Question: please please help I will rate. All questions pls. 6. The equity analysis team at OPI /S Hedge Fund has identified BZG as an attractive

please please help I will rate. All questions pls.

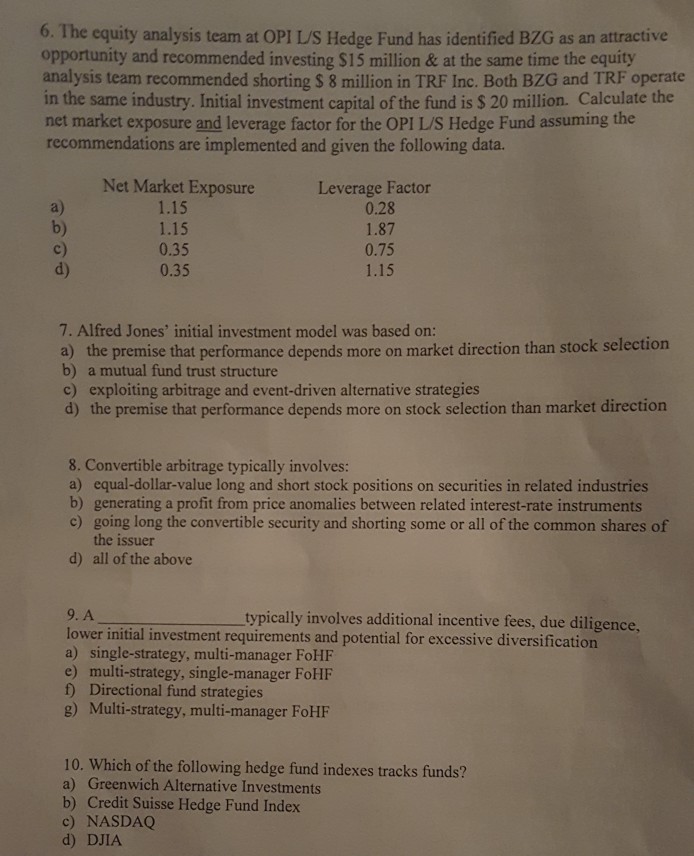

6. The equity analysis team at OPI /S Hedge Fund has identified BZG as an attractive opportunity and recommended investing $15 million & at the same time the equity analysis team recommended shorting S 8 million in TRF Inc. Both BZG and TRF operate in the same industry. Initial investment capital of the fund is S 20 million. Calculate the net market exposure and leverage factor for the OPI L/S Hedge Fund assuming the recommendations are implemented and given the following data. a) b) c) d) Net Market Exposure 1.15 1.15 0.35 0.35 Leverage Factor 0.28 1.87 0.75 1.15 7. Alfred Jones' initial investment model was based on: a) the premise that performance depends more on market direction than stock selection b) a mutual fund trust structure c) exploiting arbitrage and event-driven alternative strategies d) the premise that performance depends more on stock selection than market direction 8. Convertible arbitrage typically involves: a) equal-dollar-value long and short stock positions on securities in related industries b) generating a profit from price anomalies between related interest-rate instruments c) going long the convertible security and shorting some or all of the common shares of the issuer d) all of the above typically involves addition al incentive fees, due diligence, lower initial investment requirements and potential for excessive diversification a) single-strategy, multi-manager FoHF e) multi-strategy, single-manager FoHF t) Directional fund strategies g) Multi-strategy, multi-manager FoHF 10. Which of the following hedge fund indexes tracks funds? a) Greenwich Alternative Investments b) Credit Suisse Hedge Fund Index c) NASDAQ d) DJIA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts