Question: please please do this question urgently and perfectly. I will give positive rating if you solve this urgently and perfectly. highlight the main answer Question

please please do this question urgently and perfectly. I will give positive rating if you solve this urgently and perfectly. highlight the main answer

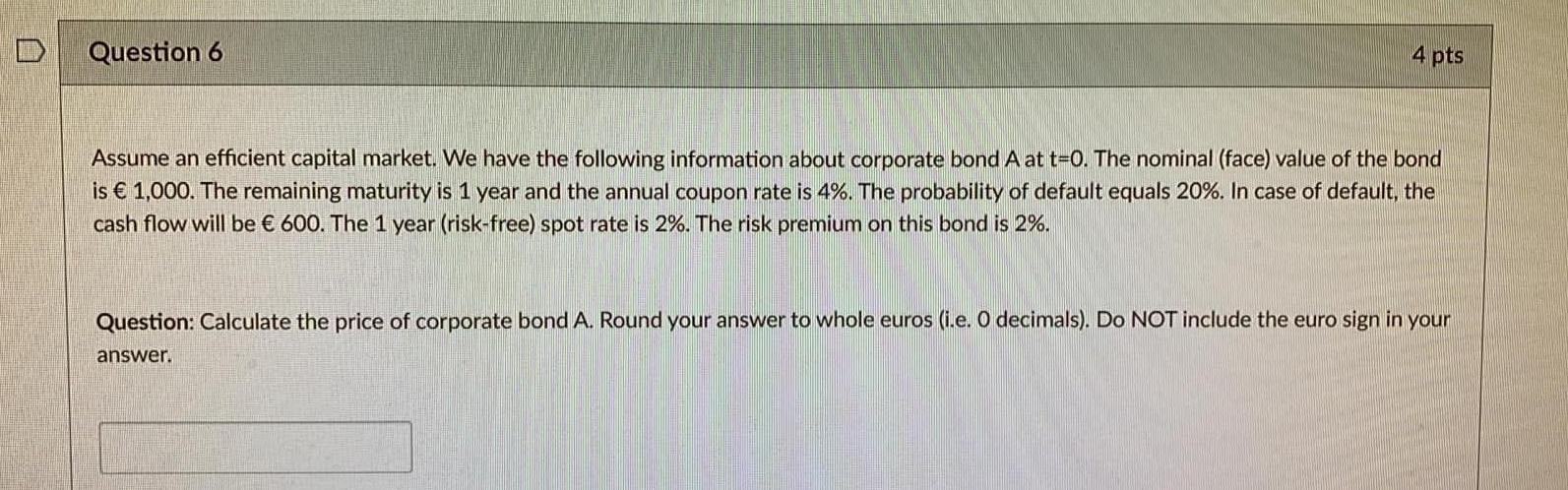

Question 6 4 pts Assume an efficient capital market. We have the following information about corporate bond A at t=0. The nominal (face) value of the bond is 1,000. The remaining maturity is 1 year and the annual coupon rate is 4%. The probability of default equals 20%. In case of default, the cash flow will be 600. The 1 year (risk-free) spot rate is 2%. The risk premium on this bond is 2%. Question: Calculate the price of corporate bond A. Round your answer to whole euros (i.e. O decimals). Do NOT include the euro sign in your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts