Question: PLEASE PLEASE HELP FAST WITH QUESTION BJinhee Ju, 27, just received a promotion at work that increased her annual salary to $40,000. She is eligible

PLEASE PLEASE HELP FAST WITH QUESTION BJinhee Ju, 27, just received a promotion at work that increased her annual salary to $40,000. She is eligible to participate in her employer's 401(k) plan, to which the employer matches dollar-for-dollar workers' contributions up to five percent of salary. However, Jinhee wants to buy a new $23,000 car in 5 years, and she wants to save enough money to make a $5,000 down payment on the car and finance the balance. Also in her plans is a wedding. Jinhee and her boyfriend, Paul, have set a wedding date 2 years in the future, after he finishes medical school. Paul will have $100,000 of student loans to repay after graduation. But both Jinhee and Paul want to buy a home of their own as soon as possible. This might be possible because at age 30, Jinhee will be eligible to access a $47,000 trust fund left to her as an inheritance by her late grandfather. Her trust fund is invested in 8 percent government bonds.

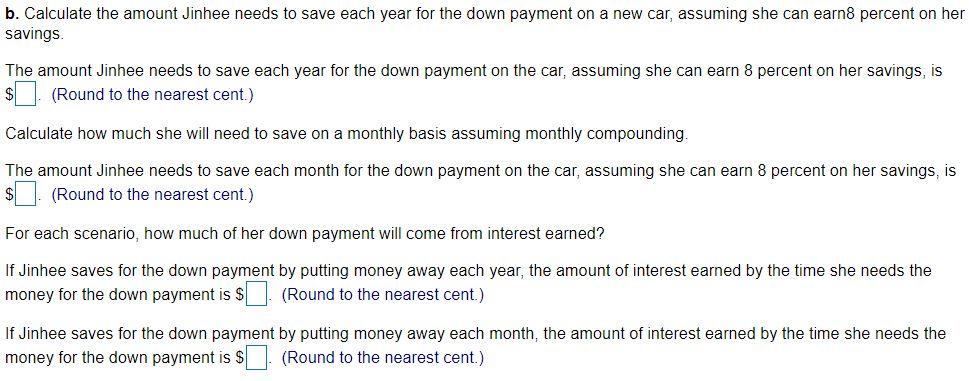

b. Calculate the amount Jinhee needs to save each year for the down payment on a new car, assuming she can earn8 percent on her savings The amount Jinhee needs to save each year for the down payment on the car, assuming she can earn 8 percent on her savings, is $ (Round to the nearest cent.) Calculate how much she will need to save on a monthly basis assuming monthly compounding. The amount Jinhee needs to save each month for the down payment on the car, assuming she can earn 8 percent on her savings, is (Round to the nearest cent.) For each scenario, how much of her down payment will come from interest earned? If Jinhee saves for the down payment by putting money away each year, the amount of interest earned by the time she needs the money for the down payment is s (Round to the nearest cent.) If Jinhee saves for the down payment by putting money away each month, the amount of interest earned by the time she needs the money for the down payment is $. (Round to the nearest cent.) b. Calculate the amount Jinhee needs to save each year for the down payment on a new car, assuming she can earn8 percent on her savings The amount Jinhee needs to save each year for the down payment on the car, assuming she can earn 8 percent on her savings, is $ (Round to the nearest cent.) Calculate how much she will need to save on a monthly basis assuming monthly compounding. The amount Jinhee needs to save each month for the down payment on the car, assuming she can earn 8 percent on her savings, is (Round to the nearest cent.) For each scenario, how much of her down payment will come from interest earned? If Jinhee saves for the down payment by putting money away each year, the amount of interest earned by the time she needs the money for the down payment is s (Round to the nearest cent.) If Jinhee saves for the down payment by putting money away each month, the amount of interest earned by the time she needs the money for the down payment is $. (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts