Question: please please please explain the steps one by one QUESTION 25 Currently, a call option on Bayou stock is available with an exercise price of

please please please explain the steps one by one

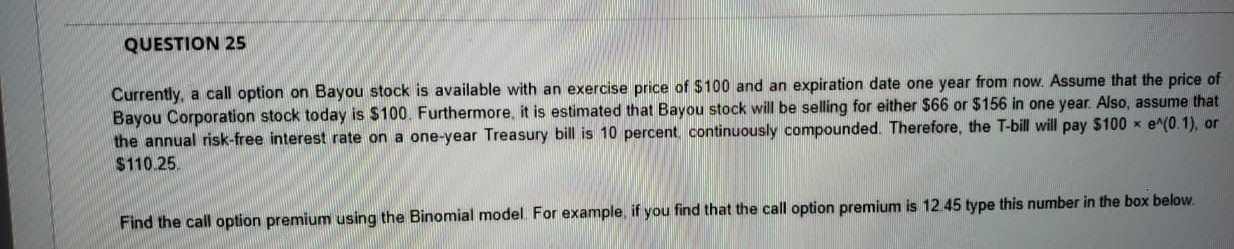

QUESTION 25 Currently, a call option on Bayou stock is available with an exercise price of $100 and an expiration date one year from now. Assume that the price of Bayou Corporation stock today is $100. Furthermore, it is estimated that Bayou stock will be selling for either $66 or $156 in one year. Also, assume that the annual risk-free interest rate on a one-year Treasury bill is 10 percent continuously compounded. Therefore, the T-bill will pay $100 * e^(0.1), or $110.25 Find the call option premium using the Binomial model. For example, if you find that the call option premium is 12.45 type this number in the box below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts