Question: please please please help! thanks! (i always rate!) GL0601 (Algo) - Based on Problem 6-2A LO P2 Wright Company set up a petty cash fund

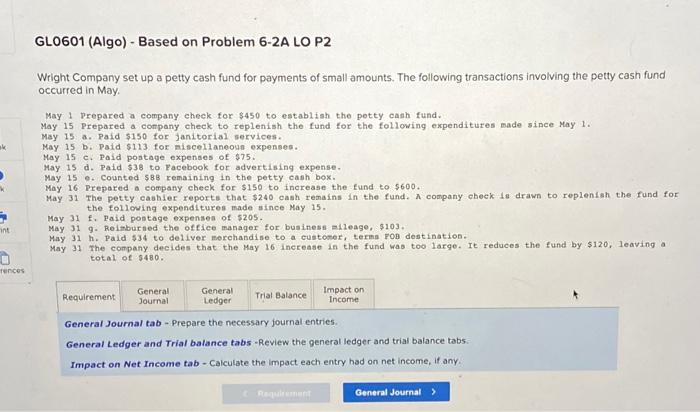

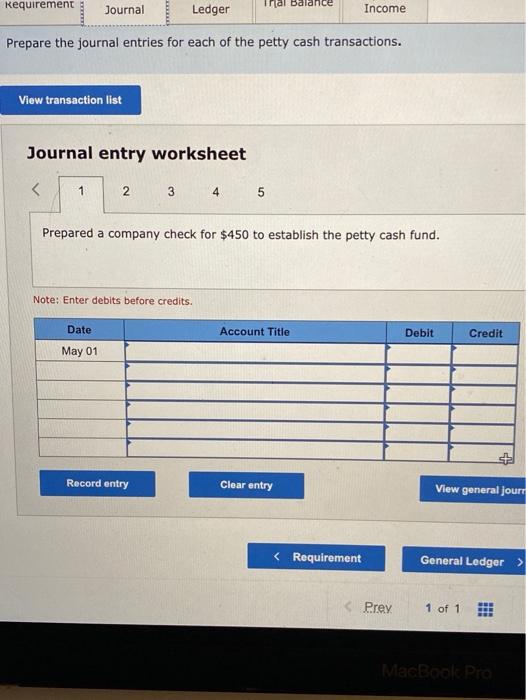

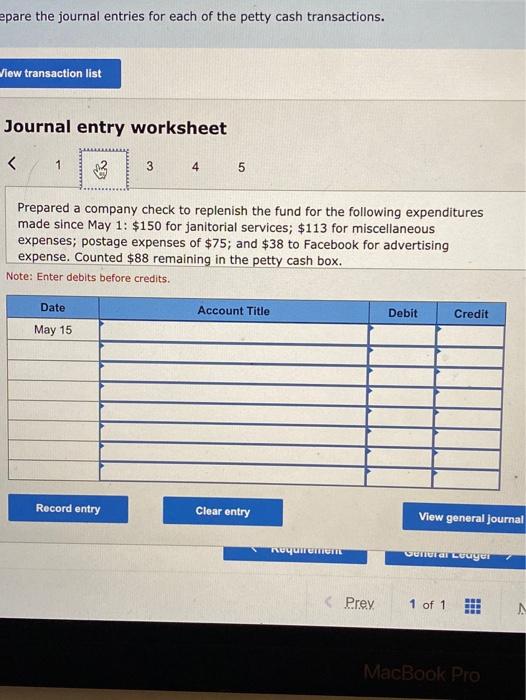

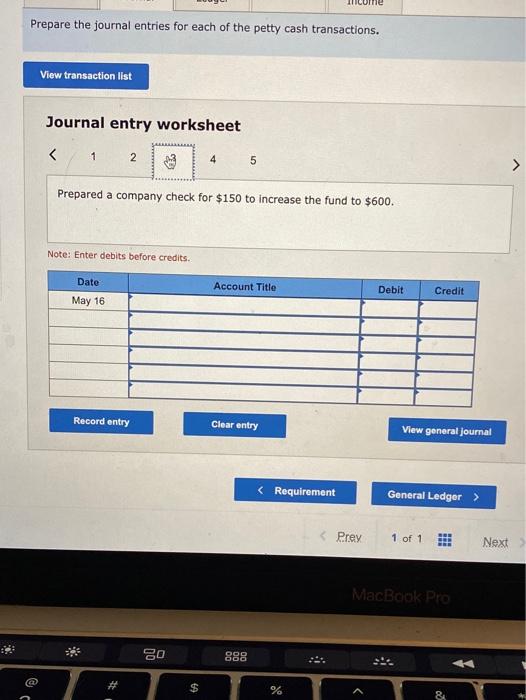

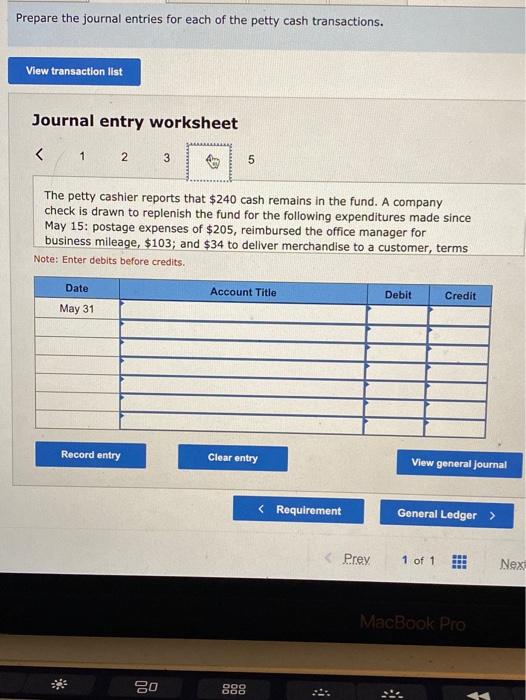

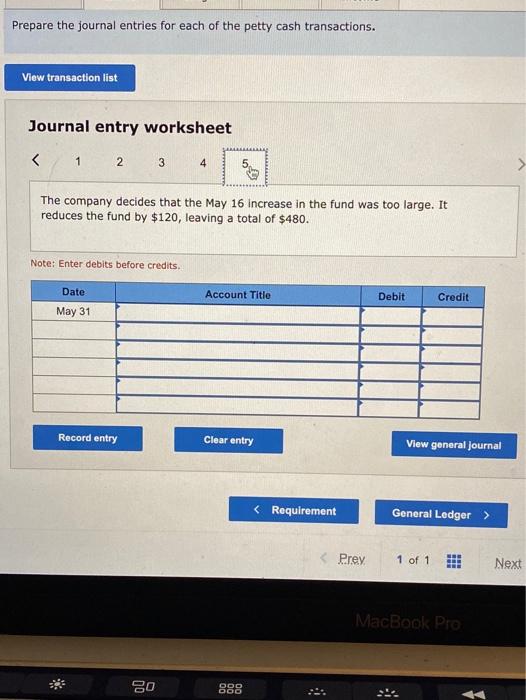

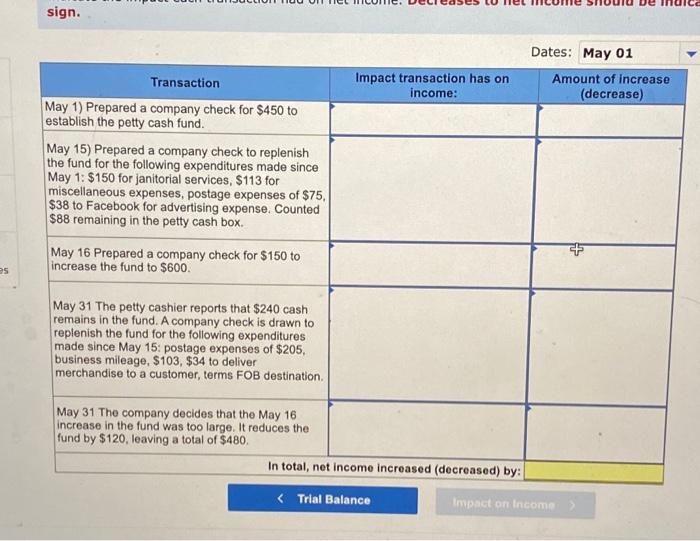

GL0601 (Algo) - Based on Problem 6-2A LO P2 Wright Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May May 1 Prepared a company check for $450 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. May 15 a. Paid $150 for janitorial services. May 15 b. Paid $113 for miscellaneous expenses. May 15 c. Paid postage expenses of $75. May 15 d. Paid $38 to Facebook for advertising expense. May 15 2. Counted $8B remaining in the petty cash box. May 16 Prepared a company check for $150 to increase the fund to $600. May 31 The petty cashier reports that $240 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. May 31 f. Vaid pontage expenses of $205. May 31 9. Reimbursed the office manager for business mileage, $103. May 31 h. Paid 534 to deliver merchandise to a customer, terma FOB destination. May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $120, leaving a total of 5480. int Tences Requirement General Journal General Ledger Trial Balance Impact on Income General Journal tab - Prepare the necessary journal entries General Ledger and Trial balance tabs - Review the general ledger and trial balance tabs Impact on Net Income tab - Calculate the impact each entry had on net income, if any. General Journal > Requirement Journal inal Balance Ledger Income Prepare the journal entries for each of the petty cash transactions. View transaction list Journal entry worksheet Prey 1 of 1 Next MacBook Pro 80 888 $ % & Prepare the journal entries for each of the petty cash transactions. View transaction list Journal entry worksheet Prey 1 of 1 BN Nex MacBook Pro 80 Oro Prepare the journal entries for each of the petty cash transactions. View transaction list Journal entry worksheet Prey 1 of 1 Next MacBook Pro * 80 298 sign. Impact transaction has on income: Dates: May 01 Amount of increase (decrease) Transaction May 1) Prepared a company check for $450 to establish the petty cash fund. May 15) Prepared a company check to replenish the fund for the following expenditures made since May 1: $150 for janitorial services, $113 for miscellaneous expenses, postage expenses of $75, $38 to Facebook for advertising expense. Counted $88 remaining in the petty cash box May 16 Prepared a company check for $150 to increase the fund to $600. as May 31 The petty cashier reports that $240 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15: postage expenses of $205, business mileage, $103, $34 to deliver merchandise to a customer, terms FOB destination May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $120, leaving a total of $480. In total, net income increased (decreased) by:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts