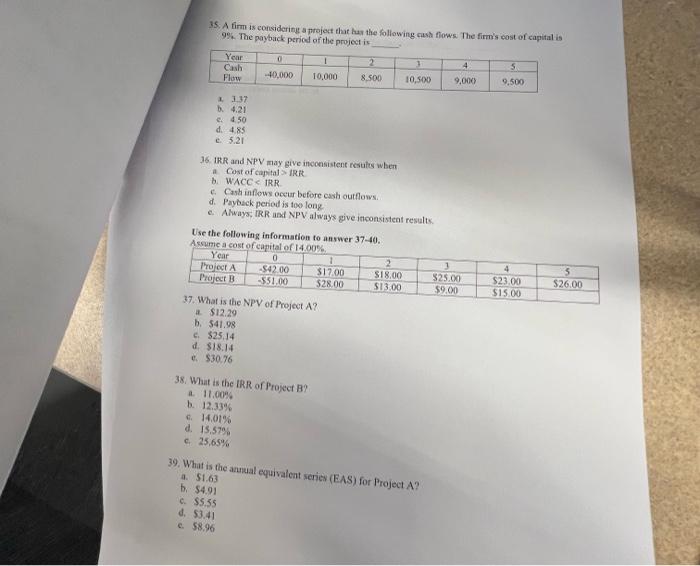

Question: please please 35. A firm is considering a project that has the following cash flows. The firm's cost of capital is 9%. The payback period

35. A firm is considering a project that has the following cash flows. The firm's cost of capital is 9%. The payback period of the project is Year 0 1 2 4 5 Cash Flow -40,000 10,000 8,500 10,500 9,000 9,500 a 3.37 b. 4.21 4.50 d. 4.85 c. 5.21 36. IRR and NPV may give inconsistent results when a Cost of capital > IRR b. WACC IRR e. Cash inflows occur before cash outflows. d. Payback period is too long. e. Always; IRR and NPV always give inconsistent results. Use the following information to answer 37-40. Assume a cost of capital of 14.00% 2 3 Year Project A 0 -$42.00 1 $17.00 $18.00 $25.00 Project B -$51.00 $28.00 $13.00 $9.00 37. What is the NPV of Project A? a $12.29 b. $41.98 c. $25.14 d. $18.14 e. $30.76 38. What is the IRR of Project B? a 11.00% b. 12.33% 14.01% d. 15.57 % c. 25,65 % 39. What is the annual equivalent series (EAS) for Project A? a. $1.63 b. $4.91 c. $5.55 d. $3.41 c. $8.96 4 $23.00 $15.00 5 $26.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts