Question: please please answer both questions , Thank you!!! A trader bought one S&P 500 Index futures contract for delivery in December. The S&P 500 contract

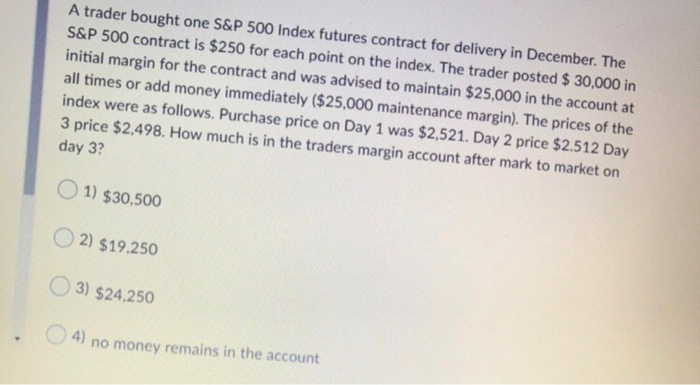

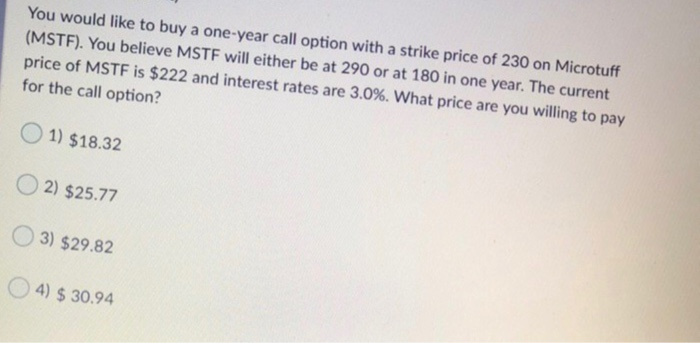

A trader bought one S&P 500 Index futures contract for delivery in December. The S&P 500 contract is $250 for each point on the index. The trader posted $ 30,000 in initial margin for the contract and was advised to maintain $25,000 in the account at all times or add money immediately ($25,000 maintenance margin). The prices of the index were as follows. Purchase price on Day 1 was $2,521. Day 2 price $2.512 Day 3 price $2,498. How much is in the traders margin account after mark to market on day 3? 1) $30,500 2) $19,250 3) $24,250 4) no money remains in the account You would like to buy a one-year call option with a strike price of 230 on Microtuff (MSTF). You believe MSTF will either be at 290 or at 180 in one year. The current price of MSTF is $222 and interest rates are 3.0%. What price are you willing to pay for the call option? 1) $18.32 2) $25.77 3) $29.82 4) $ 30.94

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts