Question: please please answer this Question in 30 minutes. I will rate your work Question 14 4 pts A company is considering the purchase of a

please please answer this Question in 30 minutes. I will rate your work

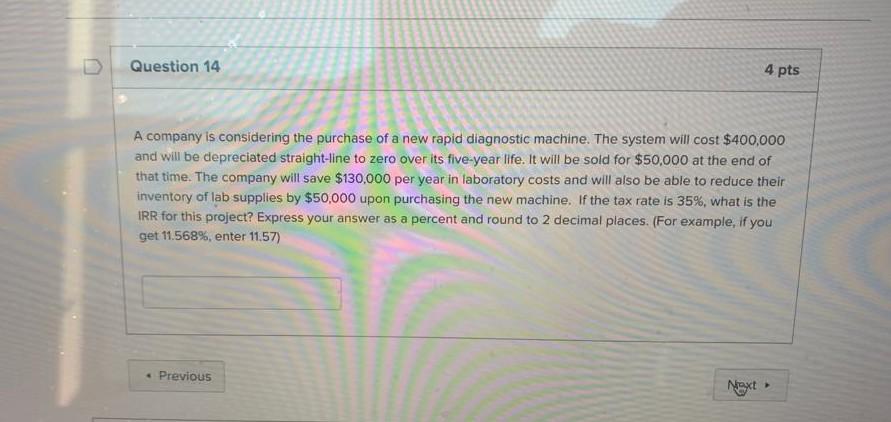

Question 14 4 pts A company is considering the purchase of a new rapid diagnostic machine. The system will cost $400,000 and will be depreciated straight-line to zero over its five-year life. It will be sold for $50,000 at the end of that time. The company will save $130,000 per year in laboratory costs and will also be able to reduce their inventory of lab supplies by $50,000 upon purchasing the new machine. If the tax rate is 35%, what is the IRR for this project? Express your answer as a percent and round to 2 decimal places. (For example, if you get 11.568%, enter 11.57) Previous Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts