehicles 6 000 Net cash from investing activities Cash flow from financing activities Proceeds from share issue ? Long-term borrowing redeemed ? Net cash from financing activities ? Net decrease in cash and cash equivalents (56 181) Cash and cash equivalents at beginning of the year Cash and cash equivalents at end of the vear ? (56 181) ? ? Net decrease in cash and cash equivalents Cash and cash equivalents at beginning of the year Cash and cash equivalents at end of the year NOTES TO THE STATEMENT OF CASH FLOWS: 1. Reconciliation of profit before tax with cash generated from operations Profit before tax Interest paid Depreciation in inventories in receivables ..in payables R ? ? ? ? ? 140 830 CALCULATIONS DONE BY THE ACCOUNTANT: 1. Tax and dividends paid Unpaid amounts at beginning of the year Income tax expense Dividends declared Unpaid amounts at end of the year Tax R ? Dividends R (18 000) 2 27 500 (38 761) ADDITIONAL INFORMATION: 1. Long term borrowings consist of a mortgage loan with a balance of R30 000 presented on the statement of financial position at the end of the current reporting period. A capital payment of R50 000 was made on 31 December 2013. The interest rate is 15% p.a. and interest paid on the mortgage loan amounts to R8 250 for current reporting period. 2. An additional 100 000 ordinary shares were issued at 240c per share at the beginning of the reporting period. There was a total of 250 000 ordinary shares issued at the end of the current reporting period. 3. Profit for the year R48 719 4. The tax rate applicable is 45% of the profit before tax. The South African Revenue Services payable at the end of the reporting period amounted to R4 100 and R3 000 at the beginning of the period. 5. Details of dividends declared and paid during the reporting period were as follows: An interim dividend of 8 cents per share R20 000 A final dividend of 11 cents per share, R27 500. 6. The revenue figure in the statement of profit or loss and other comprehensive income was R308 450. 7. The balance of cash and cash equivalents per the statement of financial position as at 30 June 2013 was R3 680 however on the 30 June 2014 a bank overdraft of R52 501 appeared in the statement of financial position 8. Details of non-current assets: Land and buildings Total Vehicles 8. Details of non-current assets: Vehicles R 61 000 73 000 (12 000) Total R 211 000 223 000 (12 000) 192 000 308 000 (6 000) Land and buildings R Carrying amount at beginning of year 150 000 Gross carrying amount 150 000 Accumulated depreciation Revaluation reserve 192 000 Additions at cost 308 000 Disposals at carrying amount Gross carrying amount Accumulated depreciation Depreciation Gross carrying amount 650 000 Accumulated depreciation Carrying amount at end of year 650 000 No profit or loss was made on the disposal of the vehicles (6000) (25 000) 19 000 (28000) 48 000 (21 000) 27 000 (28 000) 698 000 (21 000) 677 000 9. QUESTION 2 - CONTINUED Details of current assets and current liabilities: 2014 2013 R R Inventories 128 200 153 200 Receivables 182 200 169 700 Payables 210 300 206 800 REQUIRED: Complete the statement of cash flows and the applicable notes thereto of Mercury Limited for the reporting period ending 30 June 2014 by using Annexure A. (22) Please note: Ignore VAT Use any other colour book for any calculation needed. Only the answer sheet will be marked - NO answers in any book will be marked Please submit the answer sheet (Annexure A) inside the blue book

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts