Question: Please please answer correct, it very important question for me, Answer with showing working clearly, 5 points 9 6. Clavel County leases an office building

Please please answer correct, it very important question for me,

Answer with showing working clearly,

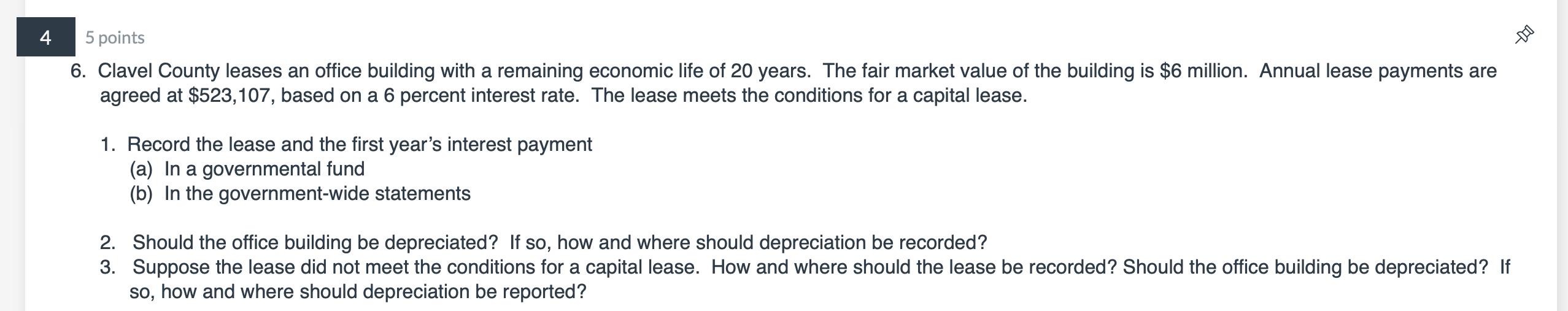

5 points 9 6. Clavel County leases an office building with a remaining economic life of 20 years. The fair market value of the building is $6 million. Annual lease payments are agreed at $523,107, based on a 6 percent interest rate. The lease meets the conditions for a capital lease. 1. Record the lease and the first year's interest payment (a) In a governmental fund (b) In the government-wide statements 2. Should the office building be depreciated? If so, how and where should depreciation be recorded? 3. Suppose the lease did not meet the conditions for a capital lease. How and where should the lease be recorded? Should the office building be depreciated? If so, how and where should depreciation be reported

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts