Question: please please please answer correctly . dont type wrong answers . please . i will like if its correct . Note: Correct answer to calculations-based

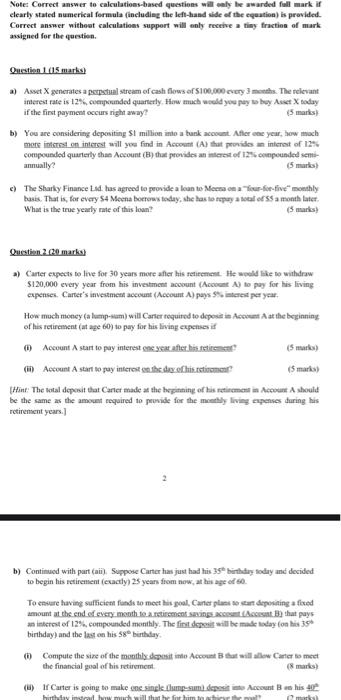

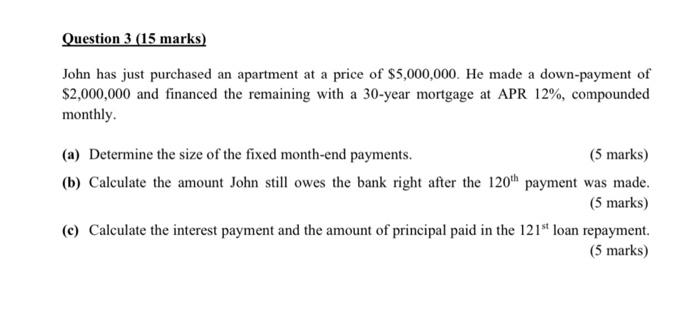

Note: Correct answer to calculations-based questions wil ealy be awarded full mark if elearly stated numerical formula (ineludieg the left-hand wide of the equation) bs providet. Correct answer withoot calculations support will enly receive a triny fraction of mark assigned for the quetion. Question 1 (1.5 marka) a) Asse X generates a persstual stream of cash fows of 5100.000 cvery 3 months. The relevant if the first paymeat occurs right away? (5 marks) b) You are considering depositing $1 million inbo a turk acoount. Afler ooe year, how moch mere interns on intersy will yee find in Account (A) thet provids an internot of 12 .5. compeunded quarenty thas Acsount (B) that provides an interet of 125 sonpounded ientannually? (5 mark) e) The Starky Finance Lid. has agreed to peovide a keun to Meens on a Ticur-fie-five" monehly busis. That is, for every $4 Meena bocrews teday, the las lo ropy a weal or $5 a month later. What is the true yearly mate of this loan? (5 marks) Question 2. \{20 markef) a) Carter expects bo live for 30 years more after his retirement. He wopld the wo withdruw $120,000 every year from his inveatment acoount (Acowent A) to pay for his living expenses. Carter's investment account (Aeeount A) pays 5% th iterest per year. How much money (a lump-sam) will Carter tequired to deposit in Asovent A as the beginning of his retirement (at ape 60) io pay for his living expenses if (i) Account A stant to pay intenest enc yeat after bist vetire and (5 marki) (ii) Aecount A start wo fay intereat inthe doy ef this tetioment? (5 maria) (Hint: The wotal depesit tat Carier made at the hepiataing of his retiremens in Aesours A should be the same ar the amount required to peovide for the meethy living espenses during his retirement years.] b) Continued with part (aii). Suppose Carter has just had his 35th berthay fodeny and decided to begin his retirement (ecacty) 25 yean from now, at his age of 60 . To esevere having sufficient funds so mett his godl, Caner plase wo eart dipoining a fixed amount at the end of every mooth to a texirement savings acesen (Aesesat B) that pays an inkernet of 12t, compounded monithy. The fint deowit aill be make lalay (on lis 39t birthday) and the last on his 58 beirtalyy. (i) Compute the sire of the monthly deposit imb Accoum B tat will allow Carter bs mect the financial goal of his retirement. (8 marks) (ii) If Carter is going to make ene singke (lunne-sumb depoin ies Acssunt B is his 40t John has just purchased an apartment at a price of $5,000,000. He made a down-payment of $2,000,000 and financed the remaining with a 30 -year mortgage at APR 12%, compounded monthly. (a) Determine the size of the fixed month-end payments. ( 5 marks) (b) Calculate the amount John still owes the bank right after the 120th payment was made. ( 5 marks) (c) Calculate the interest payment and the amount of principal paid in the 121st loan repayment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts