Question: please please help I will rate definately. All questions pls. 1. A hybrid investment that combines the safety of deposit instrument with the potential of

please please help I will rate definately. All questions pls.

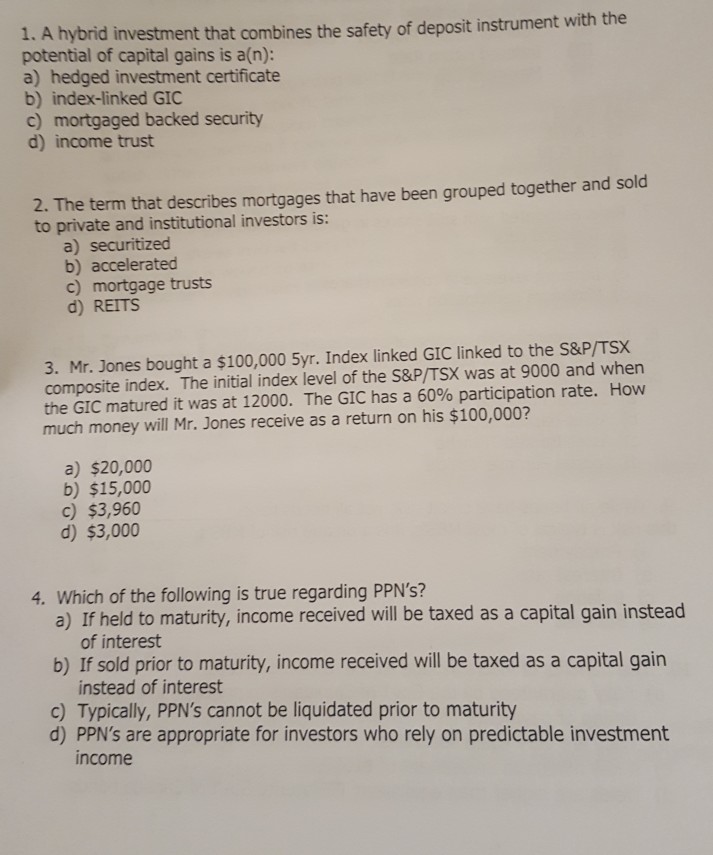

1. A hybrid investment that combines the safety of deposit instrument with the potential of capital gains is a(n): a) hedged investment certificate b) index-linked GIC c) mortgaged backed security d) income trust 2. The term that describes mortgages that have been grouped together and sold to private and institutional investors is: a) securitized b) accelerated c) mortgage trusts d) REITS 3. Mr. Jones bought a $100,000 5yr. Index linked GIC linked to the S&P/TSx composite index. The initial index level of the S&P/TSX was at 9000 and whern the GIC matured it was at 12000, The GIC has a 60% participation rate. How much money will Mr. Jones receive as a return on his $100,000? a) $20,000 b) $15,000 c) $3,960 d) $3,000 4. Which of the following is true regarding PPN's? a) If held to maturity, income received will be taxed as a capital gain instead of interest b) If sold prior to maturity, income received will be taxed as a capital gain instead of interest c) Typically, PPN's cannot be liquidated prior to maturity d) PPN's are appropriate for investors who rely on predictable investment ncome

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts