Question: please please answer th question fast you always provide me answers very late Q.3 Suppose you have a portfolio with 70% of stock funds and

please please answer th question fast you always provide me answers very late

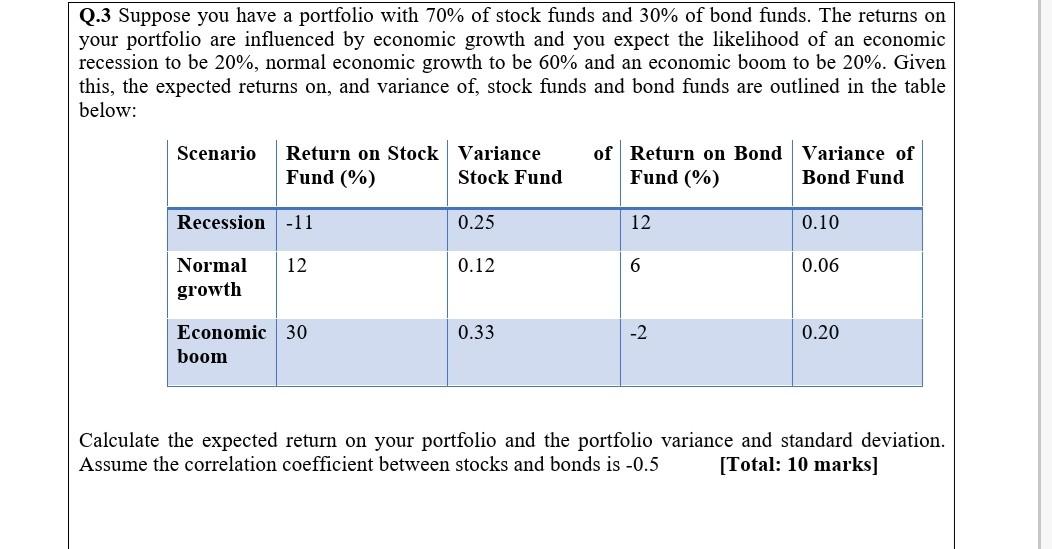

Q.3 Suppose you have a portfolio with 70% of stock funds and 30% of bond funds. The returns on your portfolio are influenced by economic growth and you expect the likelihood of an economic recession to be 20%, normal economic growth to be 60% and an economic boom to be 20%. Given this, the expected returns on, and variance of, stock funds and bond funds are outlined in the table below: Scenario Return on Stock Variance Fund (%) Stock Fund of Return on Bond Variance of Fund (%) Bond Fund Recession -11 0.25 12 0.10 12 0.12 6 0.06 Normal growth 0.33 -2 0.20 Economic 30 boom Calculate the expected return on your portfolio and the portfolio variance and standard deviation. Assume the correlation coefficient between stocks and bonds is -0.5 [Total: 10 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts