Question: Please please if someone can help with this problem . 3. (25 points) Accounts Receivable (A/R) Hedging John Deere Co. (Deere) is a U.S.-based company

Please please if someone can help with this problem

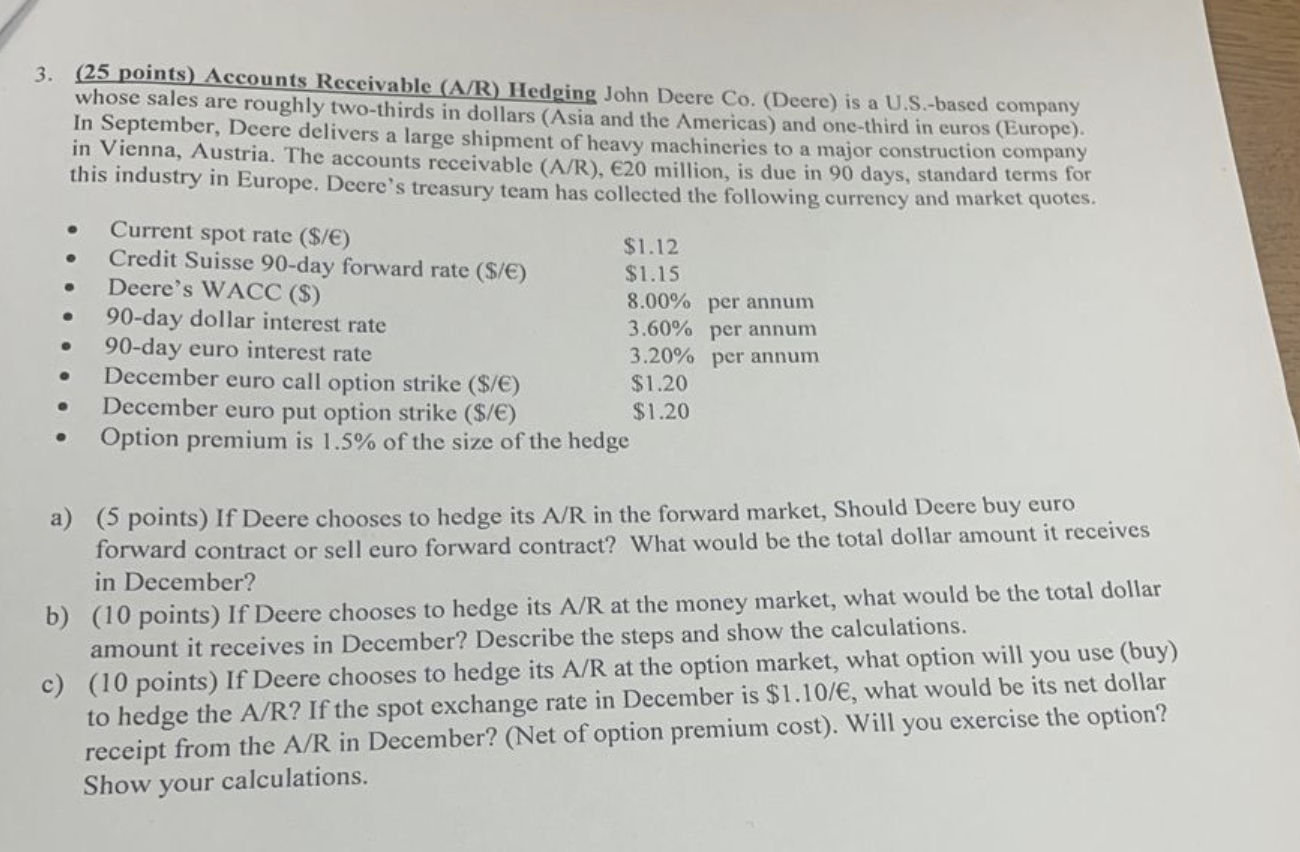

. 3. (25 points) Accounts Receivable (A/R) Hedging John Deere Co. (Deere) is a U.S.-based company whose sales are roughly two-thirds in dollars (Asia and the Americas) and one-third in euros (Europe). In September, Deere delivers a large shipment of heavy machineries to a major construction company in Vienna, Austria. The accounts receivable (A/R), 20 million, is due in 90 days, standard terms for this industry in Europe. Deere's treasury team has collected the following currency and market quotes. Current spot rate ($/) $1.12 Credit Suisse 90-day forward rate ($/) $1.15 Deere's WACC ($) 8.00% per annum 90-day dollar interest rate 3.60% per annum 90-day euro interest rate 3.20% per annum December euro call option strike ($/) $1.20 December euro put option strike ($/) $1.20 Option premium is 1.5% of the size of the hedge . . . a) (5 points) If Deere chooses to hedge its A/R in the forward market, Should Deere buy euro forward contract or sell euro forward contract? What would be the total dollar amount it receives in December? b) (10 points) If Deere chooses to hedge its A/R at the money market, what would be the total dollar amount it receives in December? Describe the steps and show the calculations. c) (10 points) If Deere chooses to hedge its A/R at the option market, what option will you use (buy) to hedge the A/R? If the spot exchange rate in December is $1.10/, what would be its net dollar receipt from the A/R in December? (Net of option premium cost). Will you exercise the option? Show your calculations. . 3. (25 points) Accounts Receivable (A/R) Hedging John Deere Co. (Deere) is a U.S.-based company whose sales are roughly two-thirds in dollars (Asia and the Americas) and one-third in euros (Europe). In September, Deere delivers a large shipment of heavy machineries to a major construction company in Vienna, Austria. The accounts receivable (A/R), 20 million, is due in 90 days, standard terms for this industry in Europe. Deere's treasury team has collected the following currency and market quotes. Current spot rate ($/) $1.12 Credit Suisse 90-day forward rate ($/) $1.15 Deere's WACC ($) 8.00% per annum 90-day dollar interest rate 3.60% per annum 90-day euro interest rate 3.20% per annum December euro call option strike ($/) $1.20 December euro put option strike ($/) $1.20 Option premium is 1.5% of the size of the hedge . . . a) (5 points) If Deere chooses to hedge its A/R in the forward market, Should Deere buy euro forward contract or sell euro forward contract? What would be the total dollar amount it receives in December? b) (10 points) If Deere chooses to hedge its A/R at the money market, what would be the total dollar amount it receives in December? Describe the steps and show the calculations. c) (10 points) If Deere chooses to hedge its A/R at the option market, what option will you use (buy) to hedge the A/R? If the spot exchange rate in December is $1.10/, what would be its net dollar receipt from the A/R in December? (Net of option premium cost). Will you exercise the option? Show your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts