Question: please please help I will rate definately rate. All questions pls. 1. Eligible dividends from taxable Canadian corporations are gross much for an income tax

please please help I will rate definately rate. All questions pls.

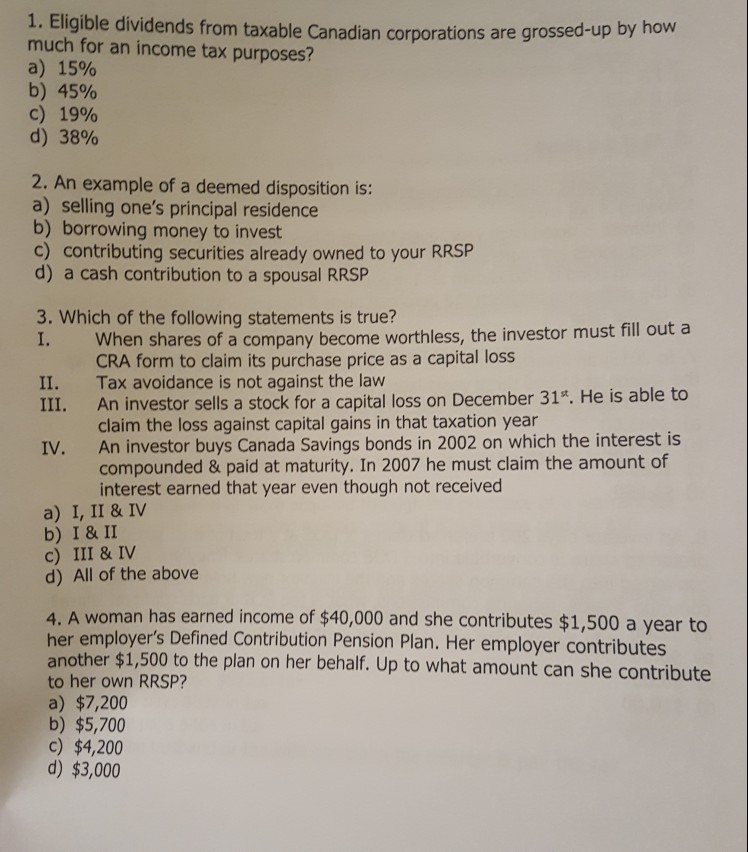

1. Eligible dividends from taxable Canadian corporations are gross much for an income tax purposes? a) 15% b) 45% c) 19% d) 38% ed-up by how 2. An example of a deemed disposition is: a) selling one's principal residence b) borrowing money to invest c) contributing securities already owned to your RRSP d) a cash contribution to a spousal RRSP 3. Which of the following statements is true? shares of a company become worthless, the investor must fill out a CRA form to claim its purchase price as a capital loss II. Tax avoidance is not against the law III. An investor sells a stock for a capital loss on December 31*. He is able to claim the loss against capital gains in that taxation year An investor buys Canada Savings bonds in 2002 on which the interest is compounded & paid at maturity. In 2007 he must claim the amount of interest earned that year even though not received IV. a) I, II & IV b) I & II c) III & IV d) All of the above 4. A woman has earned income of $40,000 and she contributes $1,500 a year to her employer's Defined Contribution Pension Plan. Her employer contributes another $1,500 to the plan on her behalf. Up to what amount can she contribute to her own RRSP? a) $7,200 b) $5,700 c) $4,200 d) $3,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts