Question: Please perform the following tasks: 1 - Prepare the unadjusted trial balance in the ' 1 2 - 3 1 - 2 2 Trial Balance'

Please perform the following tasks:

Prepare the unadjusted trial balance in the Trial Balance' worksheet based on the

General Ledger that you have received with this packet.

Prepare the Adjusting Journal Entries at December based on the information

provided in a through h above and record them on the Trial Balance' worksheet and

post them to the General Ledger Points

Post the adjusting entries to the General Ledger and extend that data to compute the

Adjusted Trial Balance on the Trial Balance' worksheet.

From the Adjusted Trial Balance, prepare the four fundamental financial statements at

December Points:

a Income Statement

b Statement of Retained Earnings

c Balance Sheet

d Statement of Cash Flows a Balance Sheet is provided to prepare the operating

activities section using the indirect method

Prepare the Closing Journal Entries at December and record them on

the Trial Balance' worksheet and post them to the General Ledger Points

Prepare the PostClosing Trial Balance at December from the Trial

Balance' worksheet your Retained Earnings balance should be the same as on your

Balance Sheet prepared in item c above.

That's are all the information needed

Please complete with excel and send the as attachments or pictures.

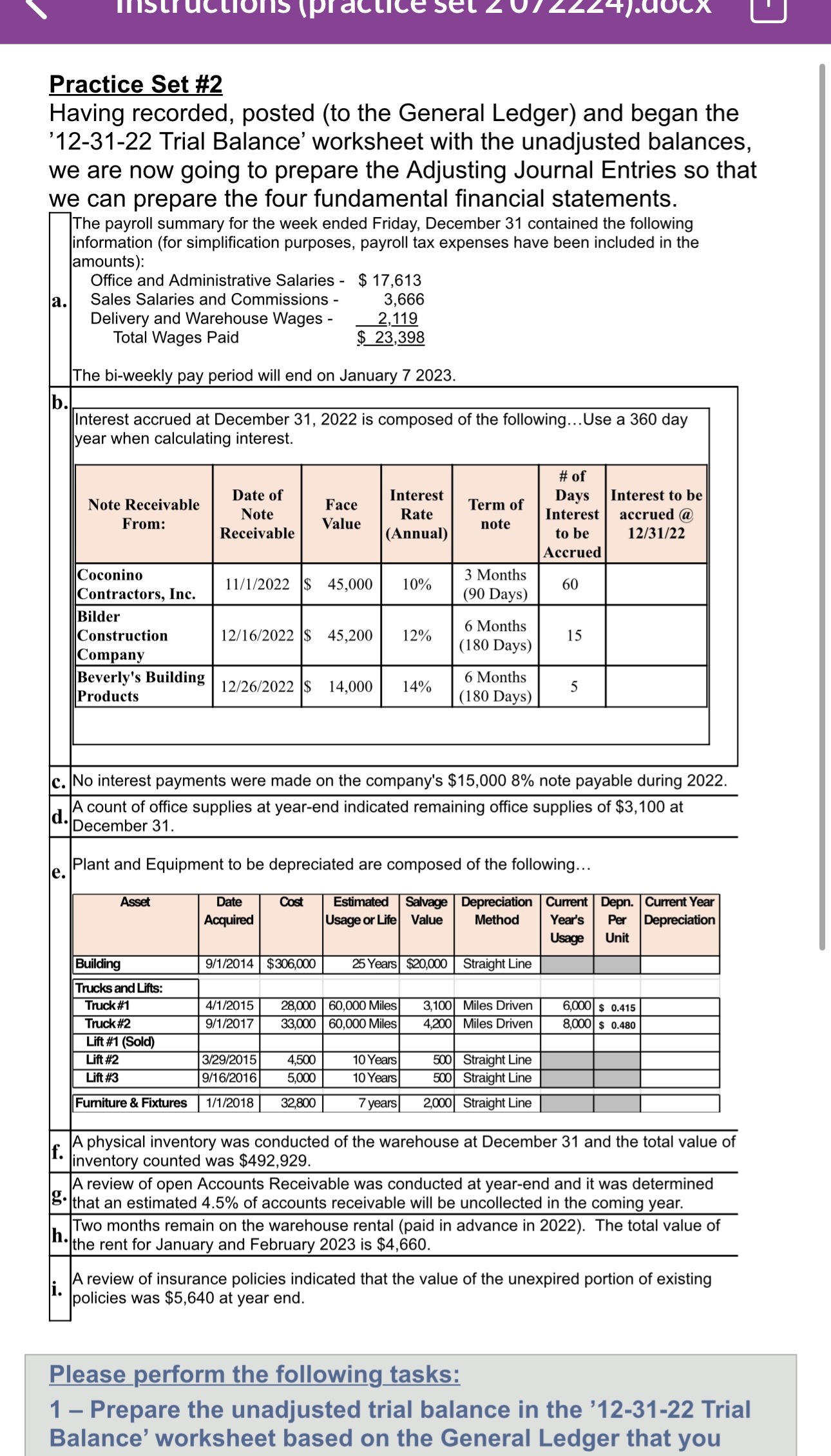

Having recorded, posted to the General Ledger and began the

Trial Balance' worksheet with the unadjusted balances,

we are now going to prepare the Adjusting Journal Entries so that

we can prepare the four fundamental financial statements.

The biweekly pay period will end on January

b

Interest accrued at December is composed of the following...Use a day

year when calculating interest.

c No interest payments were made on the company's $ note payable during

d A count of office supplies at yearend indicated remaining office supplies of $ at

d December

Plant and Equipment to be depreciated are composed of the following...

f A physical inventory was conducted of the warehouse at December and the total value of

inventory counted was $

g A review of open Accounts Receivable was conducted at yearend and it was determined

g that an estimated of accounts receivable will be uncollected in the coming year.

h Two months remain on the warehouse rental paid in advance in The total value of

the rent for January and February is $

A review of insurance policies indicated that the value of the unexpired portion of existing

policies was $ at year end.

Please perform the following tasks:

Prepare the unadjusted trial balance in the Trial

Balance' worksheet based on the General Ledger that you

f A physical inventory was conducted of the warehouse at December and the total value of

f inventory counted was $

g A review of open Accounts Receivable was conducted at yearend and it was determined

g that an estimated of accounts receivable will be uncollected in the coming year.

h Two months remain on the warehouse rental paid in advance in The total value of

h the rent for January and February is $

i A review of insurance policies indicated that the value of the unexpired portion of existing

policies was $ at year end.

Please perform the following tasks:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock