Question: Please Please Please help! this 1 question has 12 parts to it Wilitte Pharmaceuticals manufacturers an over the-counter allergy medication. The company nets, both latge

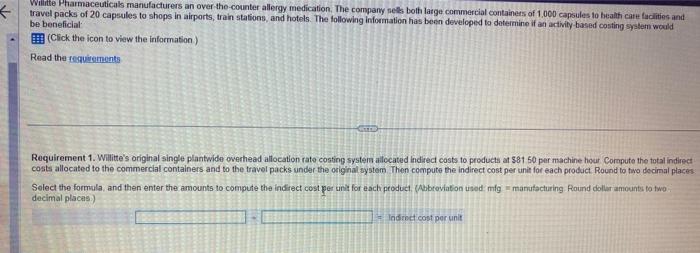

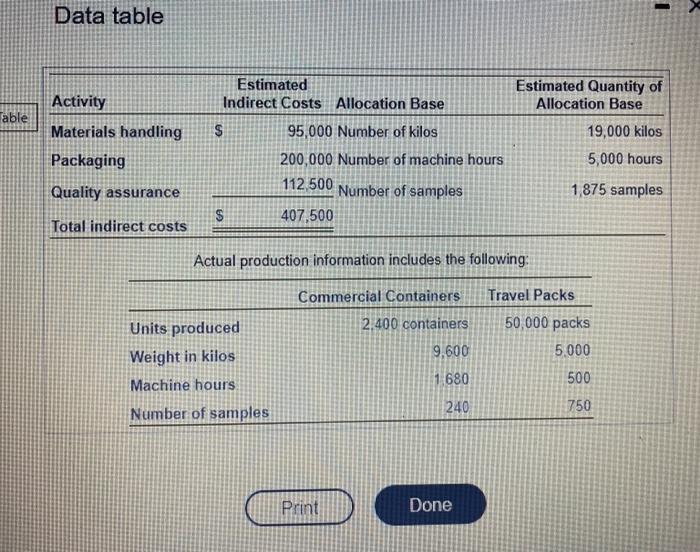

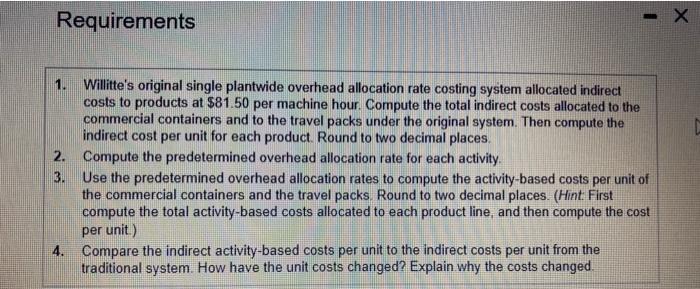

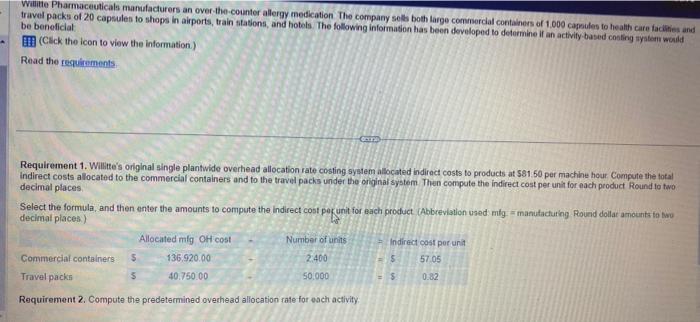

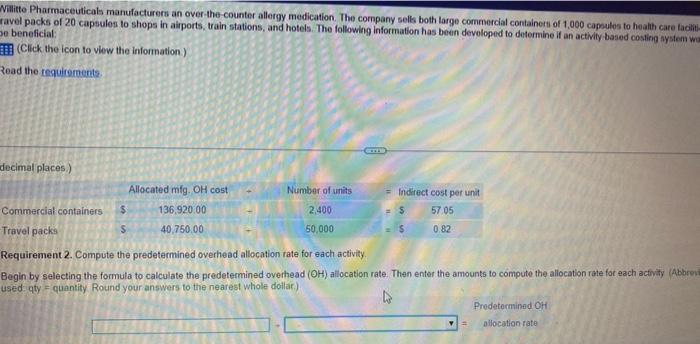

Wilitte Pharmaceuticals manufacturers an over the-counter allergy medication. The company nets, both latge commercial containers of 1.000 capsules to biealth cart fucdities and travel packs of 20 capsules to shops in airports, train stations, and hotets. The following information has been developed to dotermine if an artivily based costing systemi would be beneficial (Click the icon to view the information) Read the regvidements Requirement 1. Willitte's original single plantwide overhead allocation rate costing syster allecated lidirect costs to products at $81 so per machine hour Coropute the total indirect costs allocated to the commercial containers and to the travel packs under the orighal system. Then compute the indirect cost per unir for each product Round to tivo decimal place Solect the formula, and then enter the amounts to compute the indirect cost per unit for each product. Abbtoviaton used: mig = manulacturing Round dollar amounts to two: decimal places.) Data table Requirements 1. Willitte's original single plantwide overhead allocation rate costing system allocated indirect costs to products at $81.50 per machine hour. Compute the total indirect costs allocated to the commercial containers and to the travel packs under the original system. Then compute the indirect cost per unit for each product. Round to two decimal places. 2. Compute the predetermined overhead allocation rate for each activity. 3. Use the predetermined overhead allocation rates to compute the activity-based costs per unit of the commercial containers and the travel packs. Round to two decimal places. (Hint. First compute the total activity-based costs allocated to each product line, and then compute the cost per unit.) 4. Compare the indirect activity-based costs per unit to the indirect costs per unit from the traditional system. How have the unit costs changed? Explain why the costs changed. Wibitie Pharmaceuticals manufacturers an over-the-counter allergy medication The company sellb both large commercial containers of 1.000 cageites to health care facilies and travel packs of 20 capsules to shops in airports, train stations, and hotels. The following information has beon developed to detormine if an activity based cosling tyatem woild be beneficial (Ctek the icon to view the information.) Read the requirments. Requirement 1. Willtte's original single plantwide overhead allocation rate costing syslem allocated indiract costs to products at 581.50 per machine hour Compute the total indirect costs allocated to the commercial containers and to the travel packs unider the original system. Then compute the indirect cost per unit for each product Round to two decimel places Select the formula, and then enter the amounts to compute the indirect cost per unit for each product (Abbrevistion used: mily. = manufacturing Round dollat amounts to Avo decimal places.) Requirement 2. Compute the predetermined overhead allocation fate for esch activity? Nilitte Pharmaceuticals manufacturers an over-the-counter allergy medication. The company sells both large commercial containerti of 1,000 capsules to health care tacilit ravel packs of 20 capsules to shops in aliports, train stations, and hotels. The following information has bean devoloped to determine if an activily based costing aystem Wh oe beneficial: (Click the icon to view the information.) Read the requiroments. decimal places.) Requirement 2. Compute the predetermined overhead allocation rate for each activity. Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the allocation rate for each activity used qty = quantity. Round your answers to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts