Question: Please please help! I am very stuck on this problem!! Required information [The following information applies to the questions displayed below.] Christmas Anytime issues $750,000

Please please help! I am very stuck on this problem!!

![[The following information applies to the questions displayed below.] Christmas Anytime issues](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/671830835204f_53067183082acff4.jpg)

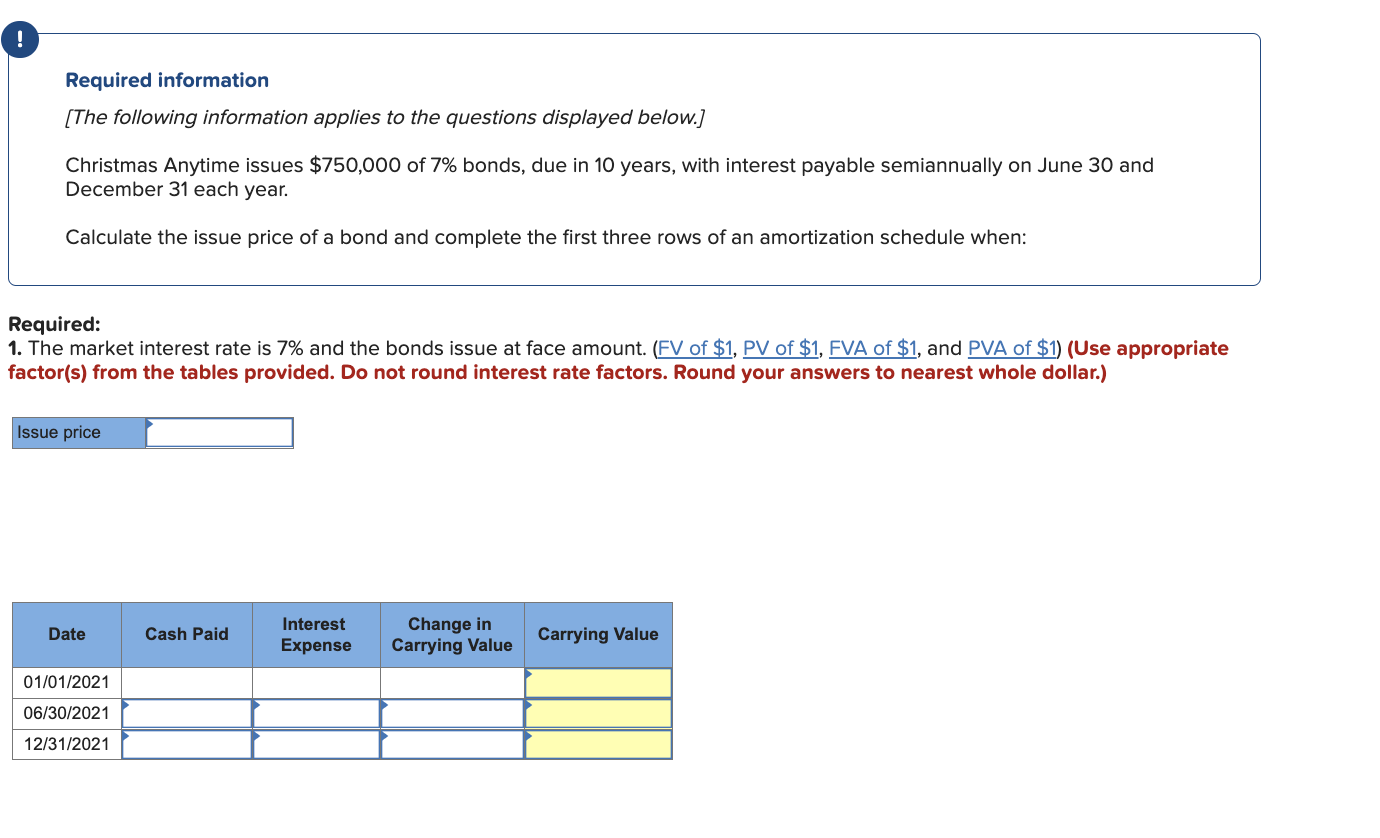

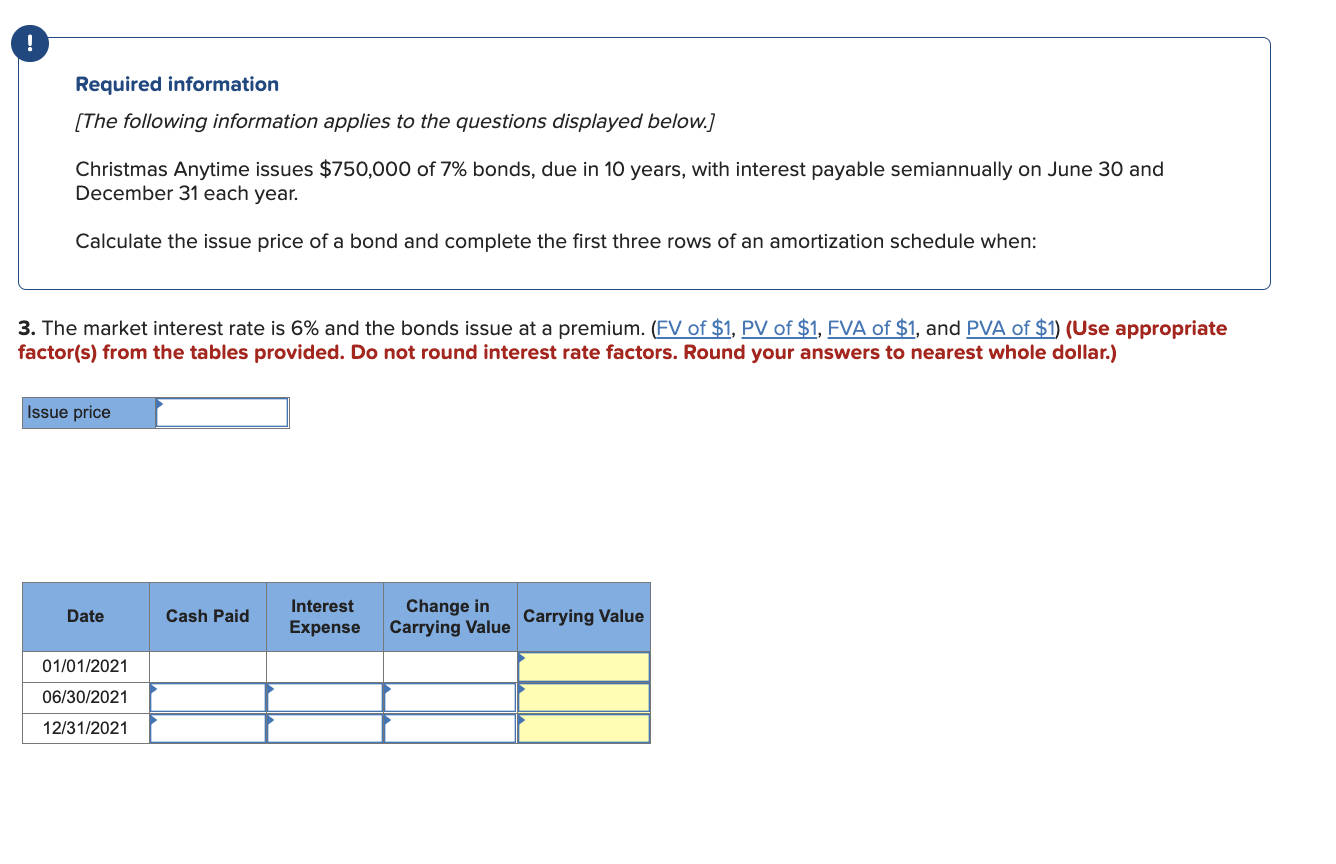

Required information [The following information applies to the questions displayed below.] Christmas Anytime issues $750,000 of 7% bonds, due in 10 years, with interest payable semiannually on June 30 and December 31 each year. Calculate the issue price of a bond and complete the first three rows of an amortization schedule when: equired: The market interest rate is 7% and the bonds issue at face amount. (FV of $1,PV of $1, FVA of $1, and (Use appropriate actor(s) from the tables provided. Do not round interest rate factors. Round your answers to nearest whole dollar.) Required information [The following information applies to the questions displayed below.] Christmas Anytime issues $750,000 of 7% bonds, due in 10 years, with interest payable semiannually on June 30 and December 31 each year. Calculate the issue price of a bond and complete the first three rows of an amortization schedule when: The market interest rate is 8% and the bonds issue at a discount. (FV of $1,PV of $1,FVA of $1, and PVA of $1 ) (Use appropriate ctor(s) from the tables provided. Do not round interest rate factors. Round your answers to nearest whole dollar.) Required information [The following information applies to the questions displayed below.] Christmas Anytime issues $750,000 of 7% bonds, due in 10 years, with interest payable semiannually on June 30 and December 31 each year. Calculate the issue price of a bond and complete the first three rows of an amortization schedule when: 3. The market interest rate is 6% and the bonds issue at a premium. (FV of $1, PV of $1, FVA of $1, and (Use appropriate iactor(s) from the tables provided. Do not round interest rate factors. Round your answers to nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts