Question: please please please help possible Nines-to-Fives, a clothing resale store, employs one salesperson, Dixie Hollace. Hollace's straight-time wage is $40 per hour, with time-and-a-half pay

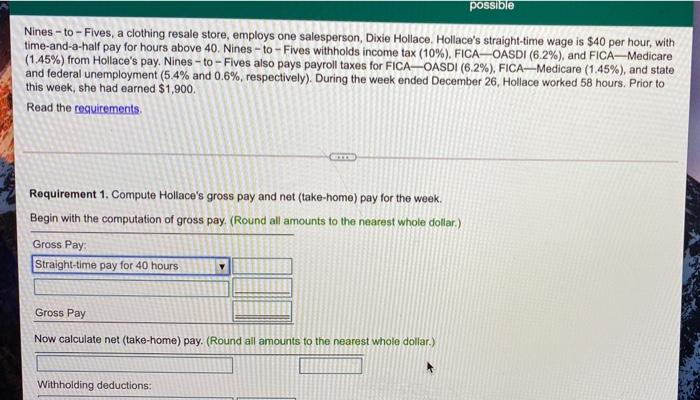

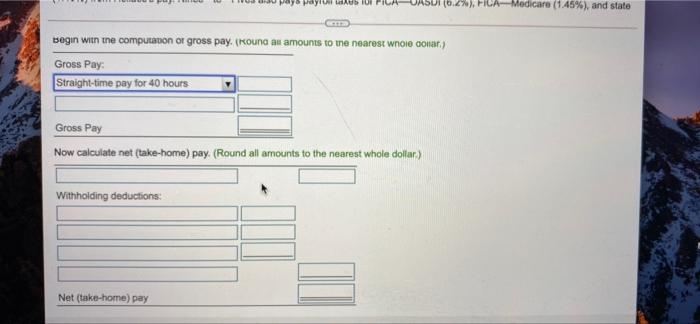

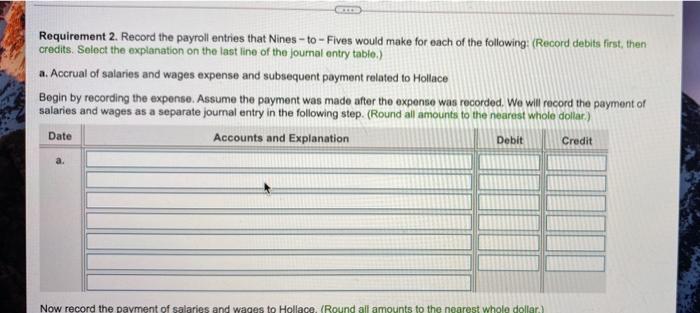

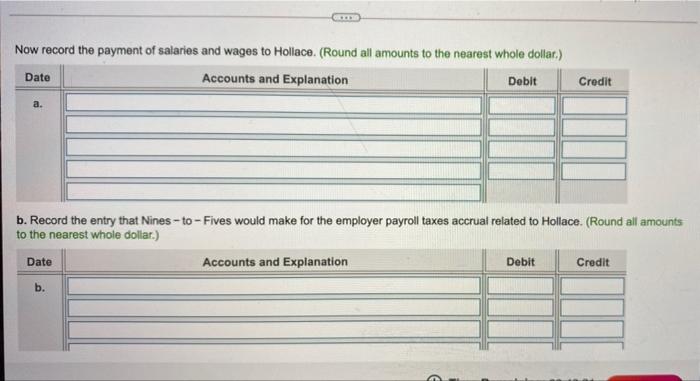

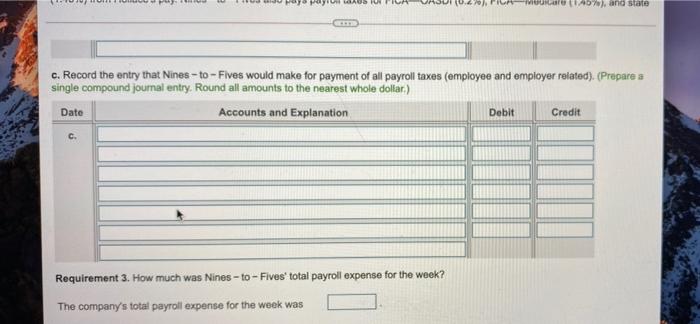

possible Nines-to-Fives, a clothing resale store, employs one salesperson, Dixie Hollace. Hollace's straight-time wage is $40 per hour, with time-and-a-half pay for hours above 40. Nines - to-Fives withholds income tax (10%). FICA-OASDI (6.2%), and FICA-Medicare (1.45%) from Hollace's pay. Nines-to-Fives also pays payroll taxes for FICA-OASDI (6.2%), FICAMedicare (1.45%), and state and federal unemployment (5.4% and 0.6%, respectively). During the week ended December 26, Hollace worked 58 hours. Prior to this week, she had earned $1,900. Read the requirements Requirement 1. Compute Hollace's gross pay and not take-home) pay for the week. Begin with the computation of gross pay. (Round all amounts to the nearest whole dollar) Gross Pay Straight-time pay for 40 hours Gross Pay Now calculate net (take-home) pay. (Round all amounts to the nearest whole dollar) Withholding deductions: 100 16.2%), FICA-Medicare (1.45%), and state begin with the computation or gross pay. (Round an amounts to the nearest wnole comar) Gross Pay: Straight-time pay for 40 hours Gross Pay Now calculate net (take-home) pay. (Round all amounts to the nearest whole dollar) Withholding deductions Net (take-home) pay Requirement 2. Record the payroll entries that Nines - to - Fives would make for each of the following: (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) a. Accrual of salaries and wages expense and subsequent payment related to Hollace Begin by recording the expense. Assume the payment was made after the expense was recorded. We will record the payment of salaries and wages as a separate journal entry in the following step. (Round all amounts to the nearest whole dollar) Accounts and Explanation Credit Date Debit Now record the payment of salaries and wages to Hollace. (Round all amounts to the nearest whole dollar) Now record the payment of salaries and wages to Hollace. (Round all amounts to the nearest whole dollar.) Date Accounts and Explanation Debit Credit a. b. Record the entry that Nines-to-Fives would make for the employer payroll taxes accrual related to Hollace. (Round all amounts to the nearest whole dollar.) Accounts and Explanation Debit Credit b. Date ADU Mul A7), and stato c. Record the entry that Nines-to-Fives would make for payment of all payroll taxes (employee and employer related). Prepare a single compound journal entry. Round all amounts to the nearest whole dollar) Date Accounts and Explanation Debit Credit C. Requirement 3. How much was Nines-to-Fives total payroll expense for the week? The company's total payroll expense for the week was

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts