Question: please please help I will rate definately. All questions pls. 5. A person invested $50,000 into a bond fund. Three years later she cashed the

please please help I will rate definately. All questions pls.

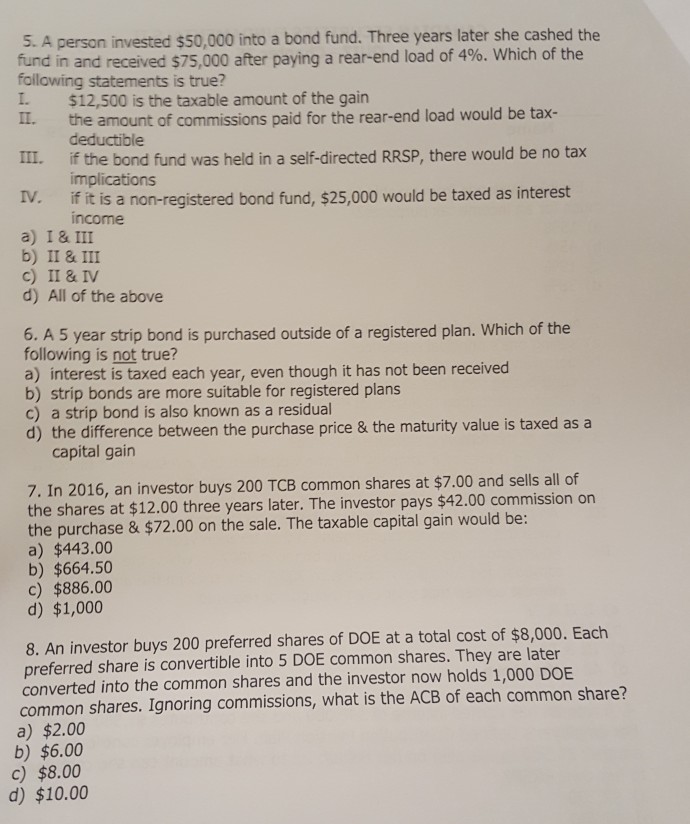

5. A person invested $50,000 into a bond fund. Three years later she cashed the fund in and following statements is true? L $12,500 is the taxable amount of the gain I. the amount of commissions paid for the rear-end load would be tax- received $75,000 after paying a rear-end load of 4%, which of the deductible III. if the bond fund was held in a self-directed RRSP, there would be no tax IV. If it is a non-registered bond fund, $25,000 would be taxed as interest implications income a) I & III b) II & III c) II & IV d) All of the above 6. A 5 year strip bond is purchased outside of a registered plan. Which of the following is not true? a) interest is taxed each year, even though it has not been received b) strip bonds are more suitable for registered plans c) a strip bond is also known as a residual d) the difference between the purchase price & the maturity value is taxed as a capital gain 7. In 2016, an investor buys 200 TCB common shares at $7.00 and sells all of the shares at $12.00 three years later. The investor pays $42.00 commission on the purchase & $72.00 on the sale. The taxable capital gain would be: a) $443.00 b) $664.50 c) $886.00 d) $1,000 8. An investor buys 200 preferred shares of DOE at a total cost of $8,000. Each preferred share is convertible into 5 DOE common shares. They are later converted into the common shares and the investor now holds 1,000 DOE common shares. Ignoring commissions, what is the ACB of each common share? a) $2.00 b) $6.00 c) $8.00 d) $10.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts